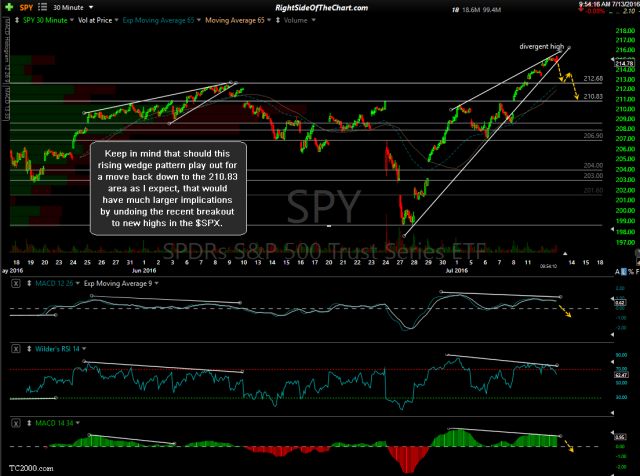

Keep in mind that should this 30-minute chart rising wedge pattern play out for a move back down to the 210.83 area as I would expect, that would have much larger implications by undoing the recent breakout to new highs in the $SPX. However, a setup is only just a setup until triggered. Still awaiting a break below the rising wedge, a MACD 9-ema cross below zero line and a bearish cross on 14/34 ema pair on both SPY & QQQ to trigger the sell signals for the broad markets. While my near-term targets remain SPY 210.83 & QQQ 108.82 (unofficial trade at this time & those are the actual support levels, best to set your BTC/closing orders slightly above to help prevent missing a fill, should the market reverse just shy of those levels).

- SPY 30-minute July 13th

- QQQ 30-minute July 13th

Also keep in mind that should these wedge patterns trigger & play out to those near-term targets, one could opt to set stops at their enter price & let the short position ride as if the $SPX can’t quickly recover the recent breakout to new highs, that would signal a failed breakout, aka bull trap, with much larger bearish implication on the stock market.