Just a reminder that the FOMC announcement is scheduled for 2pm ET today. As the probability of a rate hike is very low, it won’t be so much whether the Fed raises rates or decides to sit tight, more so what they say in their forecast that will accompany their rate decision. Actually, to be more accurate, it really doesn’t matter what the Fed does or doesn’t do or even what they say or don’t say, more so it is only the market’s reaction that matters.

Also note that the stock market has a history of very sudden knee-jerk reactions (rips or dips) immediately following an FOMC announcement & forecast. In fact, it is not unusual to see the initial rip or dip be met with an equally powerful move the opposite direction. As such, I completely dismiss the initial reaction of the market immediately following an FOMC announcement, typically pulling my stops on any positions (although I welcome a post-FOMC rip to hit one of my nearby profit targets, allowing me to book gains if that was my preferred target). Sometimes it takes a day or two for the dust to settle after a key FOMC meeting before it becomes clear as to the direction at which the market has decided to head (higher or lower).

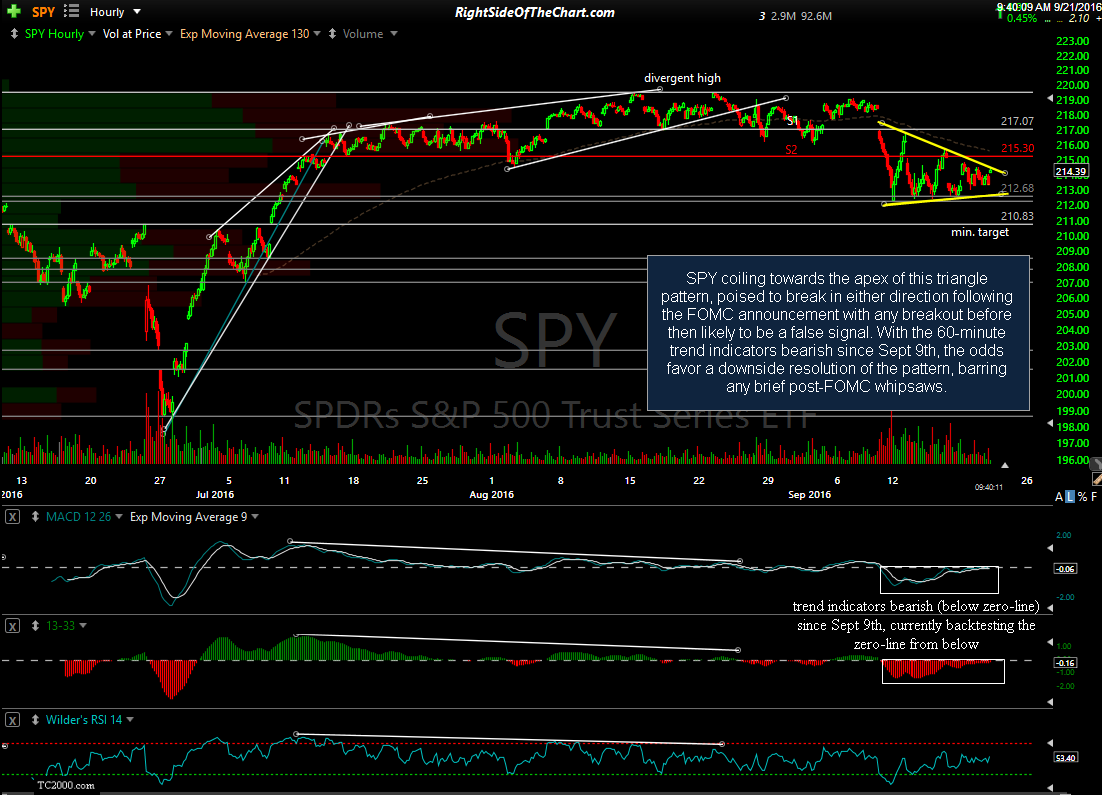

We’ve had some stops clipped in the pre-FOMC volatility recently, some or possibly all of those trades which still might be added back as new official trade ideas, depending on how the markets unfold after today. Until then, here’s a quick look at the major stock indices, starting with the SPY which appears to be coiling towards the apex of this triangle pattern, poised to break in either direction following the FOMC announcement with any breakout before then likely to be a false signal. With the 60-minute trend indicators bearish since Sept 9th, the odds favor a downside resolution of the pattern, barring any brief post-FOMC whipsaws although an upside resolution of this pattern along with bullish crossovers on the trend indicators is certainly a possibility. Remember, the chance for a whipsaw signal, even more than one, is pretty good so best to let the dust settle before aggressively engaging the market long or short.

