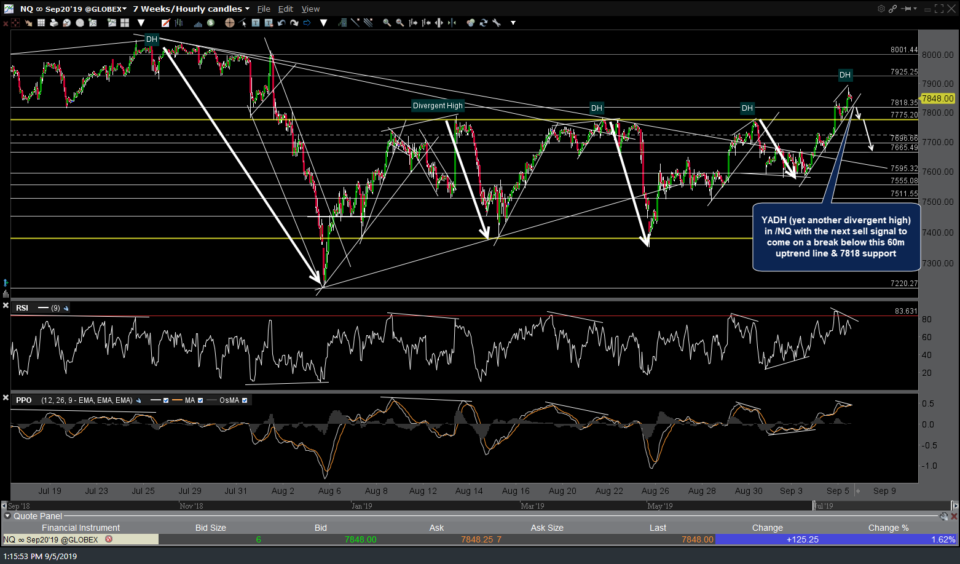

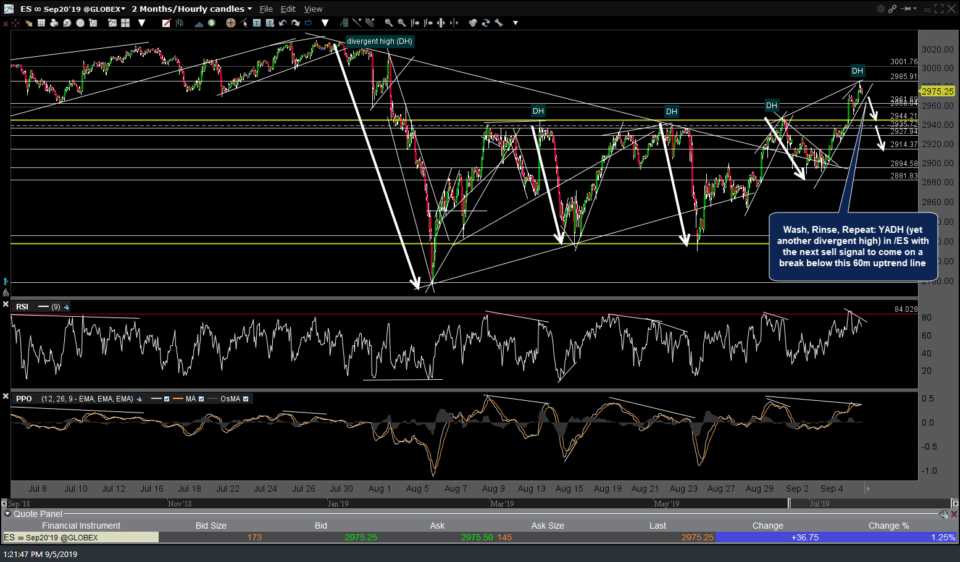

Wash, Rinse, Repeat: We have YADH (yet another divergent high) in /ES (S&P 500 futures) and /NQ (Nasdaq 100) with the next sell signal to come on a break below these 60-minute uptrend lines. Should these potential & pending sell signals trigger, that could be the catalyst for a correction that takes the futures down for a backtest of the top of the August trading ranges.

- NQ 60-min 2 Sept 5th

- ES 60-min 2 Sept 5th

If so, one could either cover a new short trade taken on the breakdown (or an existing short, for those that want out), go long for a bounce trade or a longer-term swing trade (if expecting new highs in the market) or hold tight with stops in place to see if the large-caps fall back within the trading ranges, which would mean that today’s breakouts would have failed & proved to be a bull trap. I still favor the latter but still plenty of work to be done to help firm up that longer-term bearish case, starting with a complete fade of today’s rally. For those not sure what to do, this wouldn’t be a bad time to stand aside in cash to see whether or not today’s breakout sticks or fails.