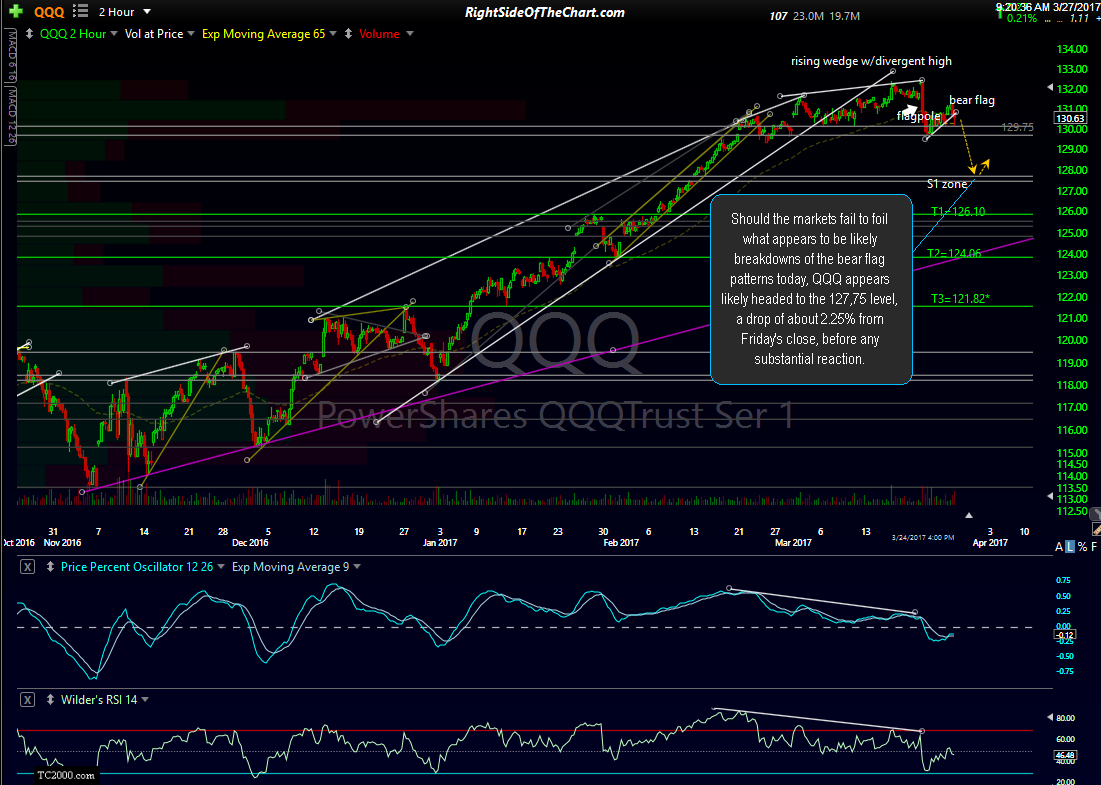

I started working on these charts before the market opened so they are reflective of Friday’s closing prices & indicate how much downside I expect before any substantial reaction in the major stock indices. Should the markets fail to foil what appears to be likely breakdowns of the bear flag patterns today, QQQ appears likely headed to the 127,75 level, a drop of about 2.25% from Friday’s close, before any substantial reaction.

