FAS (3x Bullish Financial Sector ETF) will be added as an Active Short Trade here on the break below this 30-minute bearish rising wedge pattern. The basis for this trade has just as much to do with developments on the daily time frame for the sector (via XLF) although this 30-minute wedge breakdown helps to confirm the near-term bearish case for the financial sector as well as provide an objective entry. The two near-term price targets for a short trade on FAS are shown on the 30-minute chart below. The suggest stop for this trade is any move above 27.63.

- FAS 30-minute April 21st

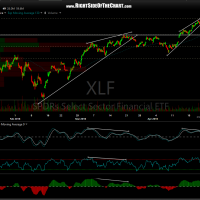

- XLF 60-minute April 21st

- XLF daily April 21st

I have opted to short FAS (and posted doing so earlier today in the trading room in advance of this wedge breakdown) as this trade may quite likely be extended into a multi-week or even multi-month swing trade. If so, the decay suffered from 3x leveraged ETFs like FAS would benefit a short position whereas a long position in FAZ (3x short financials etf) would likely suffer from that decay. For those that can’t short FAS, an XLF short or SKF (2x short financial sector ETF) might be viable options.