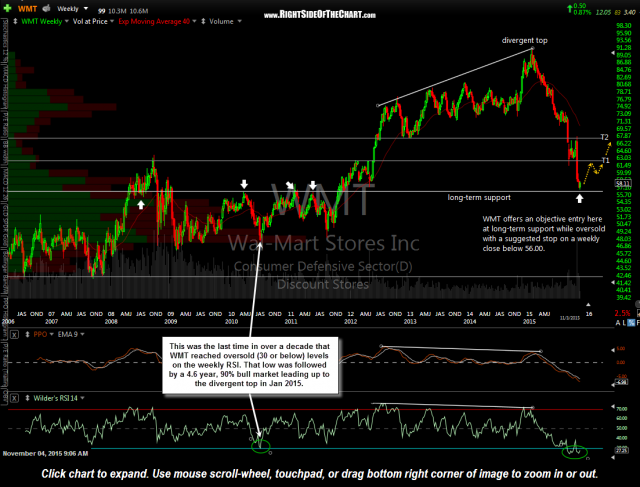

WMT (Wal-Mart Stores Inc.) will be added as an Active Growth & Income Trade at the open today. Since WMT peaked back in January of this year, the stock has plunged 37% to a well-defined long-term support level while at rarely seen oversold levels which have historically preceded major uptrends in the stock.

- WMT weekly Nov 3rd close

- WMT daily Nov 3rd close

With a current dividend yield of 3.42% and the potential for about 21% in capital appreciation, should the stock advance to the final target, T3 on the daily chart (somewhat above 70, the exact suggested sell limit levels will follow) and a suggested stop on a weekly close below 56.00, Wal-Mart offers a very attractive R/R for longer-term traders or investors, especially those looking for above average income along with the potential for capital appreciation.

As with all Trade Idea categories, a full description of the Growth & Income Trade Ideas can be found towards the top of the page when viewing the Growth & Income Trade sub-category located under Trade Ideas on the main menu.