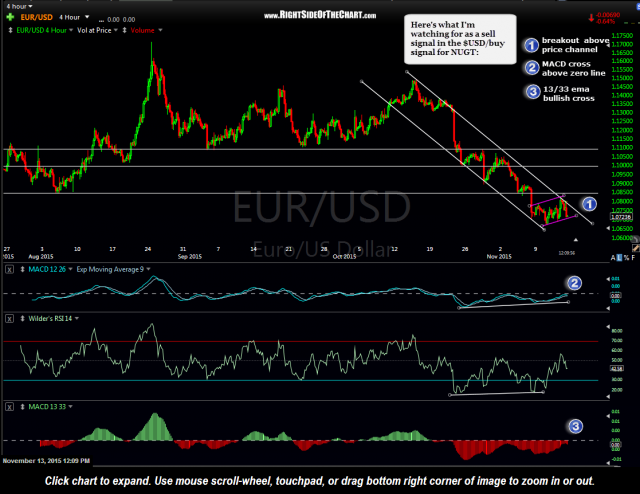

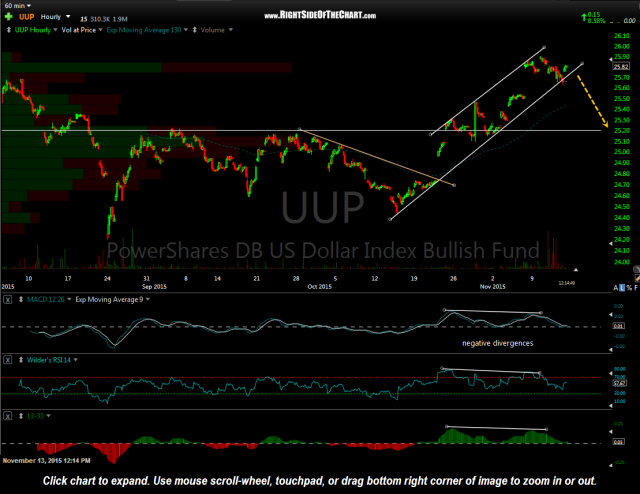

I am currently monitoring some potentially bearish developments in the US dollar that could is likely to spark a tradeable rally in the mining stocks should the $USD (as shown on this UUP 60-minute chart) and the EUR/USD pair (shown on this 4-hour period chart) break out of these price channels. Most of the momentum oscillators & indicators appear to confirm that a reversal in the dollar & euro is likely to occur soon (which is, by far, the largest component of the US Dollar Index).

- EUR-USD 4 hour Nov 13th

- UUP 60 min Nov 13th

Viewing this 3-year daily chart, the case for a more powerful reversal in the $USD could also be made here. Not only is the greenback currently backtesting the recently broken uptrend line generate off the mid-2014 lows but the Bollinger Bands have current just expanded to levels which have historically preceded sharp & nearly immediate trend reversals so with the recent trend being bullish, that would indicate a reversal (downtrend) in the dollar is likely.

Once again, until/unless the EUR/USD makes a solid break (and at least a 60-minute close below) these price channels, the trend in the dollar remains solidly intact for now. Currency traders could certainly position on a breakdown of the EUR/USD or a breakout of UUP however, my preference, should these charts play out as expected, will be a long-side trade in the miners via a NUGT long or DUST short.