The SLV (silver ETF) swing trade has just hit T3 (21.49) for a quick 5% profit. Consider booking full or partial profits and/or raising stops if holding out for any of the additional targets, depending on your trading plan. Previous & updated 60-minute charts below.

Just a reminder that we have the potential market-moving FOMC rate decision at 2:00 pm EST today followed by Powell’s press conference (most likely with more potential to move the market, as “no change” in rates is baked in) at 2:30 pm EST. As such, the markets are likely to grind around until then.

I have some things I need to take care of outside the office today so won’t be posting much although I will make a point to get a post-market update out later today. Remember, the initial reaction following a FOMC rate announcement is quite often followed by another equally or more powerful rip or dip in the opposite direction (and often another reversal again) so I usually don’t try to read too much into the market’s initial reaction.

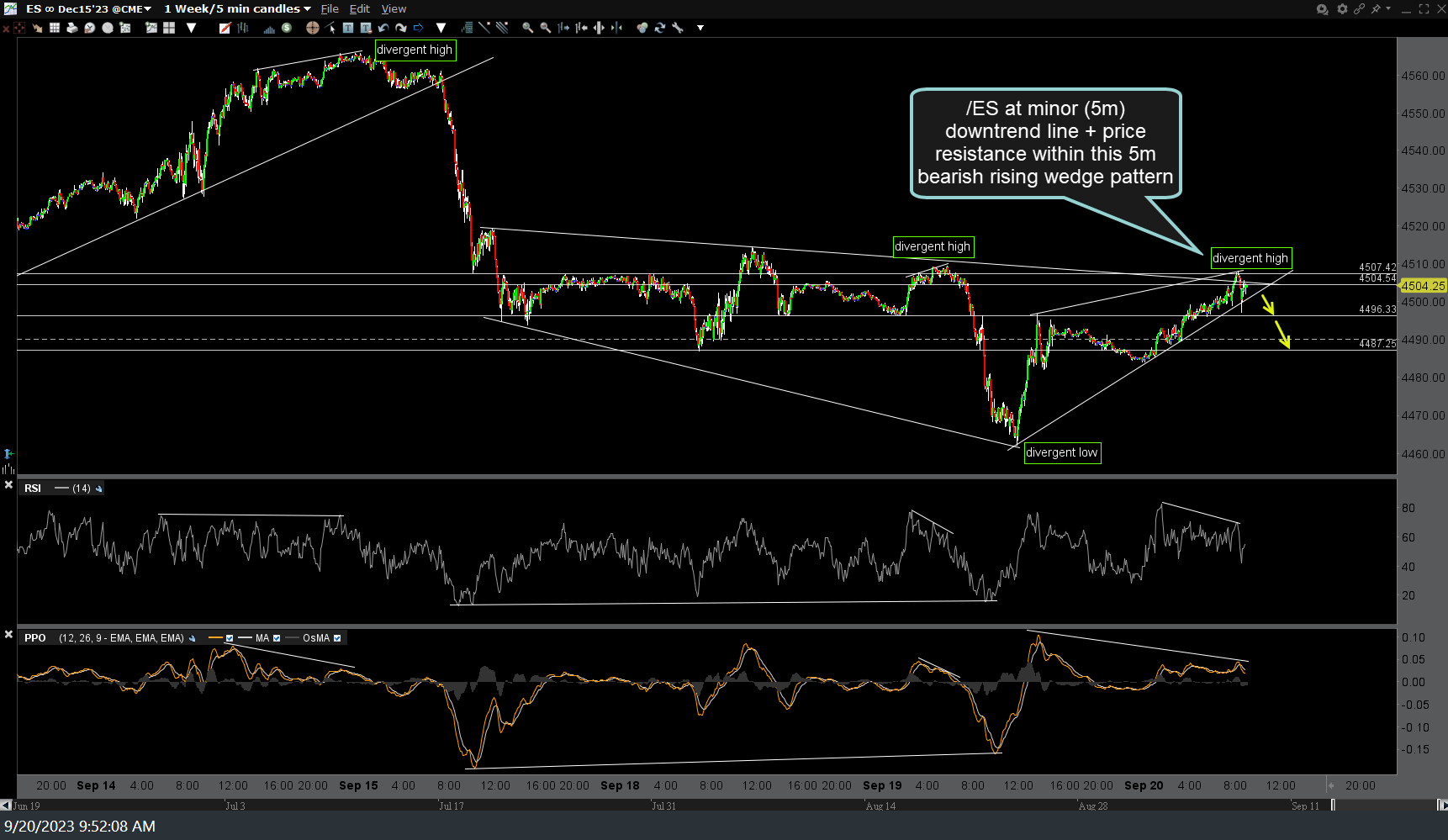

FWIW, I just booked profits on the /NQ long I mentioned reversing into off yesterday’s divergent low & reversing back to short for a quick pullback trade during the video. Here are the 5-minute charts of /NQ & /ES for reference (both at resistance inside small bearish rising wedge patterns with negative divergences).