I’ve had a couple inquires in the trading room for updates on the WEAT Active Trade as well as JO (Coffee ETF), which was mentioned as poised to break out of a bullish falling wedge pattern in the recent 2017 Agricultural Commodities Outlook post. (that wedge was shown on the chart of $COFFEE)

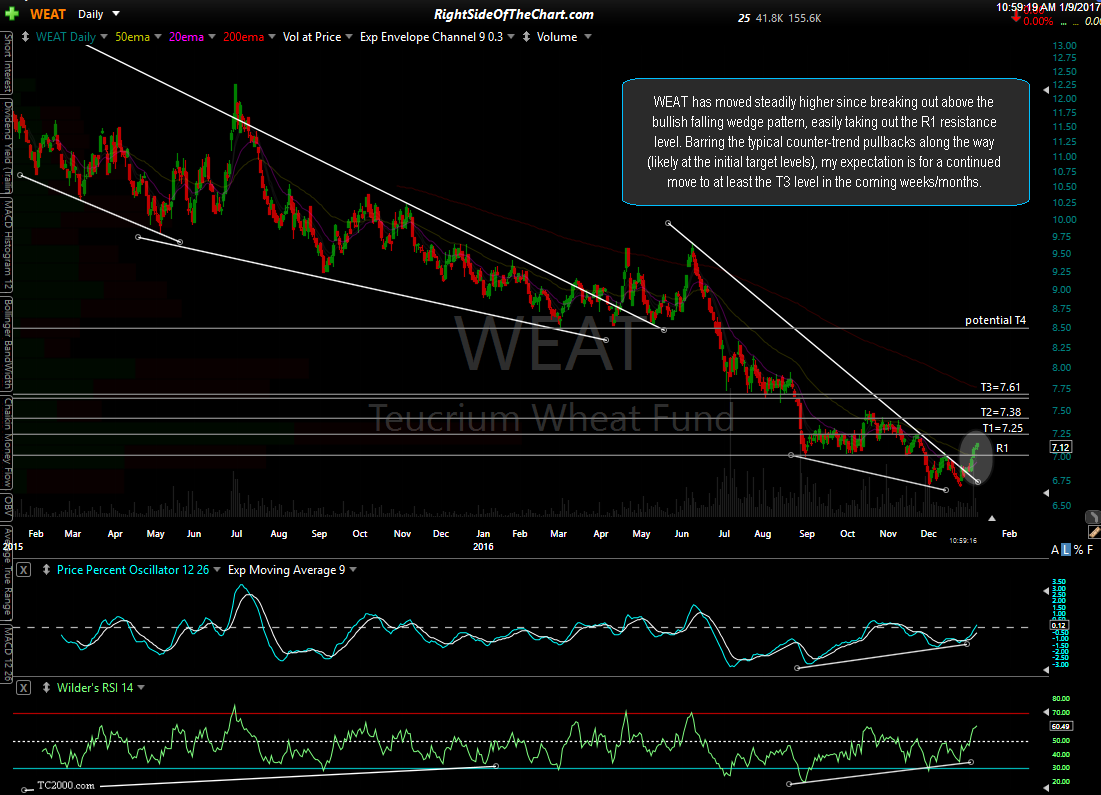

WEAT has moved steadily higher since breaking out above the bullish falling wedge pattern, easily taking out the R1 resistance level. Barring the typical counter-trend pullbacks along the way (likely at the initial target levels), my expectation is for a continued move to at least the T3 level in the coming weeks/months.

JO (coffee ETF), while not yet an official trade idea, recently broke out of the bullish falling wedge (shown on $COFFEE in the recent 2017 Ag Commodities Outlook) and has run into the first target/resistance level at 20.70. My expectation is for a continued move higher towards the 23.30 area the coming weeks or months.