The market didn’t care much for TXN (Texas Instruments) earnings report & forward guidance last night & TXN is one of several leading semiconductor stocks (with the top 5 by market cap) that looks poised for a major correction/bear market in the coming months+.

As of now, TXN remains above its primary uptrend line although the step negative divergences in place as the momentum indicators severely lag behind price at the most recent highs indicates an increased likelihood that this stock, along with quite a few other leading semiconductor stocks, either already have or will soon embark on a new bear market (i.e.- a drop of 20% or more). While it certainly won’t be a straight shot down, my expectation is for a move back down to the 59 area on TXN in the coming months+ with a sell signal to come on a break & a solid weekly close below the primary uptrend line.

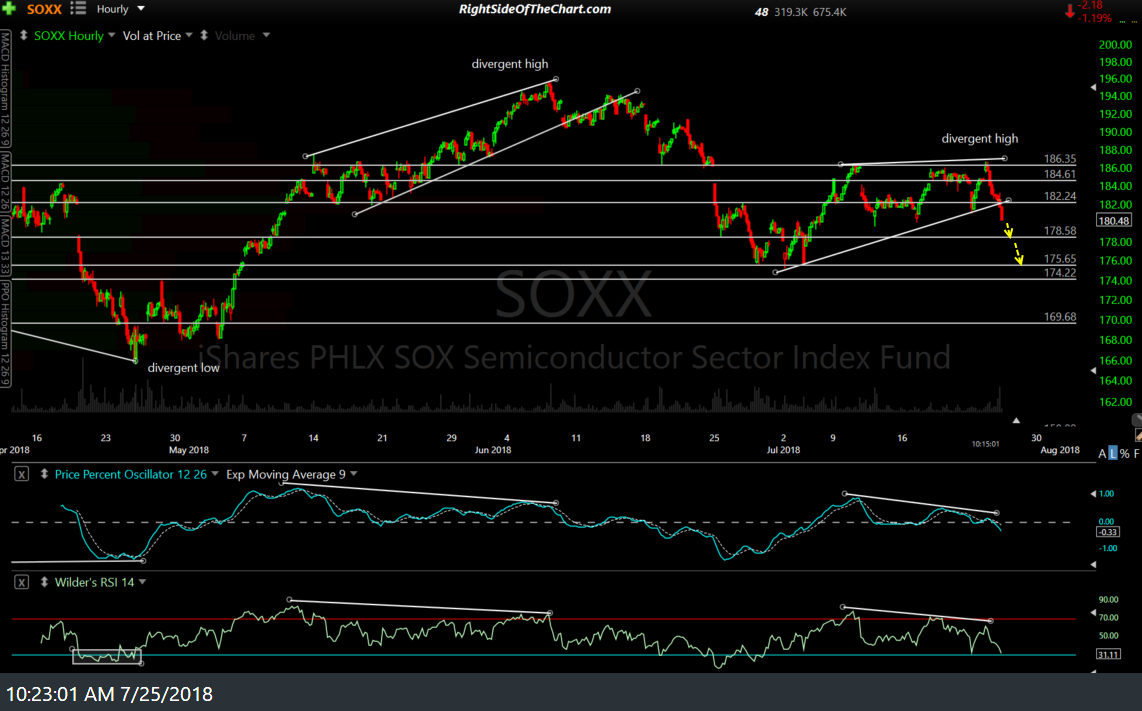

SOXX (PHLX SOX Semiconductor Sector Index tracking ETF) has already broken down below primary uptrend line support with a successful backtest of the trendline from below in early June & has been moving lower since. It appears that the “nail-in-the-coffin” support level comes in around 164.50, with a solid weekly close below that level likely to spark the next wave of impulsive selling in the semis.

The 60-minute chart above shows SOXX moving impulsive lower following the most recent divergent high with near-term targets of 178.58 & 175.65. Keep in mind that the industry leader, INTC (Intel Corp) is scheduled to report earnings tomorrow (Thursday) after the market close and as such, one should expect volatility & a likely gap in either direction, in the semiconductor sector when the market opens for trading on Friday.