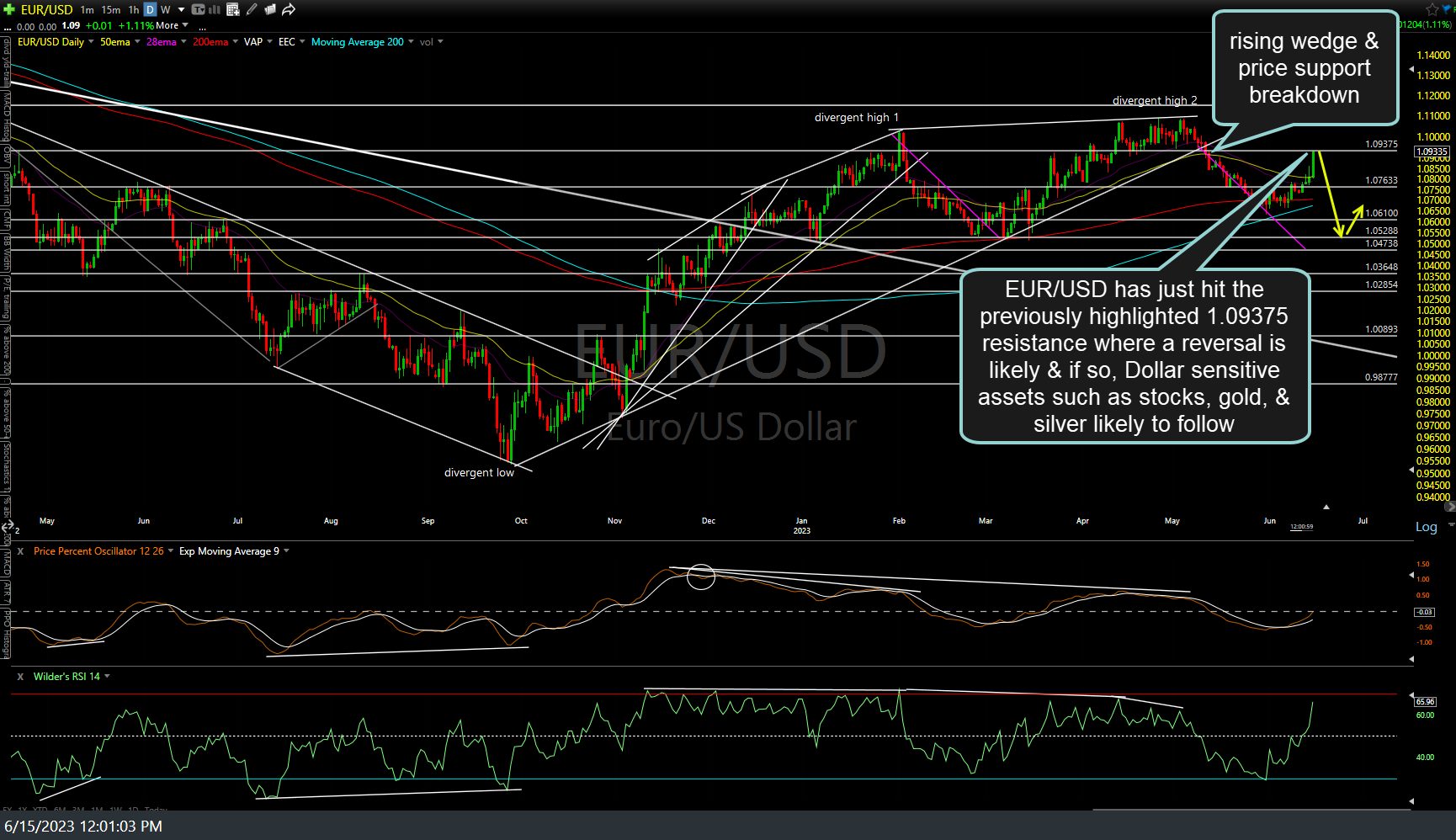

EUR/USD has just hit the previously highlighted 1.09375 resistance where a reversal is likely & if so, assuming we get another decent leg down as per the scenario in the video posted early today (see arrows on chart), Dollar sensitive assets such as stocks, gold, & silver which have a positive correlation with the Euro (negative correlation to the $USD) will likely follow. Likewise, should EUR/USD clearly power through this resistance & continue to run, that would be a net positive for the stock market & precious metals. Daily chart below.

I continue to favor the former (Euro & stock market down/US Dollar rally) vs the latter scenario but don’t care to short the metals, at least not at this time as GLD (gold ETF) is currently trading above the 180 support in this descending triangle pattern with positive divergences. Bullish on solid breaks above the downtrend line/triangle and then the 184ish resistance, bearish on a solid break below 180, especially if the divergences are taken out. 60-minute chart below.

Regarding the other recently highlighted trade ideas in the commodities arena, both natural gas & crude continue to rally with the grains (corn, wheat, & soybeans) still my favorites within the agricultural commodities. Based on both the increasingly bullish technicals as well as the fundamental case to get back into commodities now that the Fed has paused (stopped?) raising rates, I will continue to monitor various commodities for both trade ideas as well as a potential return of the “inflation trade”, as I’ve been predicting for some time that we’ll most likely continue to see that negative feedback loop I’ve discussed in the past where we’ll see bear market rallies that coincide with real or perceived abatements in inflation/interest rates followed by periods where the market begins to recognize that the Fed’s battle against inflation is not over, with the next leg down in the stock market then coinciding with the next uptrend in rates/inflationary forces.

Although one day does not make a trend, since the 2pm FOMC rate announcement yesterday, the stock market ($SPX) is up 0.8% with crude +2.4%, nat gas +8%, wheat, corn, & soybeans all 2%+. More importantly, all have constructive (bullish) charts IMO with the potential for a lot more upside in the coming months.