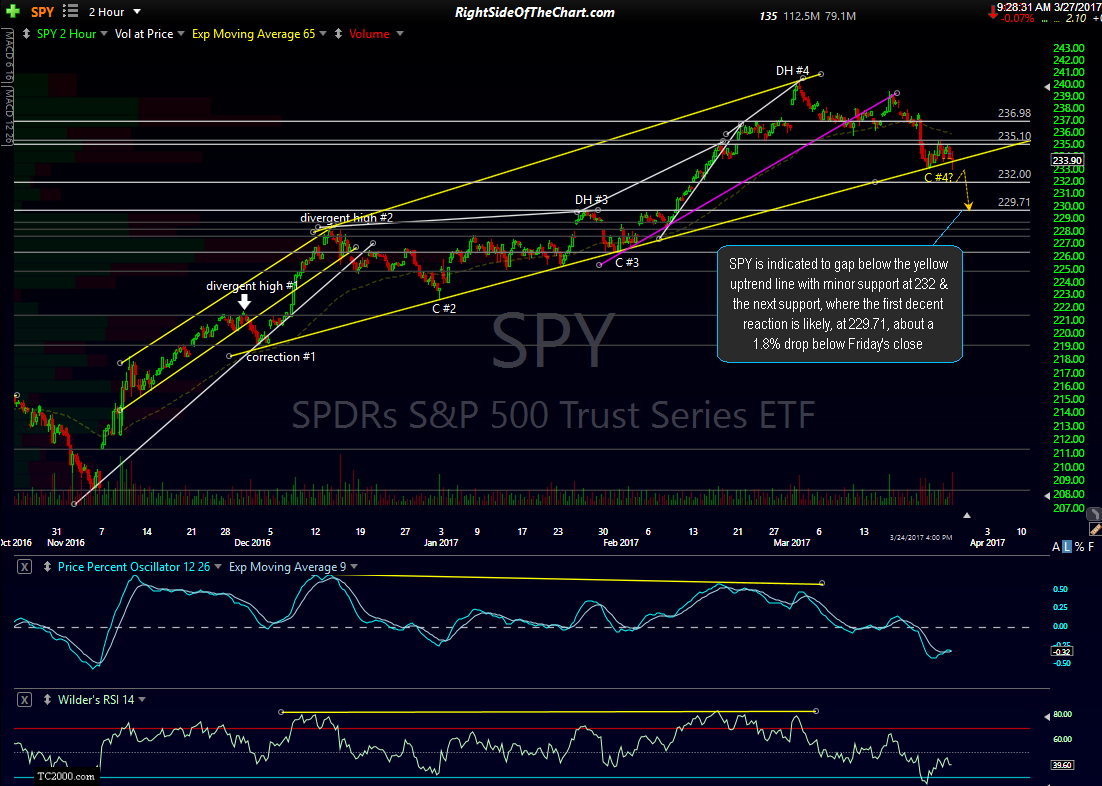

SPY is indicated to gap below the yellow uptrend line with minor support at 232 & the next support, where the first decent reaction is likely, at 229.71, about a 1.8% drop below Friday’s close.

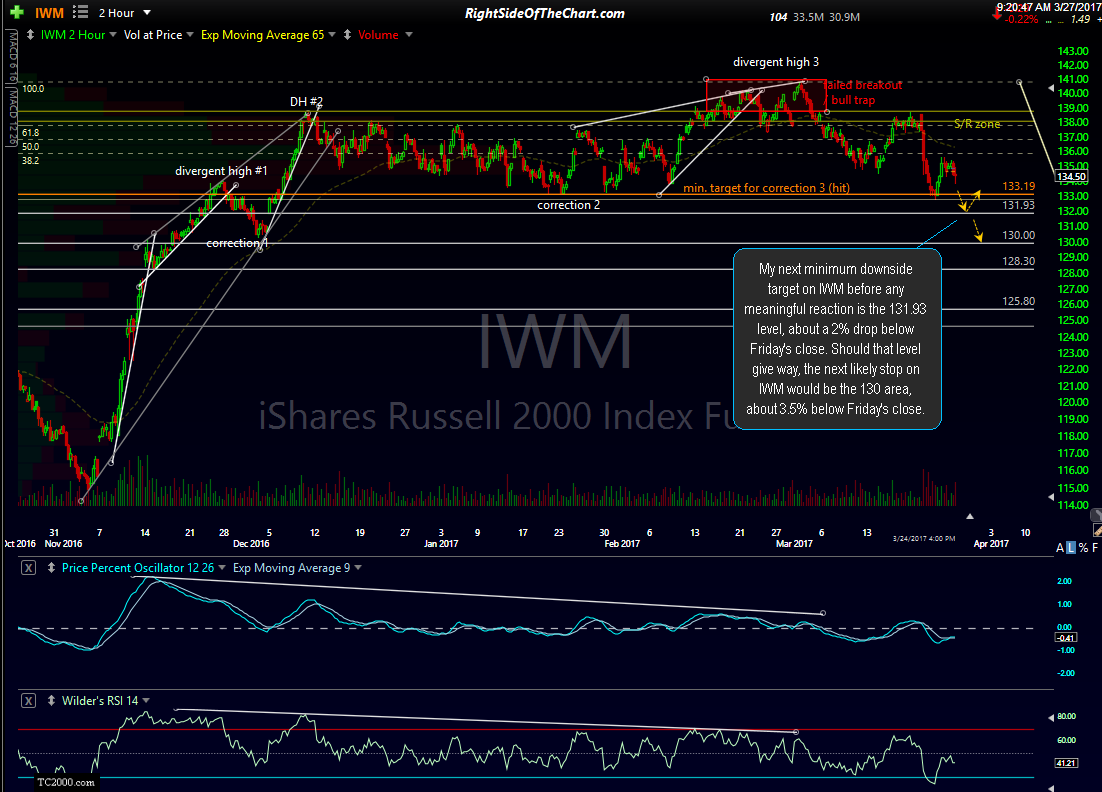

My next minimum downside target on IWM before any meaningful reaction is the 131.93 level, about a 2% drop below Friday’s close. Should that level give way, the next likely stop on IWM would be the 130 area, about 3.5% below Friday’s close.

Keep in mind that these are the only the next likely price levels where a reaction is likely although the bigger picture, should the markets follow-through & build on this morning’s gaps & breakdowns below the recently highlighted bear flag continuation patterns, would indicate considerable more downside to come this week.