Following Tuesday’s breakdown of the first minor uptrend line, QQQ offers another objective short entry on this breakdown below this secondary minor uptrend line on the 15-minute chart while QQQ remains just below the top of my Market Top Range & will continue to do so on any more slight upside to but not above the top of the range (511.74).

A higher–probability entry or add-on to an existing short on QQQ will come on a solid break and/or 60-minute close below this uptrend line on SPY. Ditto for an initial entry or add-on to a VIX long. Also keep in mind that SPY is trading in the middle of my comparable Market Top Range, so far peaking about 3½% from the top vs. QQQ making it about 1.6% from the top of its range at yesterday’s high (close enough IMO). As such, SPY will offer an objective short entry on a solid break below this trendline as well as any additional slight push up to, but not above the top of it’s market top range around 582.74 (although I favor a QQQ short over a SPY as the former is likely to outperform the latter on the next major leg down).

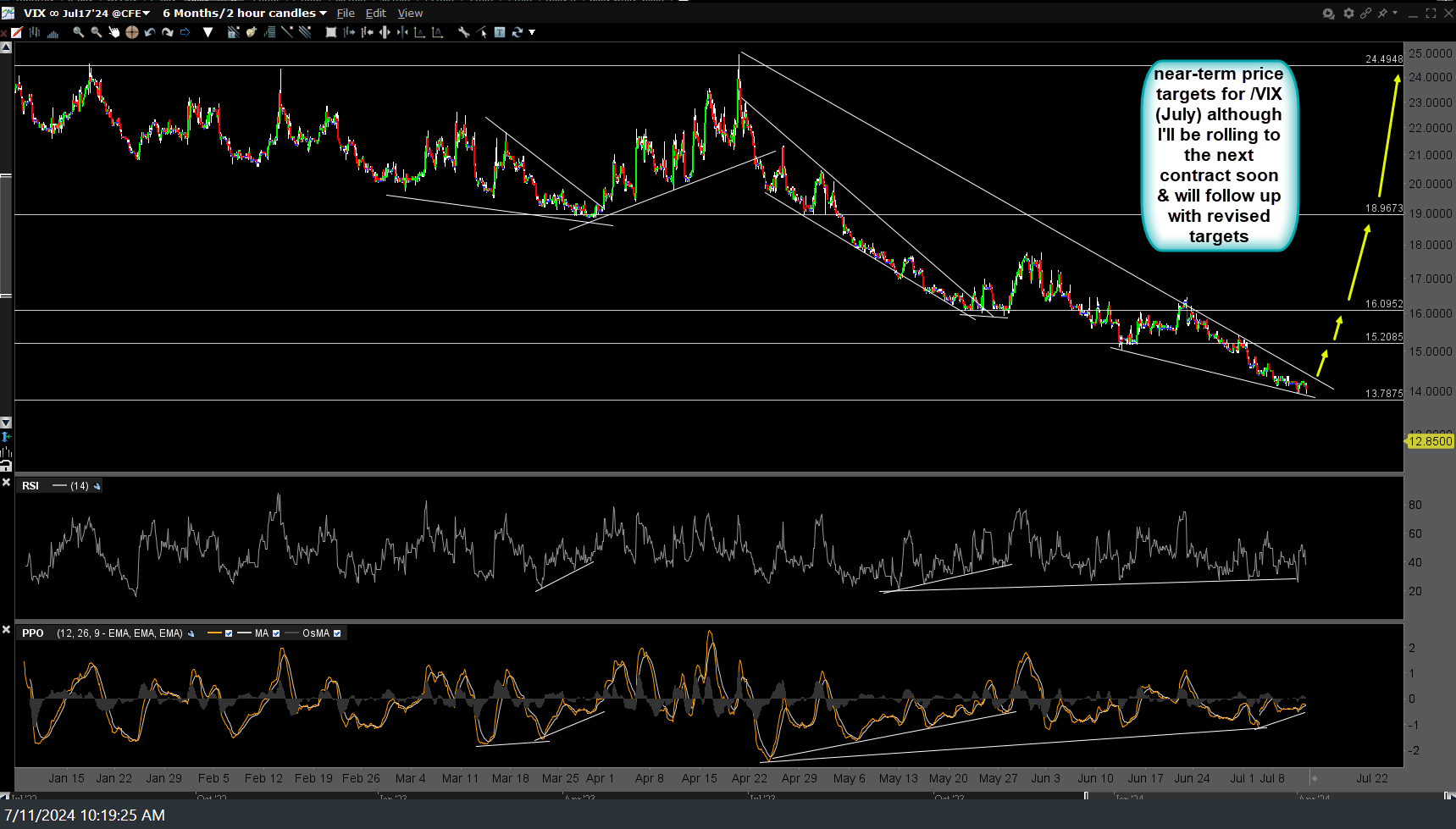

I mentioned the $VIX in the video the other day as both setting up bullishly, at long-term support with large positive divergences, so I’ve marked up some targets for /VIX (July $VIX futures), in which a starter position could be taken here and/or on a breakout above the downtrend line on this 120-minute chart. Note: The July contract still has the most volume but will be rolling soon, with a new chart & revised targets on the August contract to follow).

For those that don’t trade futures, here’s a daily chart of VIXY ($VIX short-term futures ETF) with buy signal to come on a solid break above this bullish falling wedge pattern & some ‘rough’ price targets shown.