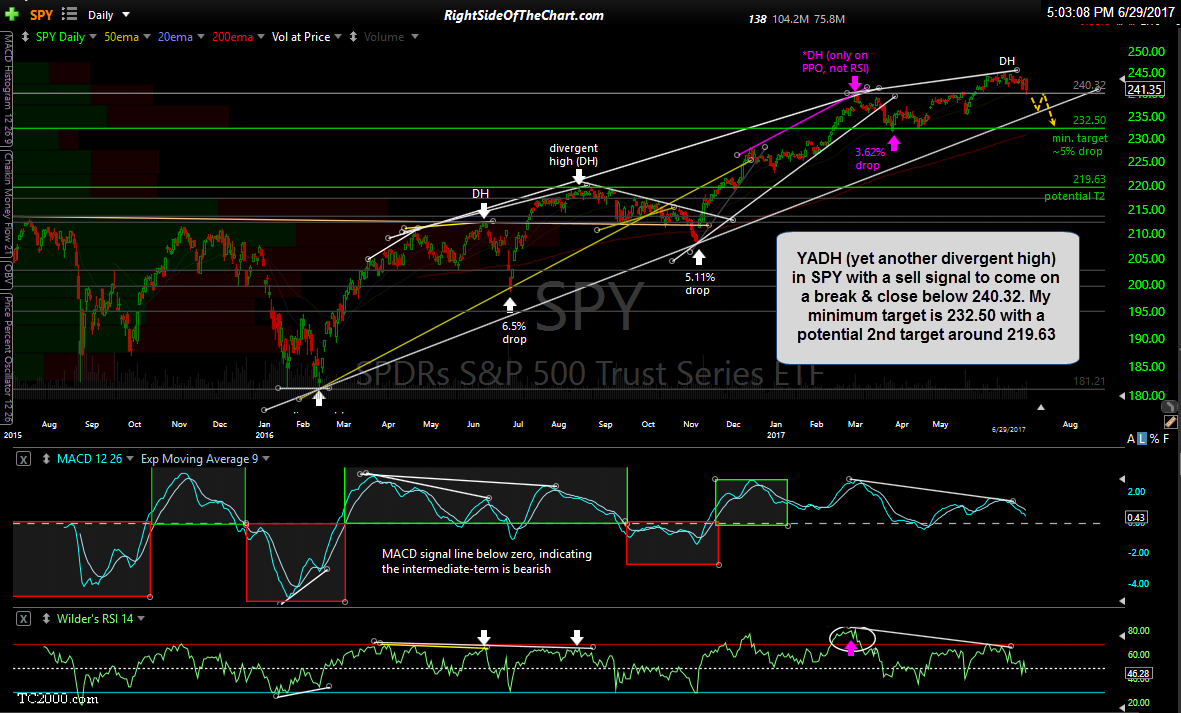

Here’s a quick look as the SPY (S&P 500 Index tracking ETF) along with the four largest sectors within the S&P 500. As recently highlighted, we have YADH (yet another divergent high) in SPY with a sell signal to come on a break & close below 240.32. My minimum target is 232.50 with a potential 2nd target around 219.63.

My first target in XLK was hit today followed a slight reaction off that key uptrend line. As technology is the largest sector within the S&P 500 with a weighting of 23.2%, should that trendline get taken out with XLK moving down to any of my additional targets, the tech sector will almost certainly take the stock market down along with it.

