I’ve had a few inquiries in the trading room regarding price targets for TVIX (2x leveraged short-term VIX futures ETN) so I figured that I’d share that charts, along with my daily chart of the $VIX (spot VIX index) on a front page post for both Silver & Gold members that might be interested.

- TVIX daily May 31st

- VIX daily May 31st

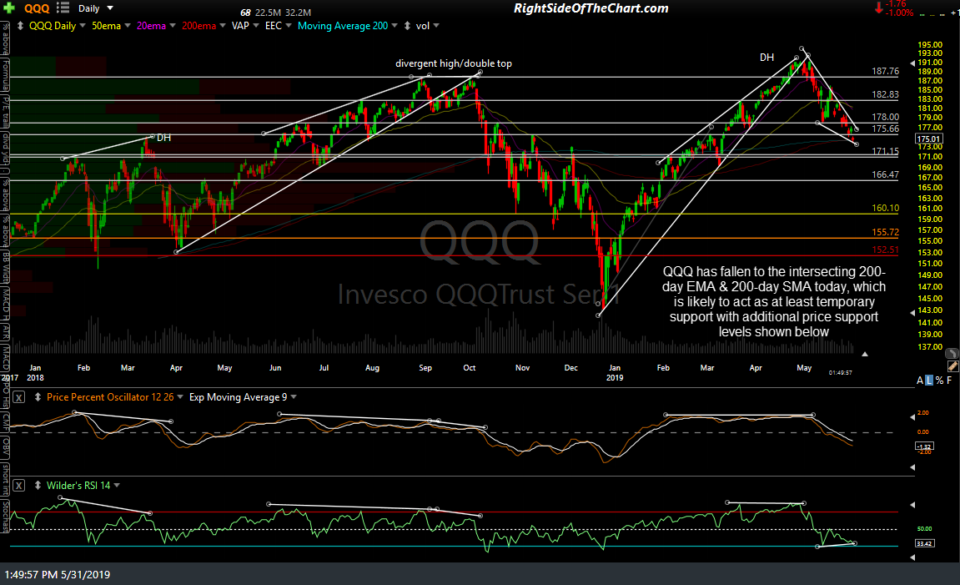

I’ve also been focused largely on some of the near-term potential bounce targets for SPY & QQQ recently yet, as I’m still very much open to the possibility of more downside in the markets should the current bullish divergences on the 60-minute charts fail to translate into a bounce next week, my daily chart of QQQ with some of the key support levels & potential price targets for a short-side trend trade on QQQ is posted below.

Essentially, the first key support on QQQ comes in right around where the Q’s are currently trading with the 200-day EMA (exponential moving average) at 174.56 & the 200-day SMA (simple moving average) at 174.31. While I’m still leaning towards a bounce following today’s tag of those key MA’s from above, should those supports fail to at least put a temporary halt to this slide, the next support zone below come in around 171.65-171.15 followed by the 166.50ish support.