Despite the basically flat (+0.01%) close in the S&P 500 today, the bullish divergences on the /ES 30-minute chart* highlighted in Saturday’s 5 Reasons Why The Stock Market Will Likely Rally Next Week post have grown even larger on today’s marginal new low, very much keeping the odds for a stock market rally this week favorable. (*incorrectly labeled as a 60-minute chart in Saturday’s post)

The initial bounce target for /ES (S&P 500 E-mini futures) from the post on Saturday was hit 3 times since they opened trading for the week; twice on Sunday evening & once today, gaining 0.5% from Friday’s close or about $670 per ES contract. With the expected pullback off that level that what outlined in that previous scenario (first chart from Saturday below) now most likely complete coupled with the fact that the previous bullish divergences how grown even larger with today’s marginal new low, my expectation is for a rally of about 1% from current levels (2672) up to the 2697 level, a gain of about $1335 per ES contract if hit.

- ES 30-min April 21st

- ES 30-minute April 23rd

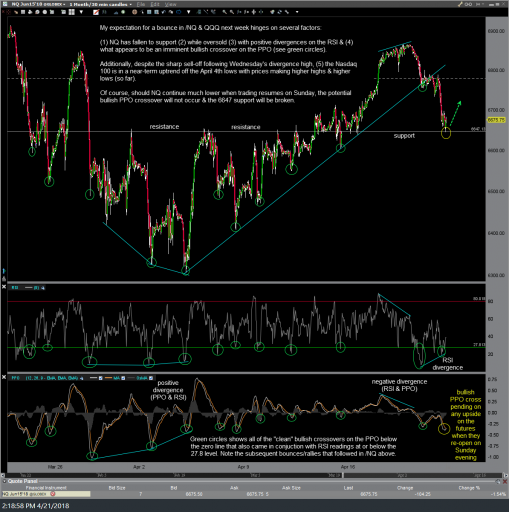

The Nasdaq 100 E-mini futures (/NQ) rallied about +0.80%, or $1,065/per contract following Saturday’s post (showing Friday’s closing value). After today’s highs, /NQ pulled back for a brief undercut of support/stop-raid to put in bullish divergences on this 30-minute time frame & setting the stage for an even larger rally this week. Previous & updated 30-minute charts of NQ below (the previous NQ chart was also incorrectly labeled as a 60-minute chart in Saturday’s post):

- /NQ 30-minute chart April 21st

- NQ 30-minute April 23rd

Bottom line: With an even larger divergent low now in place on the 30-minute chart of the S&P E-minis & bullish divergences also now in place with the Nasdaq 100 E-minis coupled with the fact that the false breakdown/bear trap/stop-raid below those key support levels on both the S&P 500 & Nasdaq 100 so far appear to be just that, with both major indices regaining those key levels before the close today, it appears still appears that the stock market is still poised to rally this week.

Keep in mind that the thick of earnings season is now underway. GOOG/GOOGL (Alphabet Inc.) reported earnings after the market close today, immediatley surging nearly 5% followed by an equally swift plunge right back down around where the stock closed today. Although there are some notable companies reporting tomorrow & Wednesday, three of the largest components of the Nasdaq 100; AMZN, MSFT & INTC, all report on Thursday after the market close. Therefore, the chances for a decent sized gap in either direction on Friday morning are quite good. My plan, unless stopped out before then, will be to book profits on my /NQ position just before the bottom and/or the top of the 6787 – 6818 resistance/target zone (rougly 165 – 165.70 on QQQ).