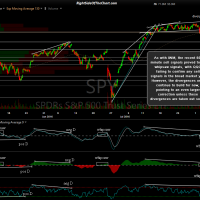

There isn’t much new to report in the equity market other than a few recent whipsaw signals on the 60-minute trend indicators for SPY & IWM that occurred last week. As with any indicator, these 60-minute trend indicators are not 100% effective & as with all trend indicators, in order to help filter out the whipsaw signals, they are most effective when confirmed with other buy or sell signals, such as the breakdowns below the aforementioned support levels on SPY, QQQ & IWM (of which only SPY very briefly traded below last week).

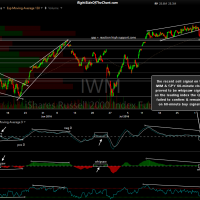

- IWM 60-minute Aug 5th close

- SPY 60-minute Aug 5th close

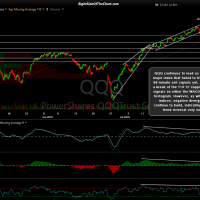

- QQQ 60-minute Aug 5th close

In hindsight, the recent IWM short entry was premature as I didn’t wait for all of the sell signals (price support breaks with trend indicator confirmation) in ALL 3 of these major indices highlighted here in last Monday’s market update, instead jumping the gun on an early breakdown in the least significant of all three of those major indices. Hindsight is 20/20 & I certainly regret jumping the gun by adding IWM as an official trade although stops were set unusually tight on that trade because both the SPY & QQQ had not confirmed at the time. I was very confident at the time that both SPY & QQQ would both trigger all of those 60-minute sell signals last week & still am at this point but will hold off before adding any more broad market shorts (both officially & personally) until they do.

Essentially, we will begin this week as we did last week, awaiting all three (QQQ, SPY & IWM) to trigger both breaks of those key support levels as well as confirmation on the MACD & 13/33 trend indicators. Should the current bearish divergences on the daily & 60-minute time frames get taken out with the MACD & RSI going on to move above the previous reaction high, then the current bearish setups will have been foiled. Until then, the charts still indicate that a significant reversal in the stock market is likely to occur any day now.