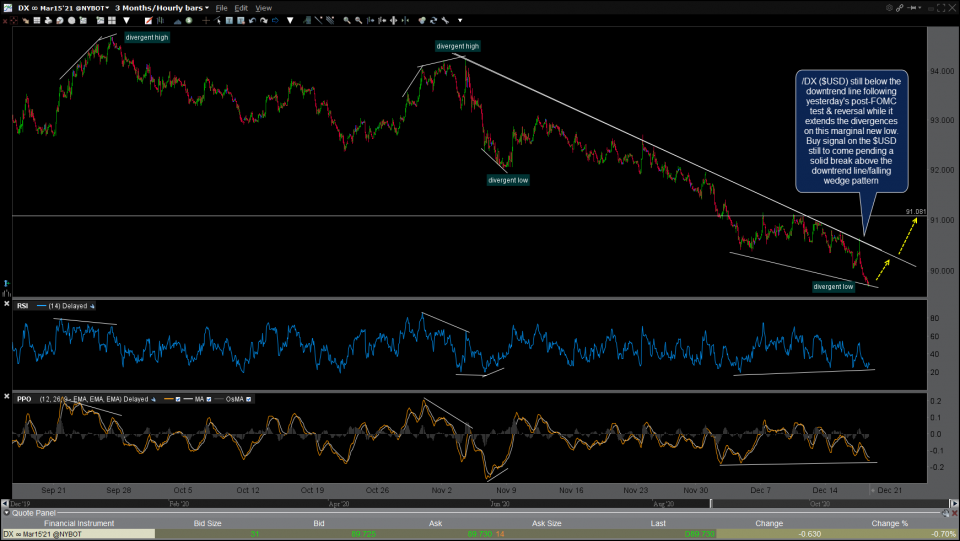

/DX (US Dollar futures) is still below the downtrend line following yesterday’s post-FOMC test & reversal while it extends the divergences on this marginal new low. A buy signal on the $USD would still to come pending a solid break above the downtrend line/falling wedge pattern as long as the pattern remains intact. Updated 60-minute chart below.

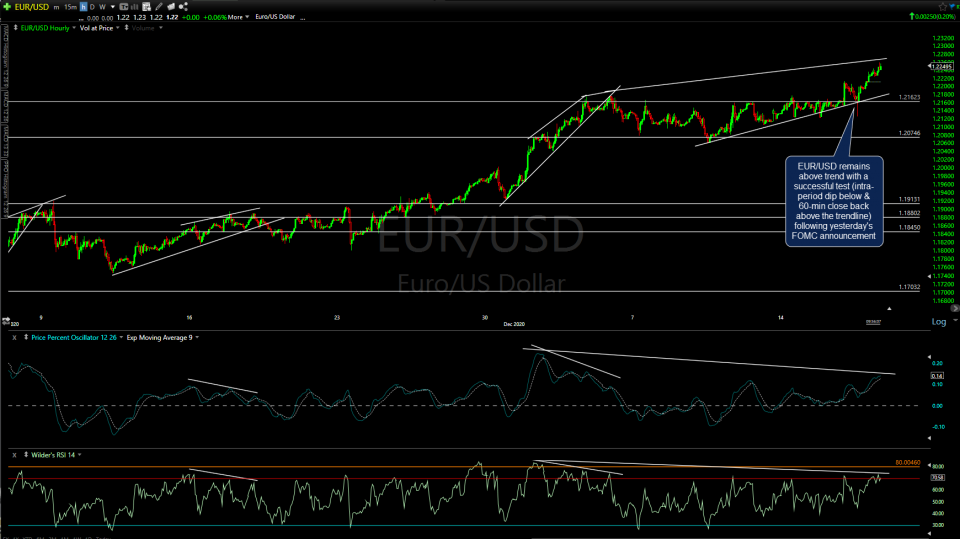

Likewise, the $EUR/USD remains above its comparable 60-minute trendline with a successful test (consisting of an intra-period dip below & a 60-minute close back above the trendline) following yesterday’s FOMC announcement.

Bottom-line: No buy signal on the $USD or sell signal on the Euro yet, with both reversing off their respective trendlines yesterday which was net bullish for gold, silver, & the mining stocks so far. However, these potentially bullish (Dollar) and bearish (Euro) setups remain intact for now as the divergences on both continue to build. That also opens the door to a move down to that 89ish long-term support on the $USD as covered in yesterday’s video. i.e.- Minimal downside in the US Dollar from here before it hits a fairly solid support level where a reaction is likely.