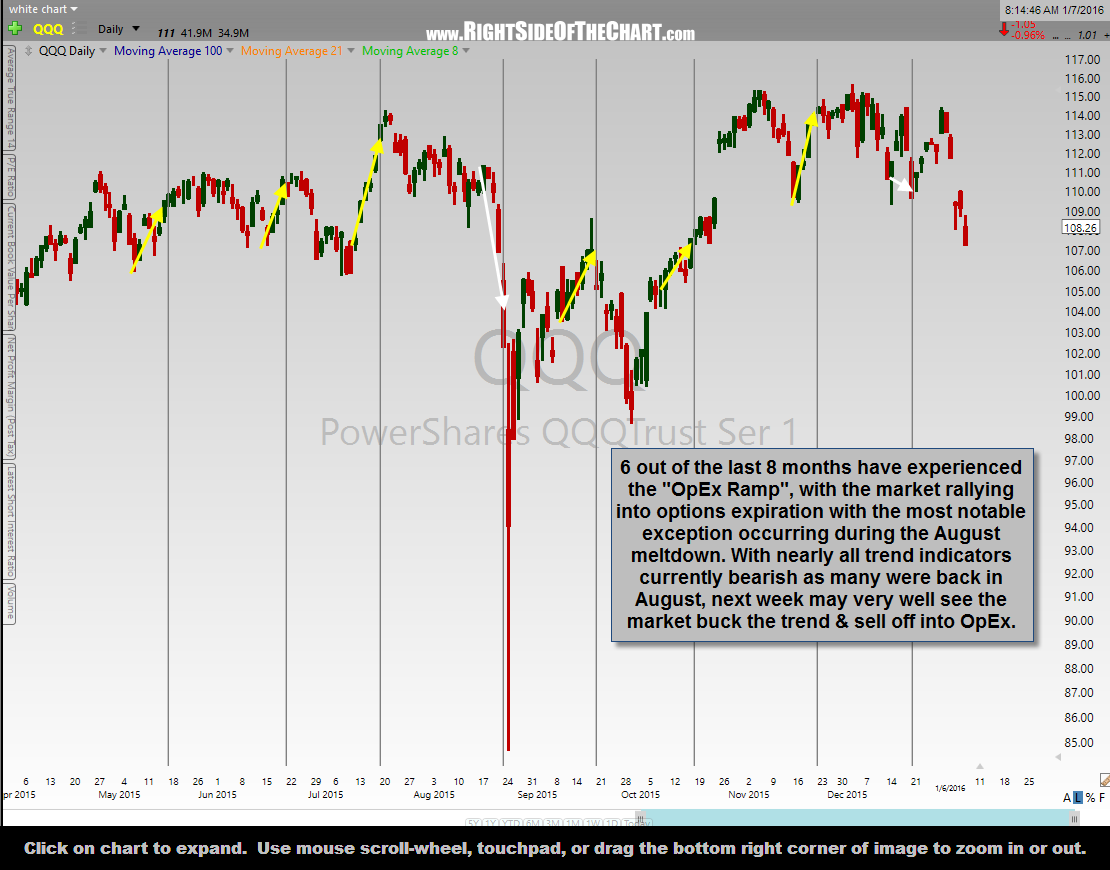

For a while, I’ve pointed out the tendency for the stock market to rally into OpEx (Options Expiration, which occurs the 3rd Friday of every month). 6 out of the last 8 months have experienced the “OpEx Ramp”, with the market rallying into options expiration with the most notable exception occurring during the August meltdown. With nearly all trend indicators currently bearish as many were back in August, next week may very well see the market buck the trend & sell off into OpEx.

