Member @stock51 requested an update on silver within the trading room & as I started to compose my reply along with the charts, I realized that the precious metals could be at or near a significant inflection point & as such, will post my analysis here on the front page for all members to see.

The first chart above is a daily chart of SLV (silver ETF). As the circles on the RSI at the bottom of the chart highlight, SLV just hit the first overbought (70+) reading in over a year with the previous two overbought readings followed by substantial corrections of 9-14%+. I’ve also circled the PPO which appears to be rolling over but has not yet made a bearish crossover. Based on my analysis, it is almost a coin-toss as to whether silver (as well as gold & platinum) bounce soon to make one more marginal new high before a more substantial correction occurs. Should a rally up to the 16.40ish resistance level in SLV occur within the next month or so, even if SLV moves a little lower before then, that has the potential to form negative divergence on the daily time frame, setting the stage for a much deeper correction. Either way, it appears that the risk/reward for a long position in silver is not very favorable at this time with minimal upside potential compared to the downside risk.

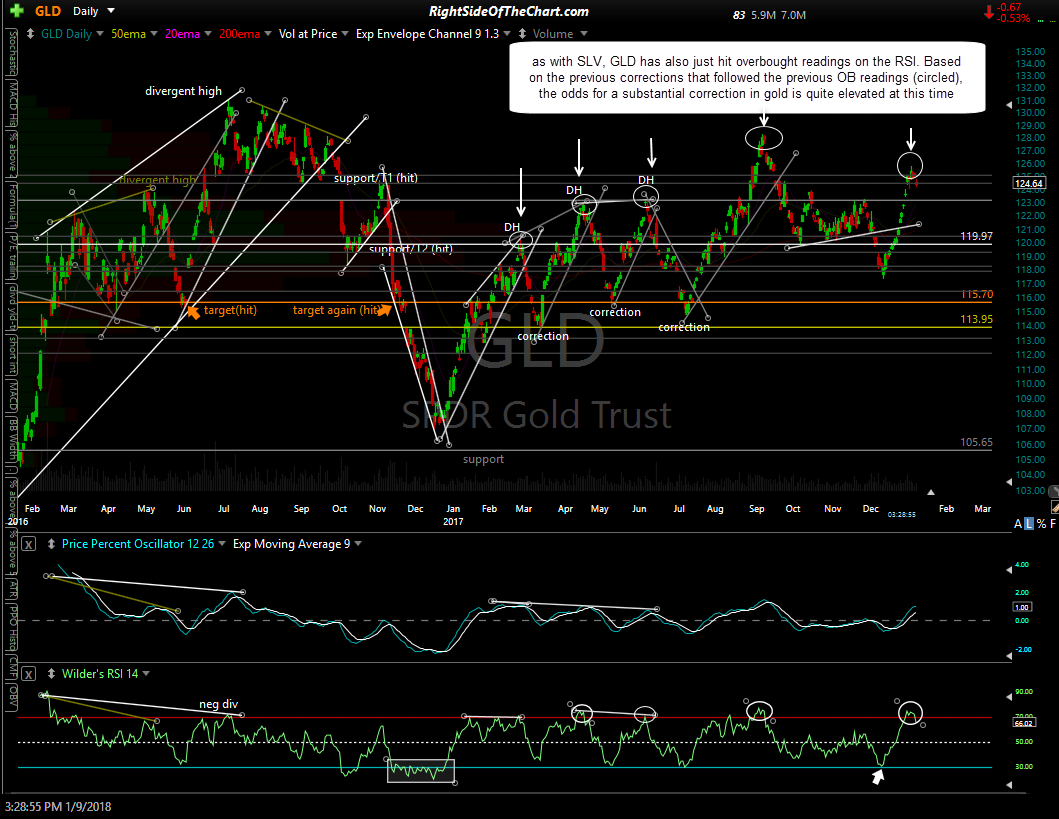

As highlighted in the daily chart of GLD above, as with SLV, GLD has also just hit overbought readings on the RSI. Based on the previous corrections that followed the previous OB readings (circled), the odds for a substantial correction in gold is quite elevated at this time.

