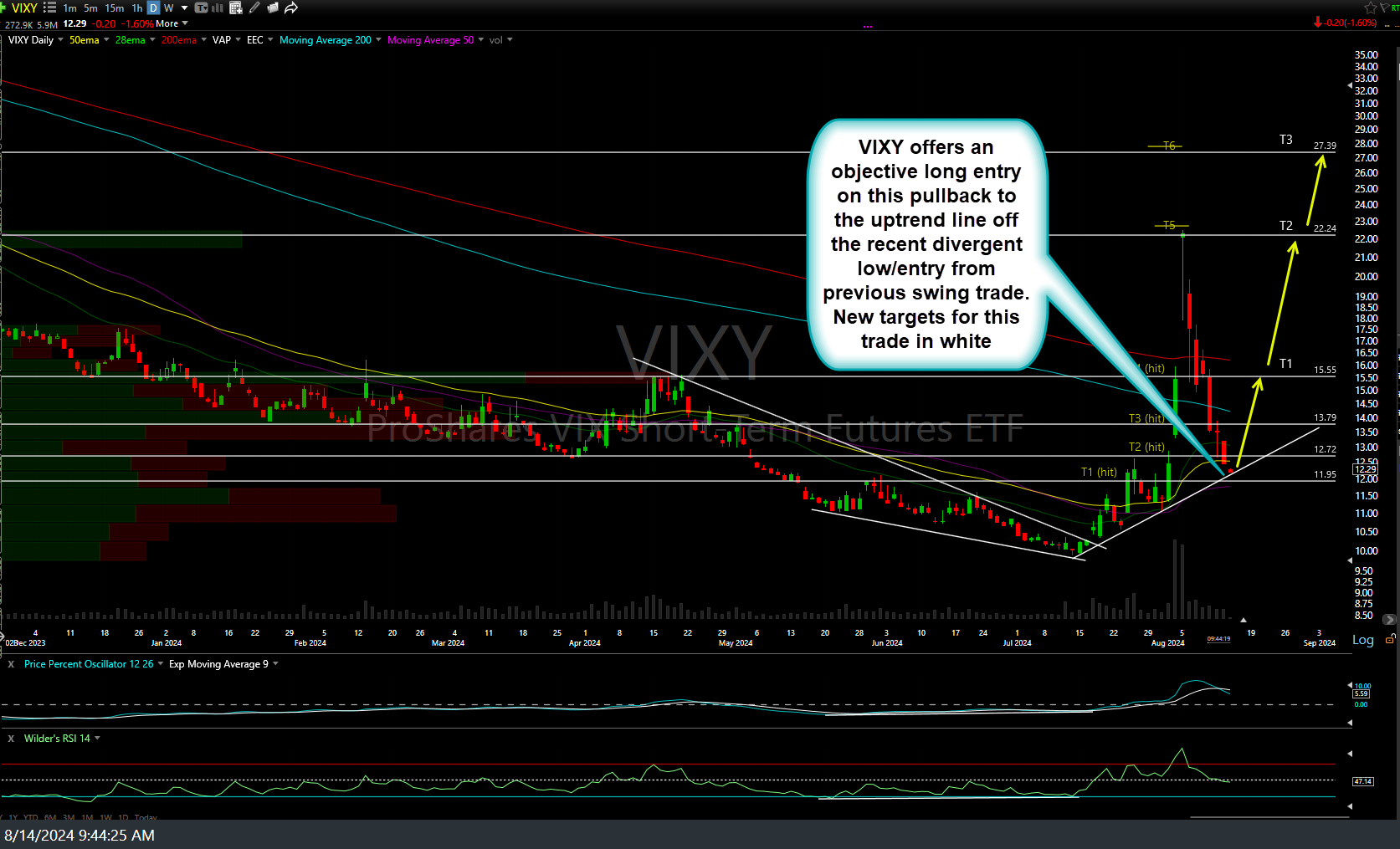

VIXY ($VIX short-term futures ETN) offers an objective long entry on this pullback to the uptrend line off the recent divergent low/entry from previous swing trade. New targets for this trade in white with the targets on the recent previous trade now yellow on the daily chart below. Stop commensurate with one’s prefer price target(s).

For futures traders, /VIX (Sept $VIX futures contract) offers an objective long entry here just above intersecting the 16.70 price & uptrend line support down to but not much below the uptrend line with stops somewhat below it, depending on one’s preferred price target(s). Note that we’ll be rolling to the Oct’s soon although the Sept contract still has more volume/liquidity. 60-minute chart below.

The case for an objective long on the $VIX, other than the technical reasons highlighted above (pullback to key support following the initial explosive rally off major long-term support with big positive divergences on the daily charts), can also be made from the fact that QQQ parked on (yesterday) & is still currently testing the primary downtrend line resistance with most market-leading tech stocks also running into price and/or key Fibonacci retracement levels in what appears to be a counter-trend rally.

I didn’t expect any surprises from today’s CPI, which came in right inline with expectations, however, I do think that a potential catalyst to spike the next leg up in the $VIX/down in the stock market could come on the flurry of economic reports due tomorrow before the market opens including Jobless Claims, Retail Sales, & a pair of key Manufacturing Index reports. Maybe those send the market the other way but for now, sticking with my trading plan & following the charts.