As requested by member @lee1 in the trading room, here are my thoughts on the USD/CAD pair:

Viewing this 3-year chart with 2-day period candlesticks (every stick represents 2-days of price history), the USD/CAD recently broke down below this well-defined uptrend line following a blow-off top & divergent high (bearish). With a healthy drop in the pair since, along with the current oversold readings, I favor a near-term bounce before the key 1.28 support level gives way, opening the door to the next major thrust down. One possible scenario would be a bounce that forms the RS of a larger H&S topping pattern, with the 1.28 support level as the neckline.

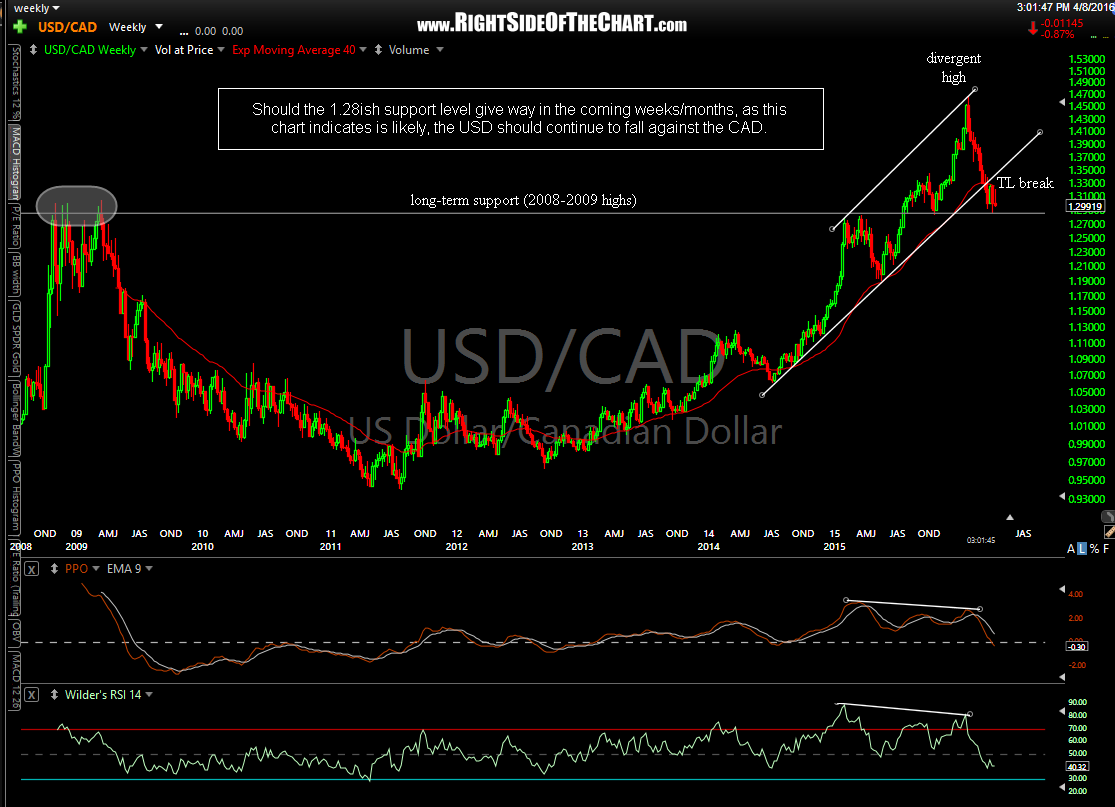

This 8-year weekly chart below highlights how the recent reactions off the 1.28 level in late 2014, 2015 & another recent reaction so far in 2016, also align with the ceiling that capped the USD/CAD pair on numerous occasions back in 2008 & 2009, thereby adding to the technical significance of the 1.28 area. Also note the clear negative divergence that built over a period of nearly 12 months before the blow-off top in USD/CAD. Blow-off tops, especially in conjunction with negative divergence on the weekly time frame greatly increases the odds that the Jan 16th top in this currency pair was a lasting top, with the US Dollar most likely in a new bear market against the Canadian Dollar vs. the recent drop just being simply just a correction within an on-going bull market.

I would like to add that although I favor a bounce or at least some consolidation to alleviate the current oversold readings, parabolic blow-off tops, such as the USD/CAD recently experienced, are often followed by price drops that are just as impulsive as the preceding steep rally into the highs. As such, my bounce or consolidation scenario may or may not play out & most importantly, any solid break below 1.28 should be respected as that is likely to open the door to another impulsive wave of selling.