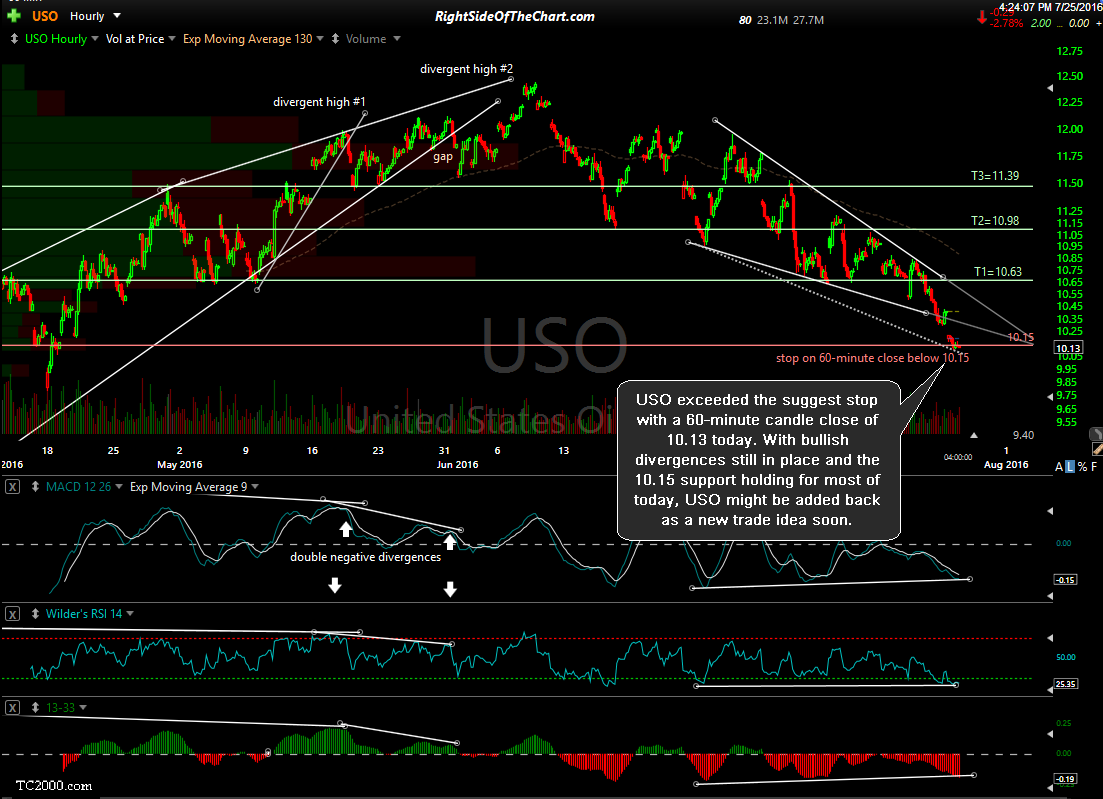

USO exceeded the suggested stop with a 60-minute candle close of 10.13 for a loss of 1.8% today. With bullish divergences still in place and the 10.15 support holding for most of today, USO might be added back as a new trade idea soon. The USO long/UWTI short trade will now be moved to the Completed Trades category but for those still in the trade or following crude, I posted the following comments earlier today in reply to a question on the USO trade:

The official entry for USO (or a UWTI short) was where it was trading when posted on Friday with the suggested stop being a 60-minute candlestick close below 10.15, which is the level USO is trading at as I type & if you look at a 1-minute period intraday chart, you’ll see that USO has been trading nearly flat on top of that key support level all day, helping to validate that level as an important & well watched technical level.

I’m going to keep the official stop as is, which means that it could be hit soon but I will also add that the 60-minute divergences are still in place so one could certainly go long here around USO 10.15 with stops maybe 2-3% below as I think that would still be a very objective long entry (or add-on to a starter/fractional position that was taken on Friday, which would thereby lower one’s cost basis & allow for a slightly lower stop calculated off the adjusted basis & preferred price target).