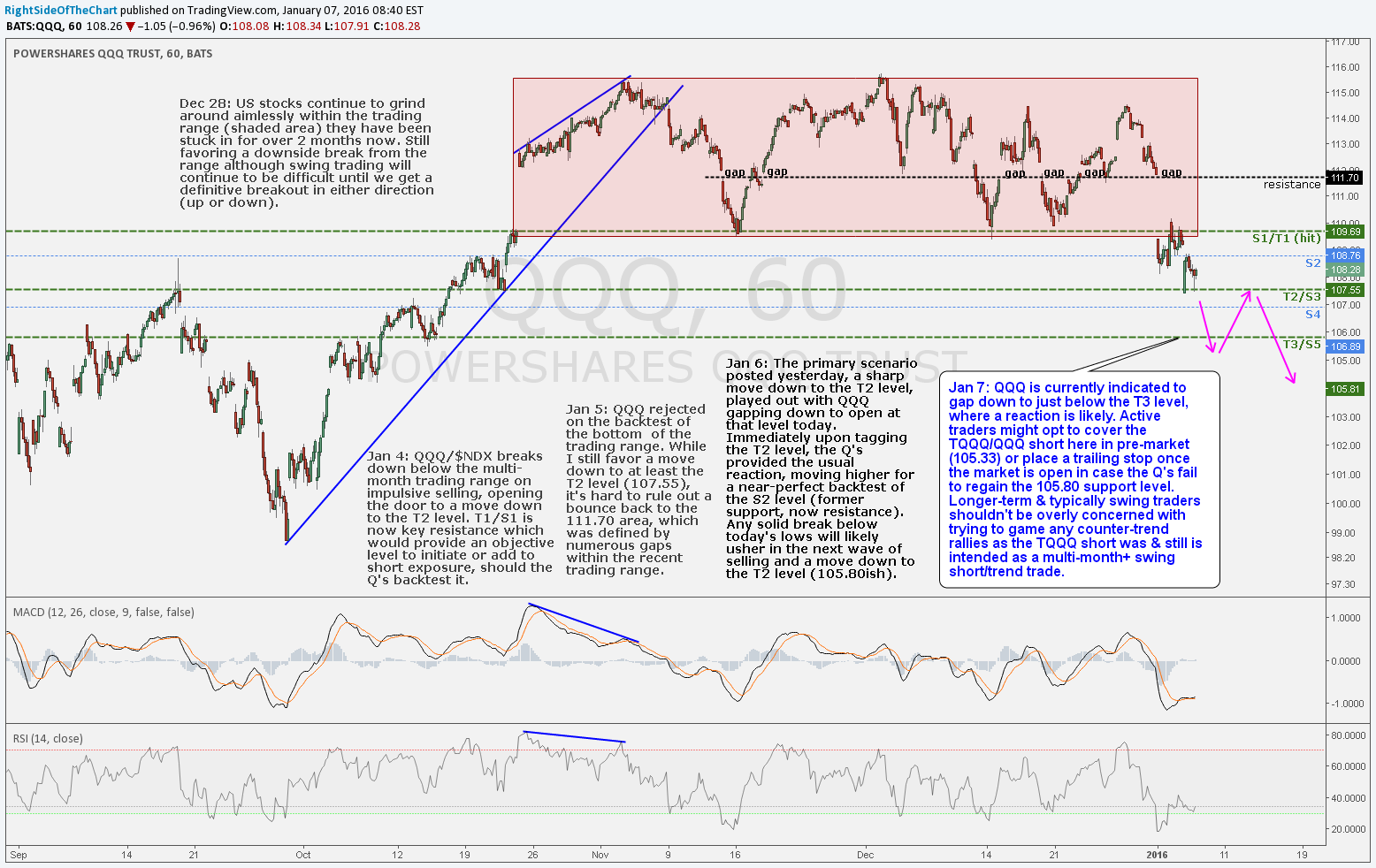

With that being said, the fairly consistent pattern of OpEx ramps are only one of numerous factors that go into my analysis for the near-term direction of the market. First & foremost would be price & volume. For example, should the markets continue to sell off into the weekend while approaching a key support level with bullish divergences in place (15-60 minute time frames), along with a large volume surge indicative of a selling climax, then the odds would favor a reversal.

Currently, we have potential positive divergence setting up on the QQQ 30-minute time frame as the Q’s are currently indicated to gap down to just below the 3rd price target on my 60-minute chart (T3 at 105.81). However, during a confirmed downtrend such as this, I typically prefer to see bullish divergence on the 60-minute time frame (along with the major indices trading down to a well-defined support level) before reversing from a net-short to a net-long bias.