This upcoming week will most likely be marked by increased volatility as we have a slew of potentially market-moving earnings reports due out, including two of the market leading FAAMG stocks. GOOG/GOOGL (Alphabet Inc.) kicks things off with their earnings report on Monday after the market close (AMC), followed by one the leading semiconductor stocks, TXN (Texas Instruments) on Tuesday AMC, FB (Facebook) on Wednesday AMC, both AMZN (Amazon) and the largest chip-maker & 6th largest component of QQQ, INTC (Intel) on Thursday AMC & wrapping up the week with the two goliaths of the energy sector, XOM (Exxon Mobil Corp) & CVX (Chevron Corp) reporting BMO (before market opens) which collectively, account for a whopping 50% of the energy sector ETF (XLE) as their market caps dwarfs all other companies in the energy sector. As such, it is safe to say this is one of the most significant weeks of the earnings season.

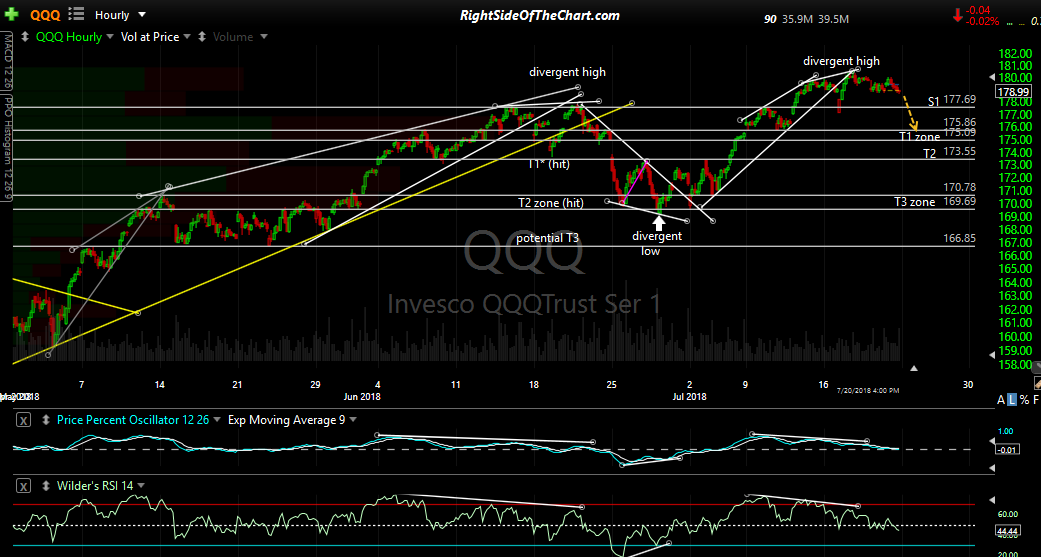

I was away from my desk on Friday & will be away from my desk most of tomorrow. I will reply to any questions or comments after I return Monday evening. I wasn’t able to post any updates on Friday although there really wasn’t much to report. The most recent negative divergences on the 60-minute charts of QQQ & SPY continue to play out with relatively mild selling, as suspected, as the market goes into a holding pattern in front of the upcoming big earnings week. I still favor more downside in the near-term with some potential targets shown on the 60-minute charts below.

- QQQ 60-min July 22nd

- SPY 60-min July 22nd

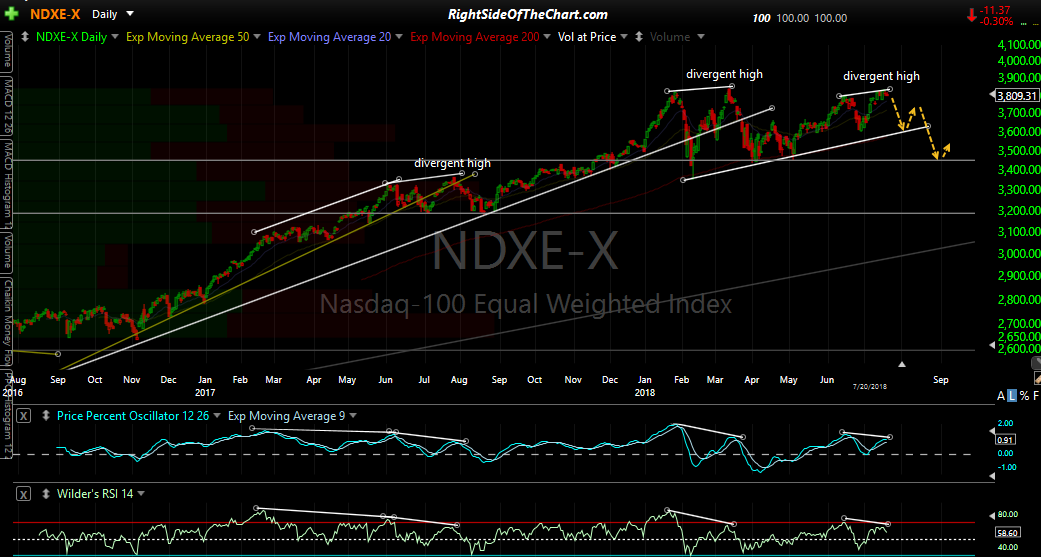

Zooming out to the daily timeframe of the leading index, the Nasdaq 100, the larger divergences that have been building since early January continue to increase the odds of a more substantial correction in the coming months. However, the trend remains bullish at this time without any sell signals on the daily charts.

The next chart below is the Nasdaq 100 Equal-weighted index which paints a different picture compared to the FAAMG top-heavy Nasdaq 100 index, which recently put in a new high while the $NDX-E peaked back in mid-March.

Bottom line: Despite the recent uptrend in the market, the recent divergence on the intraday time frames as well as the more significant daily time frames, coupled with the recent 60-minute trendline breaks on both SPY & QQQ (as well as the ES & NQ E-mini futures) indicate an elevated chance of a correction in the coming days to weeks. The slew of market moving earnings reports all but assures that well see an increase in volatility this week with earnings-induced opening gaps likely in the market this week.