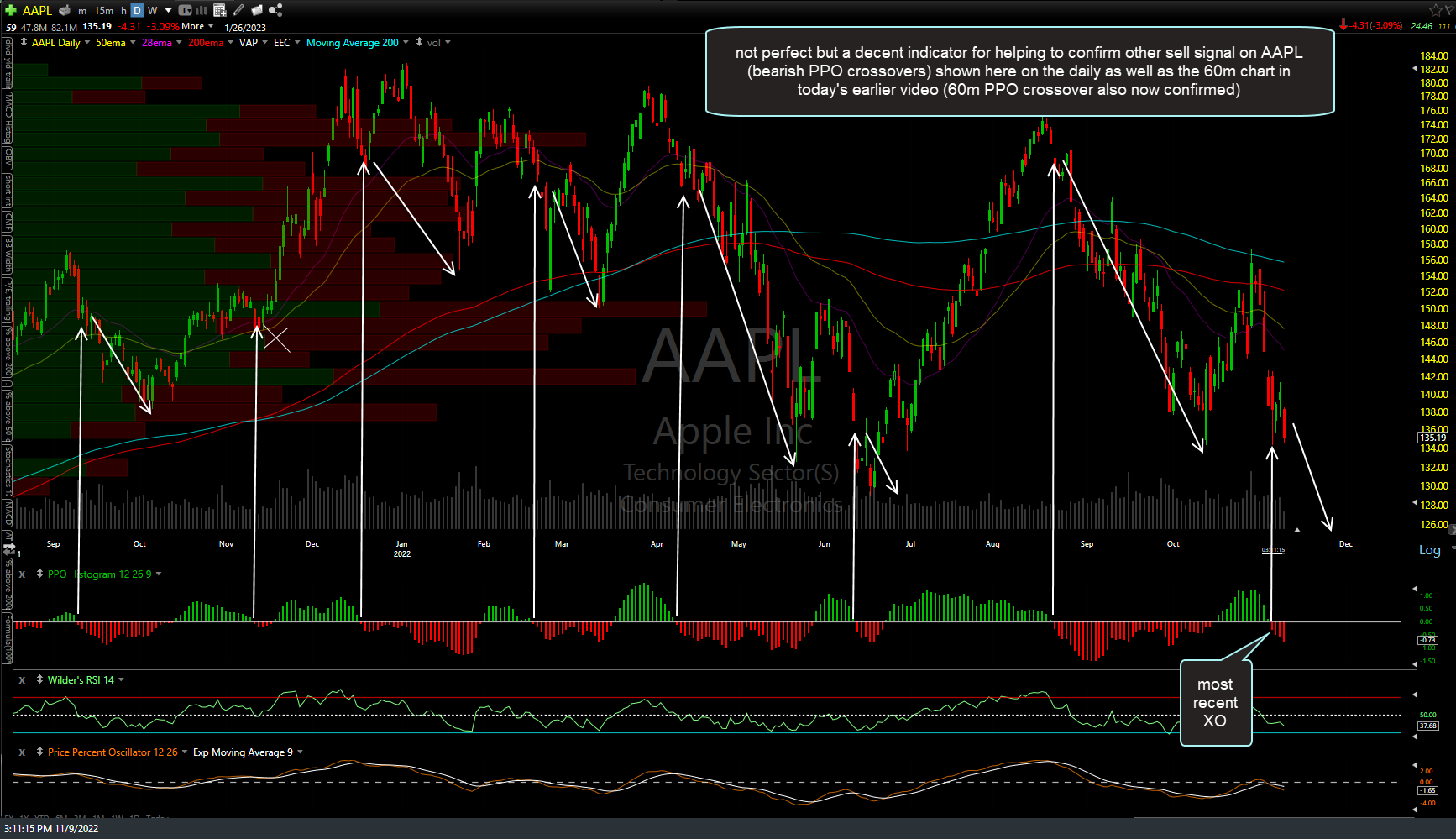

It only takes on bad AAPL (Apple Inc.) to ruin the bunch. Shortly after highlighting the pending bearish PPO crossover on the 60-minute time frame in the video posted earlier today, AAPL did go on to make a bearish PPO crossover, indicating more downside to come. While I used the 60-minute time frame in that example, the bearish PPO crossovers on the more significant daily time frame also provide fairly reliable sell signals on the King Of All Stocks. (largest component of the S&P 500 & Nasdaq 100). The arrows on this daily chart of AAPL show the recent bearish PPO crossovers and the subsequent price drops (with only one whipsaw over the past year+).

Also worth noting is the fact that both AAPL as well as some other key market leaders, such as TSLA, are currently testing key support levels. As such, any substantial downside from here has the potential to usher in the next wave of selling & quite possibly be the catalyst to take out the previous bear market lows. However, breakouts above these 5-min bullish falling wedges on SPY & QQQ would likely give us a late-session pop followed by a drop.