/CL crude oil remains en route to my 49.86ish target following the recent triple top, divergent high & trendline breakdown/backtest, which should provide a tailwind to the XOP short/DRIP long trades. 60-minute chart below.

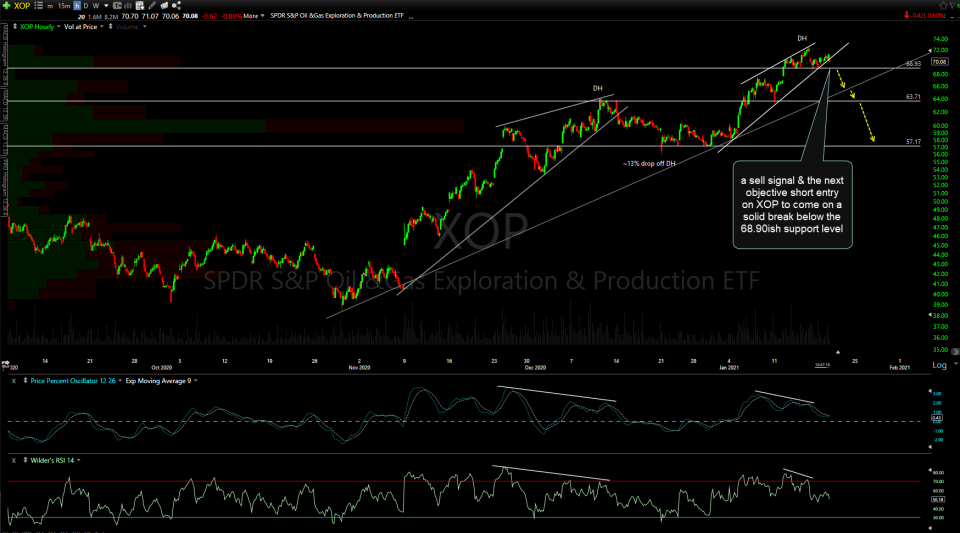

XOP (oil & gas exploration & production ETF) is currently at ‘potential’ uptrend line support in the pre-market session although I suspect any reaction will be minor, if at all, with a continued move down to the 63.70ish target likely before the first decent reaction. Previous & updated 60-minute charts below.

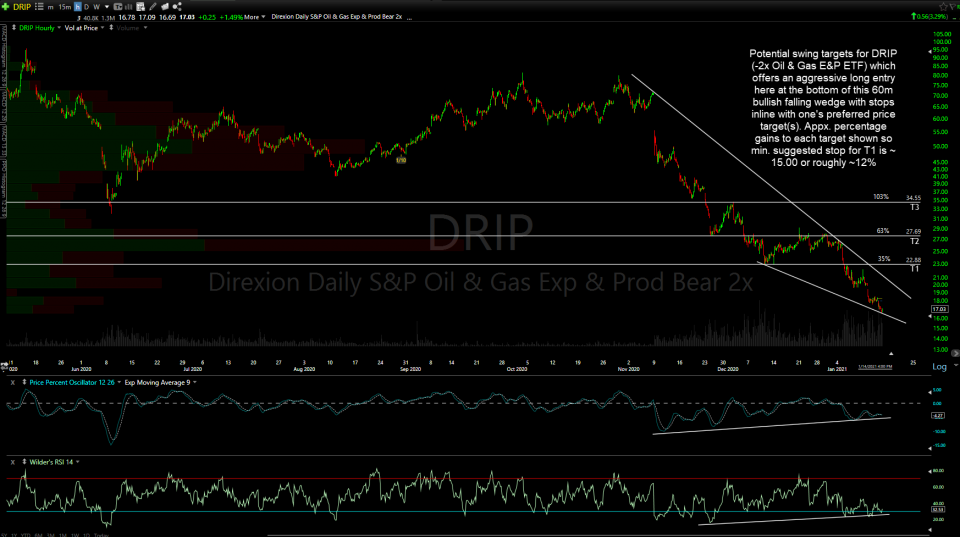

Likewise, DRIP (2x bearish/inverse of XOP) is trading at minor resistance (horizontal price resistance + potential downtrend line) in the pre-market session so any substantial upside from here (downside in XOP) would provide the next objective entry or add-on to an existing position. Previous & updated 60-minute charts below.