In response to the 5-minute triangle patterns that have been highlighted recently, I received a couple of emails today pointing out similar patterns on the larger, 60 minute time frame. Those patterns, at least the lower uptrend lines, were actually highlighted in yesterday’s video on both the SPY & $NDX (which I used because the Aug 24th candlestick on the QQQ is distorted & unrepresentative of the actual price action in the Nasdaq 100 as well as most of its component stocks that day). Those 60-minute trendlines were discussed starting around the 6:50 mark in yesterday’s video.

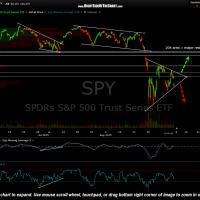

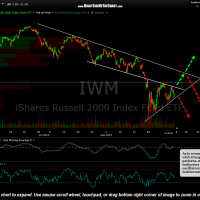

The breakdown of the 5-minute charts resulted in a sharp move down in prices that were relative to that very short time frame, as stated earlier. The updated 60-minute charts of the SPY, QQQ & IWM show the larger triangle patterns, the bottom of which all of which have been tested at today’s lows. As with those smaller 5-minute patterns, the next major move in the market is likely to be determined by the direction in which these patterns break and as these are much larger patterns, the ensuing selloff or rally is likely to be much larger as well. As is common with triangle patterns, most indicators & oscillators are indeterminable as price & momentum indicators tend to also pinch down towards the middle of their ranges in a similar triangle shape.

- SPY 60 miinute Sept 3rd

- $NDX 60 minute Sept 3rd

- IWM 60 minute Sept 4th

Bottom line: I still favor another major thrust down in the markets but to short here with prices just above support would not be very objective. Those expecting a move to the top of these 60-minute triangle patterns and possibly beyond (as an upside break would be bullish) could certainly take a shot at a long trade here with stops somewhat below those patterns (to allow for a brief whipsaw signal). For those favoring a downside resolution of these patterns, the next objective short entry will come on a solid break to the downside.

Being that today is the Friday before a 3-day weekend, there’s a good chance that we may just chop around today with most traders likely adverse to establishing positions in front of an extended weekend that is almost certainly bound to result in a substantial gap one way or another when the U.S. markets open on Tuesday. Personally, I’m taking home most, if not all of the swing short position that I’ve scaled back into over the last week or so as I believe the R/R is clearly skewed to the downside at this time. As always, trade according to your own risk tolerance, market bias, & trading plan.