/ES (S&P 500 futures) has been stair-stepping lower since the initial snapback rally & divergent high that followed the June 11th sell signals with little to no evidence of a trend reversal or buy signals at this time. 60-minute chart below.

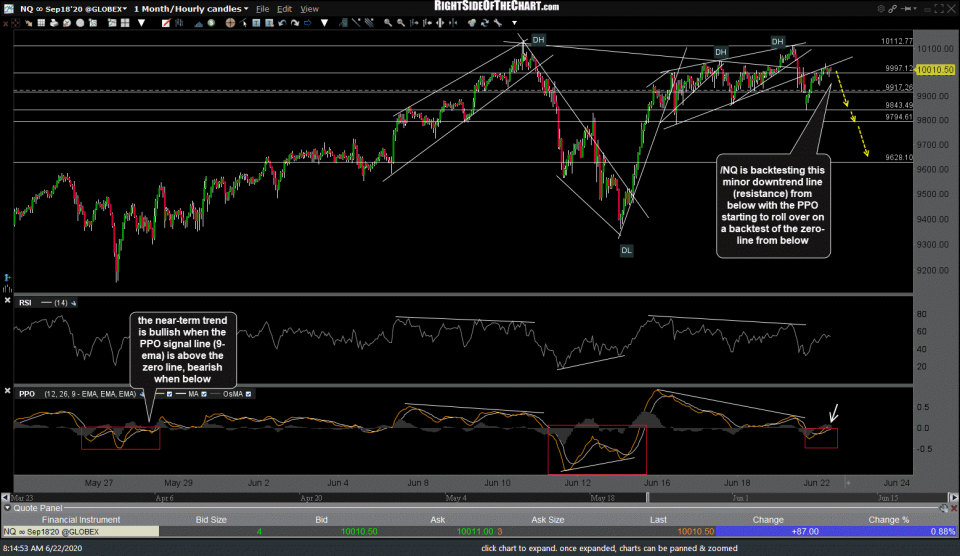

/NQ (Nasdaq 100) is backtesting this minor downtrend line (resistance) from below with the PPO starting to roll over on a backtest of the zero-line from below. Potential near-term targets shown below.

/GC (gold) is backtesting the 1756 former resistance (now support) as it continues to move higher following the June 5th divergent low/bear trap as well as Friday’s breakout above the downtrend line.

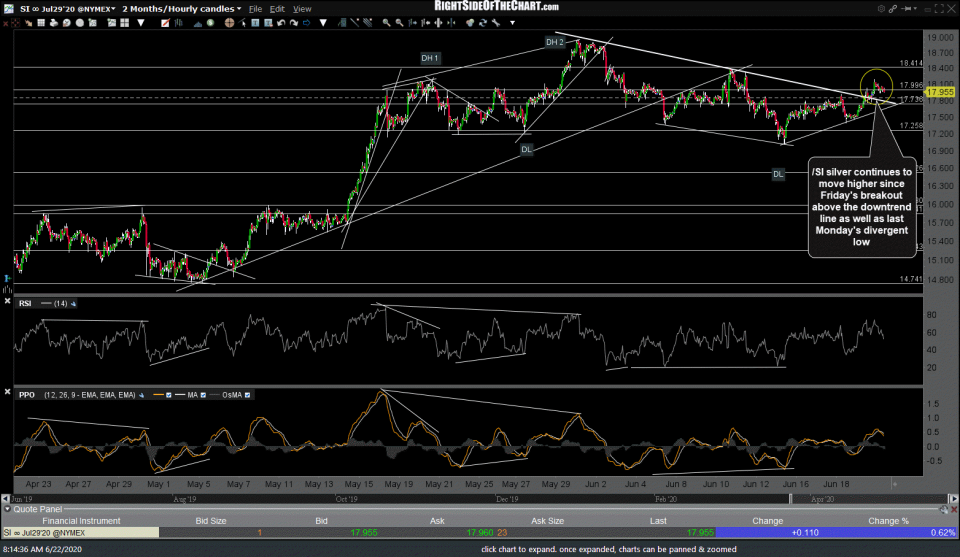

/SI (silver) continues to move higher since Friday’s breakout above the downtrend line as well as last Monday’s divergent low.

/DX ($USD) is testing the bottom of this 60-minute bearish rising wedge pattern following the recent divergent high & failure at the 97.585ish resistance level with a sell signal to come on a solid break below the wedge & then the 97ish support. Should the Dollar breakdown & start a new downtrend, that should help to provide a tailwind for the precious metals.