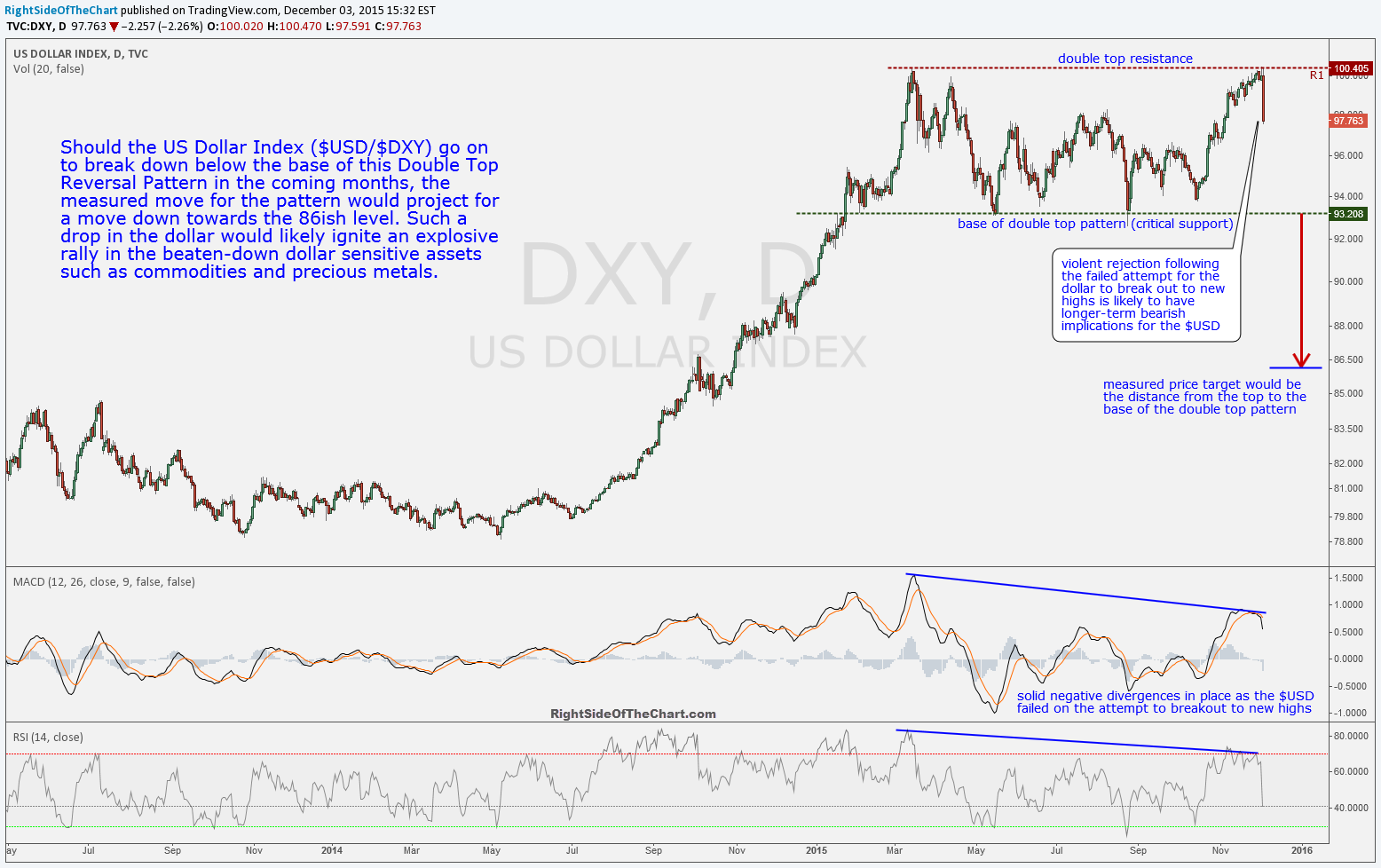

The US Dollar Index has experienced a violent rejection following the failed attempt to break out to new highs, which is likely to have longer-term bearish implications for the $USD. Should the US Dollar Index ($USD/$DXY) ultimately go on to break down below the base of this Double Top Reversal Pattern in the coming months, the measured move for the pattern would project for a move down towards the 86ish level. Such a drop in the dollar would likely ignite an explosive rally in the beaten-down dollar sensitive assets such as commodities and precious metals.

There’s still plenty of work to be done as the US Dollar index is only about a day or so off mutli-year highs but this pattern is definitely worth monitoring as the well-defined support around the 93 level makes this a very “clean” double-top pattern and with the long $USD/short $EUR trade being dangerously one-sided, not to mention the fact a solid technical case that can be made for a top in the US Dollar index, a move down towards the bottom of the pattern could come sooner than most expect.