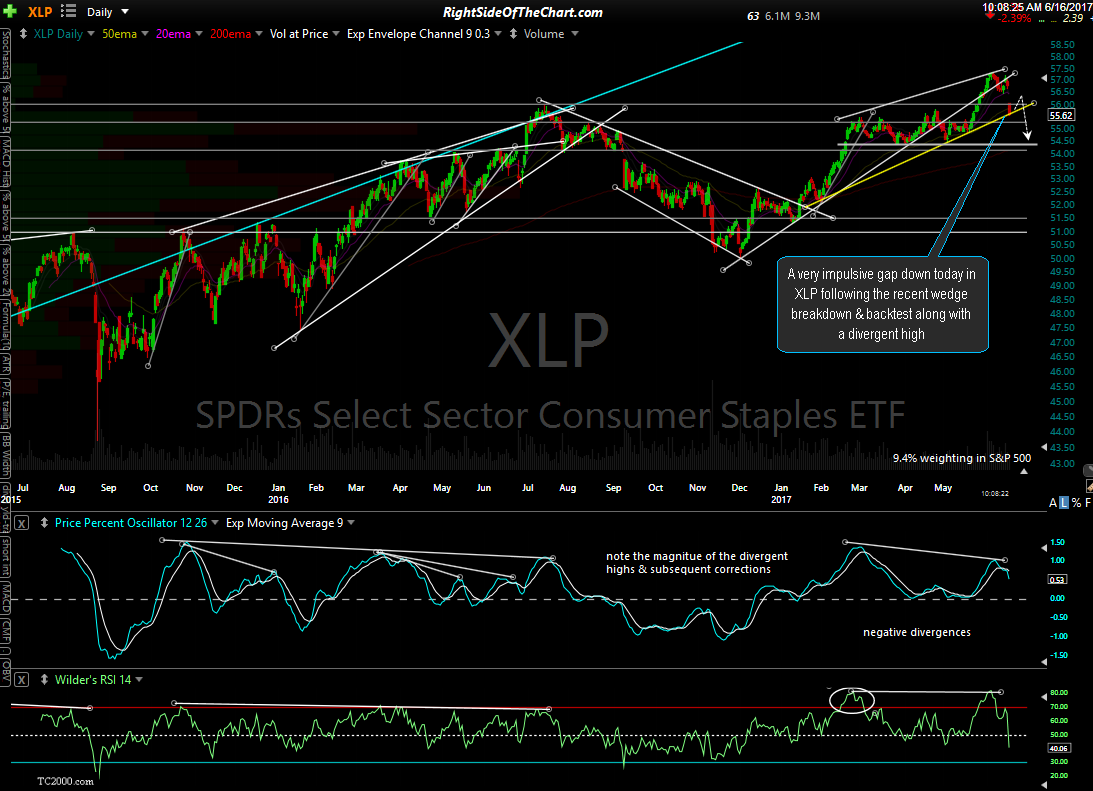

XLP (consumer staples ETF) had a very impulsive gap & breakdown today. Several key staples companies such a WMT, COST, WBA, CVS & to a lesser extent (weighting-wise but not percentage loss), KR mentioned in the trading room earlier all down big so far today.

At a weighting of 9.4%, XLP is one of the largest sectors in the S&P 500 & highlighted recently in the S&500 Sector Analysis update posted on Wednesday. I’ve since added a minor trendline (yellow) which could come into play here but even though a reaction is likely soon due to the near-term oversold conditions that today’s unusually large drop in XLP is experiencing (down -2.5%), today’s breakdown coupled with the powerful negative divergences that were in place at the recent highs & are now confirmed, the consumer staples sector is likely to continue lower in the coming weeks & months. If so, that would almost certainly have an impact on the broader market.