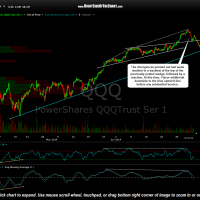

For the most part, nothing major has changed from a technical perspective in weeks now & as such, I continue to keep my trading light for the time being. Last week I highlighted the divergent highs in both the SPY & QQQ as well as a backtest of the SPY wedge. Shortly afterwards those divergences did begin to play out with both major index tracking ETFs finding support at the levels shown on the updated 60 minute charts below (following their respective previous 60 minute charts for reference). Although my opinion is not as strong as I would like it to be to establish a short position against the broad market, my current scenario would have this most recent bounce off those support levels terminating very soon, quite possibly on this morning’s post-opening bounce, with prices continuing lower to the targets shown on these updated 60 minute charts.

- SPY 60 minute July 1st

- SPY 60 minute Jully 9th

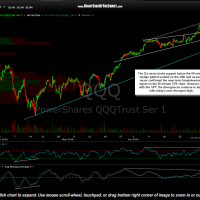

- QQQ 60 minute July 1st

- QQQ 60 minute July 9th

As far as gold, silver & the associated mining sector, the recent price action has been about as bullish as I could have expected. The near-term overbought conditions, negative divergences & 60 minute uptrend line/rising wedge pattern breakdown did cause the mining stocks to trade sideways for the last couple of weeks but the ‘correction’ fell shy of even my most modest pullback target (so far) and with the GDX starting to move above the recent highs of that consolidation range today (albeit by only a slight margin so far), the miners continue to exhibit bullish price action that is likely to continue going forward on the intermediate & longer-term time frames.

However, the metals themselves (GLD & SLV) are still within their respective recent consolidation ranges and unless/until both the miners & the metals clearly break above these ranges (or pullback to my aforementioned pullback targets) will I begin to aggressively add back the exposure that I reduced to the sector recently. Bottom line is that the metals & miners can break either way & my confidence is not high enough, nor is the R/R favorable to position long or short in advance of my “best guess”, which if I had to pick one or the other at this time, would probably be a downside break from the current trading ranges with GDX, GLD & SLV going on towards one or more of the downside targets listed on these updated 60 minute charts.

- GDX 60 minute July 9th

- GLD 60 minute July 9th

- SLV 60 minute July 9th