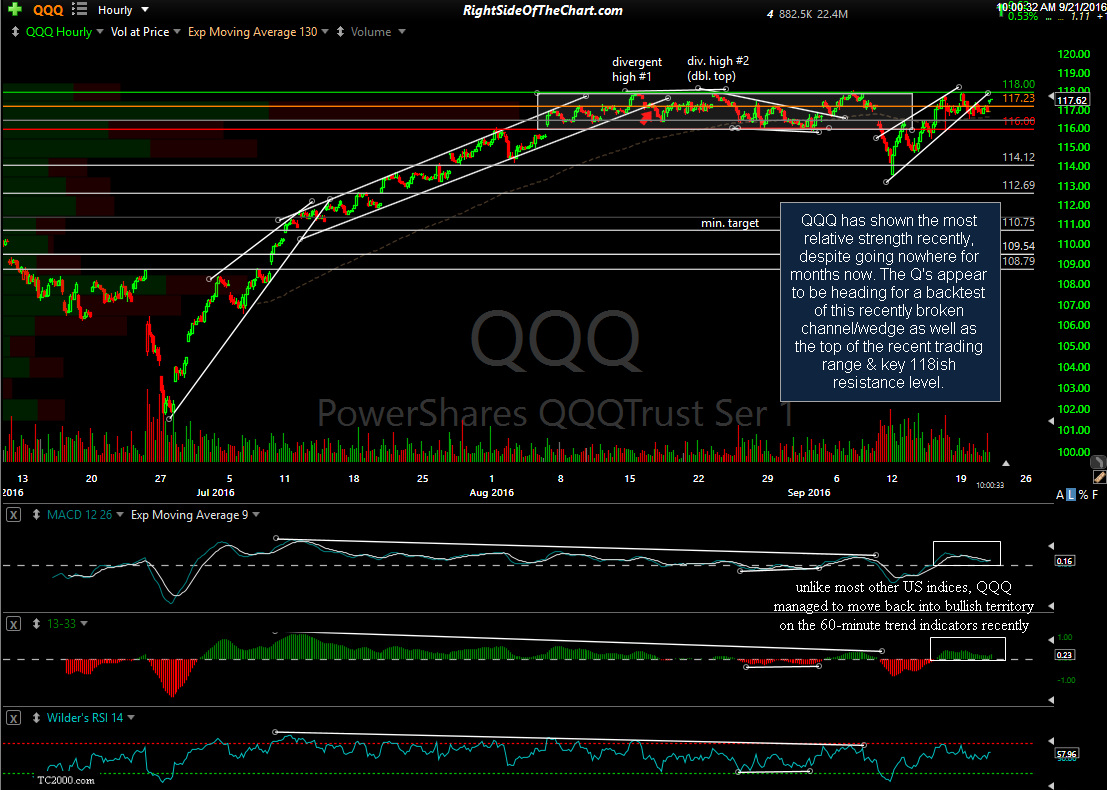

QQQ has shown the most relative strength recently, despite going nowhere for months now. The Q’s appear to be heading for a backtest of this recently broken channel/wedge as well as the top of the recent trading range & key 118ish resistance level. Unlike most other US indices, QQQ managed to move back into bullish territory on the 60-minute trend indicators recently.

Regarding the recent cannabis related trade ideas, CARA has just hit the first price target for about a 12%, 2-3 day gain; GRNH has taken out the 0.05 resistance level today (although still watching for some follow-through on volume); ACBFF closed above the 1.00 yesterday & continues to build on those gains today, now trading at 1.07, providing the official ACBFF Long-term Trade a gain of 95% from the original entry price (0.55) so far. It will be longer-term bullish if the stock can hold above the 1.00 level going forward.