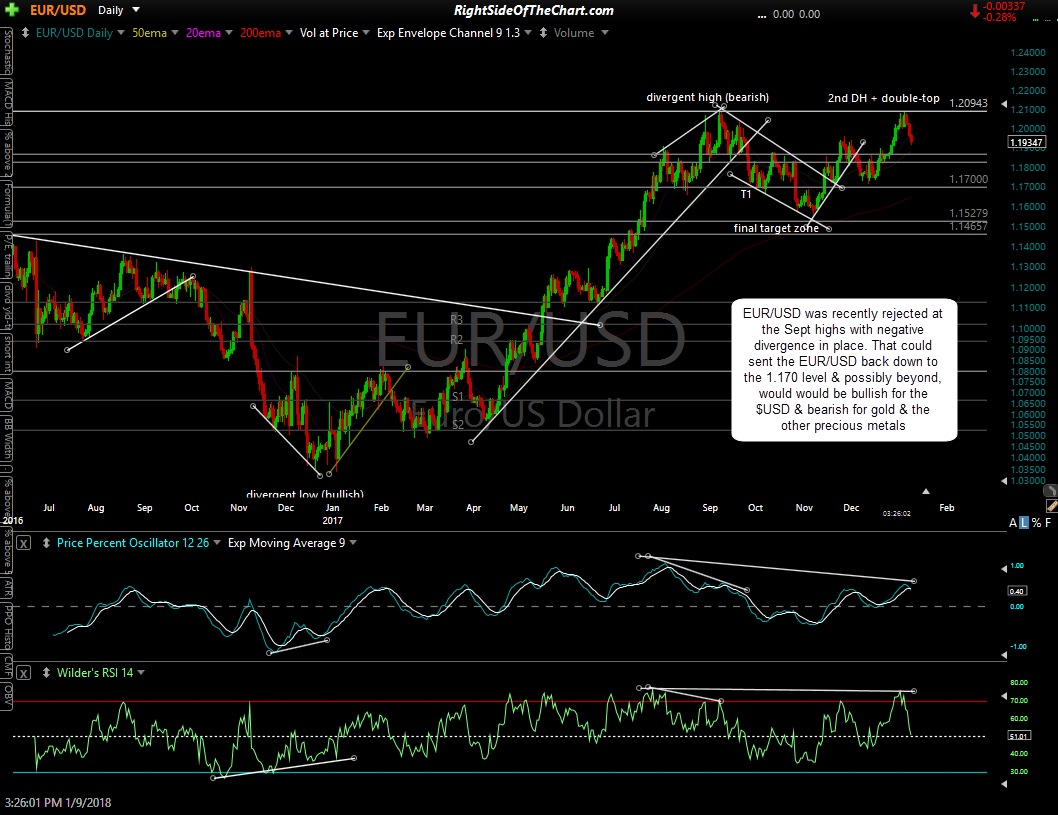

Finally, I like to confirm (or refute) my analysis on gold with the outlook for the US Dollar. EUR/USD was recently rejected at the Sept highs with negative divergence in place. That could send the EUR/USD back down to the 1.170 level & possibly beyond, would would be bullish for the $USD & bearish for gold & the other precious metals. I’ll also continue to monitor this chart in the coming weeks & months for a potential breakout above that recent double-top high, as that could be quite bullish for the gold & the mining stocks. I should add that I continue to maintain a longer-term bullish outlook for the EUR/USD, meaning that I am longer-term bearish on the $USD. The chart above only reflects my near-term & possibly intermediate-term analysis.

Bottom line is that we had a very profitable run in the precious metals & mining stocks since the bullish case to go long was made in this video back on December 12th, the very day that gold & GDX bottomed and although I’m on the fence as to whether or not the rally in metals & miners will soon resume, taking out the recent highs, it does appear that any upside at this point is overshadowed by the downside risk in the coming weeks to months.

Longer-term trend traders & investors with positions in gold, silver, platinum or any of the mining stocks could certainly let those positions ride with the appropriate stops in place below to assure profits at this point as the trend is still bullish. As I often say, oversold in itself is not a sell signal, merely an indication that prices are getting extended & the chances of a pullback are rising. I don’t have any screaming sell signals in the PM or miners right now but as I like to say in trading; When in doubt, get out.