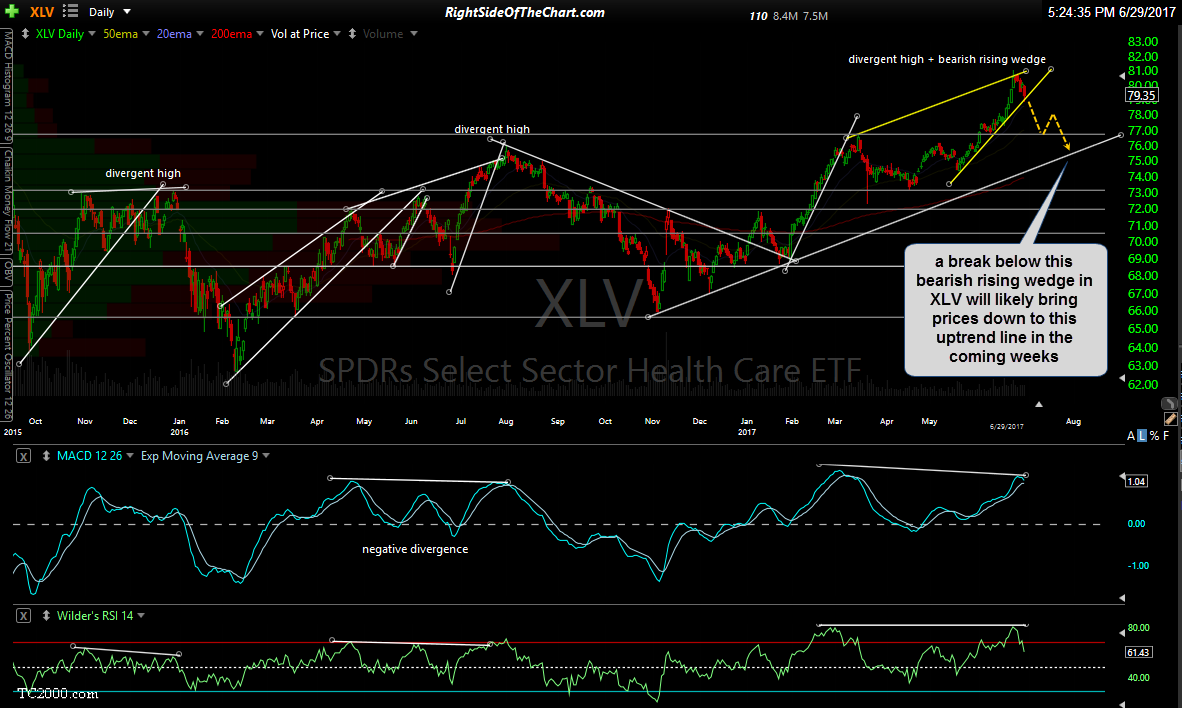

At a 13.9% weighting in the SPX, the healthcare sector is the second largest sector, albeit accounting for just over half of the performance as technology. A break below this bearish rising wedge in XLV will likely bring prices down to the uptrend line highlighted on this daily chart in the coming weeks.

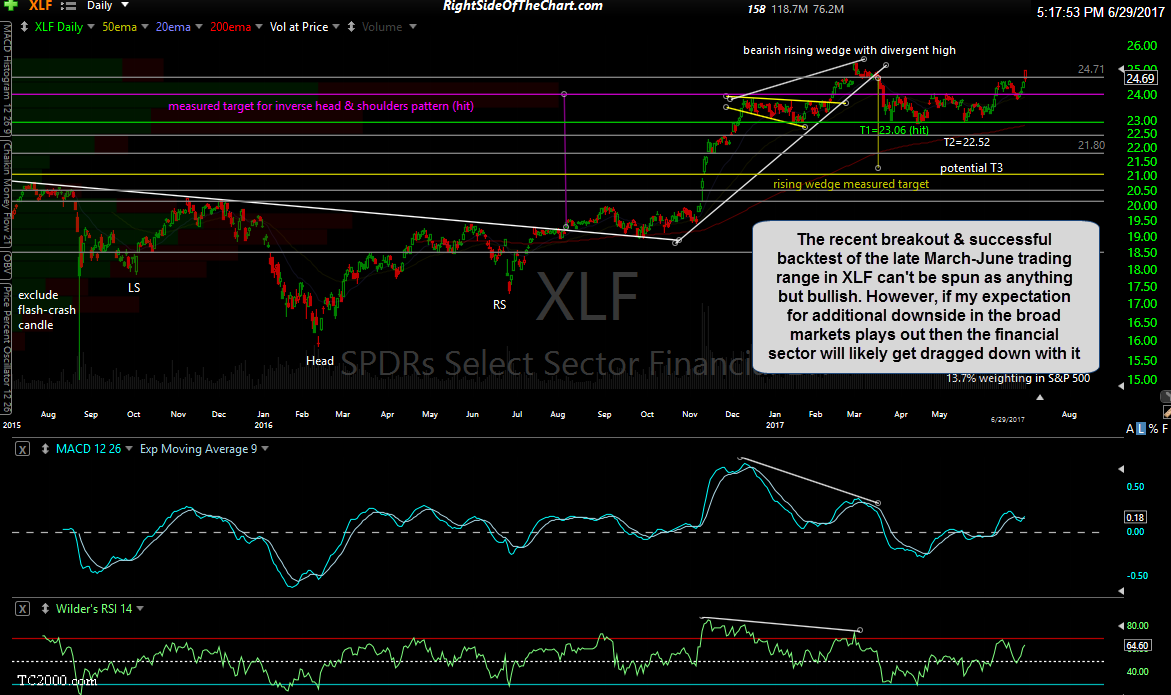

Right behind the healthcare sector comes the financials at a 13.7% weighting in the S&P 500. The recent breakout & successful backtest of the late March-June trading range in XLF can’t be spun as anything but bullish. However, if my expectation for additional downside in the broad markets plays out then the financial sector will likely get dragged down with it.

XLY continues to play out as expected following the recent divergent high & channel breakdown & backtest. As one of the largest sectors in the S&P 500 with a 12.5% weighting, the Consumer Discretionary sector looks poised to drag the market lower in the coming weeks to months.

Just another reminder that I will be traveling on vacation until July 9th with limited access to emails & the trading room. I will reply to any questions or comments at my earliest convenience. This is a semi-working vacation so market analysis & trade ideas/updates will continue to be posted although updates will be less frequent until I return.