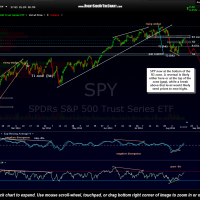

The SPY is now at the bottom of the R3 zone. A reversal is likely either here or at the top of the zone (gap), while a break above that level would likely send prices to new highs. The QQQ is currently backtesting both the blue uptrend line as well as a horizontal resistance level defined by three recent gaps. The recent bullish falling wedge breakout in GLD is still well intact with gold prices continuing higher since the breakout.

- SPY 120 minute Aug 14th

- QQQ 120 minute Aug 14th

- GLD 120 minute Aug 14th

Overall I remain somewhat cautiously bearish on equities, primarily the regional banking sector and other financial related stocks although I have a fairly diversified portfolio of individual shorts scattered amongst various sectors. I also remain bullish on gold & the mining sector as well as a few select commodities, including WEAT, CORN & select coal stocks in additional to a few miscellaneous long positions. While new highs in the US broad markets is certainly a possibility in the coming days/weeks, I continue to believe that the rally since the second & final near-term downside target (T2) on the SPY 60 minute chart was recent hit is simply the first counter-trend bounce in the early stages of a more substantial correction in stocks. As such, I have continued to add short exposure up to this level but from this point forward, will only add short exposure below these current resistance levels on the SPY & QQQ or on the most compelling individual short setups. As is most often the case, my stops are based on the individual technicals of each position and not what the broad market does although the bearish scenario will begin to rapidly deteriorate should the markets move much above these current resistance levels.

- $SPX weekly Aug 14th

- $OEX weekly Aug 14th

- $DJIA daily Aug 14th

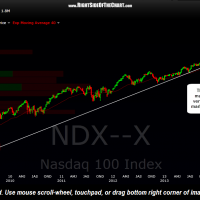

- $NDX weekly Aug 14th

- $MID weekly Aug 14th

- $RUT weekly Aug 14th

For those that prefer trading the broad markets (SPY, DIA, QQQ, MDY, IWM) or any of the related inverse or leveraged ETFs, options or futures contracts, I’d have to say that a short around current levels with a stop over the recent highs, particularly for the $SPX & $NDX (SPY, SDS, QQQ, QID, ES, NQ, etc…), offers a unusually attractive risk/return ratio with minimal downside if stopped out compared to the potential downside, should the $SPX & $NDX join the $RUT (small cap), $MID (mid-caps), and $DJIA (DJ Industrials/blue chip, large caps), all of which have recently broken below their bull market uptrend lines generated off the 2009 lows. I would also have to add that any shorts on the broad markets at this time are still counter-trend trades until/unless we see both the $SPX, $NDX, & $RUT join the $DJIA & $MID in breaking down below their respective bull market trendlines and as such, should be considered aggressive trades, unless used as a hedge against existing long positions.

The bottom line on both equities and gold is that the next major leg, up or down, should be decided soon: Some of the major US stock indices like the $SPX & $NDX are just a stone’s throw away from making new all time highs (bullish) while just below sit those all-important bull market uptrend support lines. Gold, although up a respective 10% YTD and the gold mining sector (GDX) up about 33% YTD, still has some work to do in order to help add to the case that a new cyclical bull market is underway, namely a break above the highs made back in mid-March. Both the mining stocks as well as US equities have been much more conducive to active trading (swing trading) so far this year vs. buy & hold strategy and my expectation for the remainder of the year would be much of the same (trader’s market) although I am treating my most recent move back into the mining stocks as longer-term positioning for the next major leg up, unless stopped out or the charts convince me otherwise.