/NG (natural gas futures) has pulled back to the 2.379 former resistance, now support level thereby offering another objective long entry with an appropriate stop below (depending on one’s target(s) & avg. cost). 60-minute chart below.

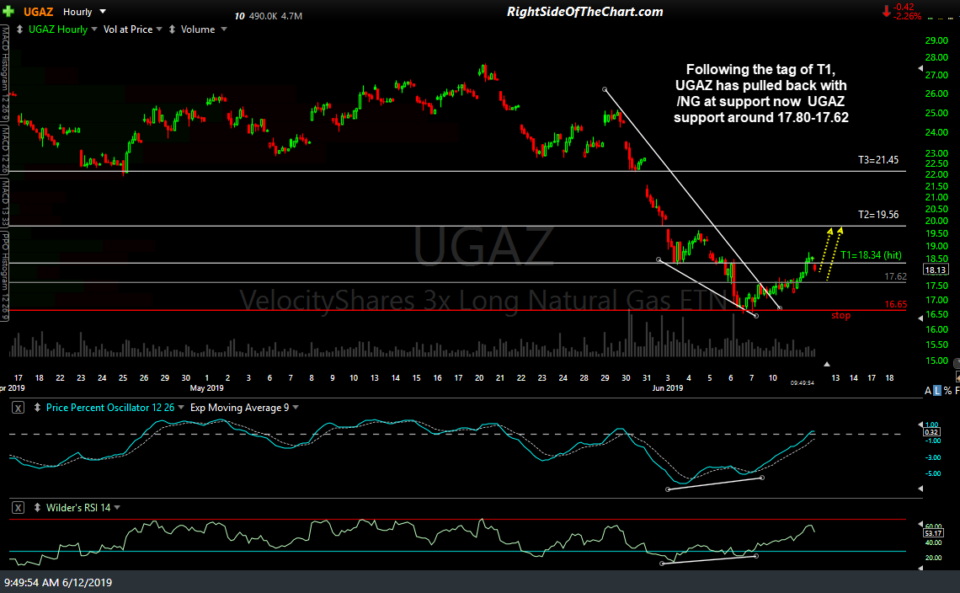

Following the tag of T1, UGAZ has pulled back with /NG at support now UGAZ support around 17.80-17.62. 60-minute chart:

Please note, the weekly crude inventories report will be released shortly at 10:30 am EST today, which often causes not only sharp spikes in crude oil but also natural gas, followed by the nat gas inventory report (which is usually followed by a sharp rip or dip in the very volatile natural gas price) tomorrow (Wed) also at 10:30 am EST.

Entering or adding to a position just in front of an inventory report entails an added degree of risk. As with any trade, stops are not an option, especially when trading the extremely volatile & fast-moving natural gas leveraged ETNs or futures contracts. Just wanted to pass along this objective, yet aggressive entry for those interested.