Here’s a quick update on some of the recently highlighted swing trade ideas, including a new trade idea on INTC (Intel Inc.).

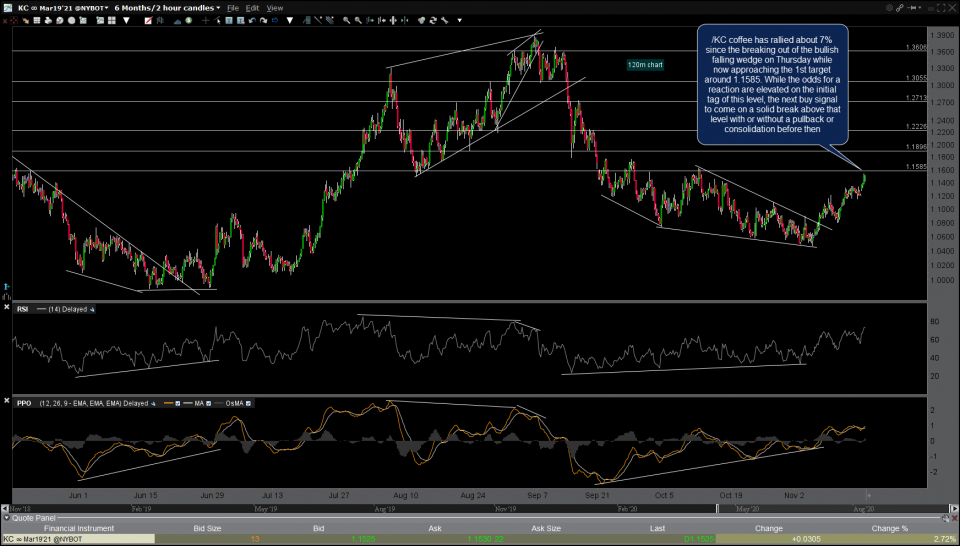

/KC (coffee futures) has rallied about 7% since the breaking out of the bullish falling wedge on Thursday while now approaching the 1st target around 1.1585. While the odds for a reaction are elevated on the initial tag of this level, the next buy signal to come on a solid break above that level with or without a pullback or consolidation before then. 60-minute chart below.

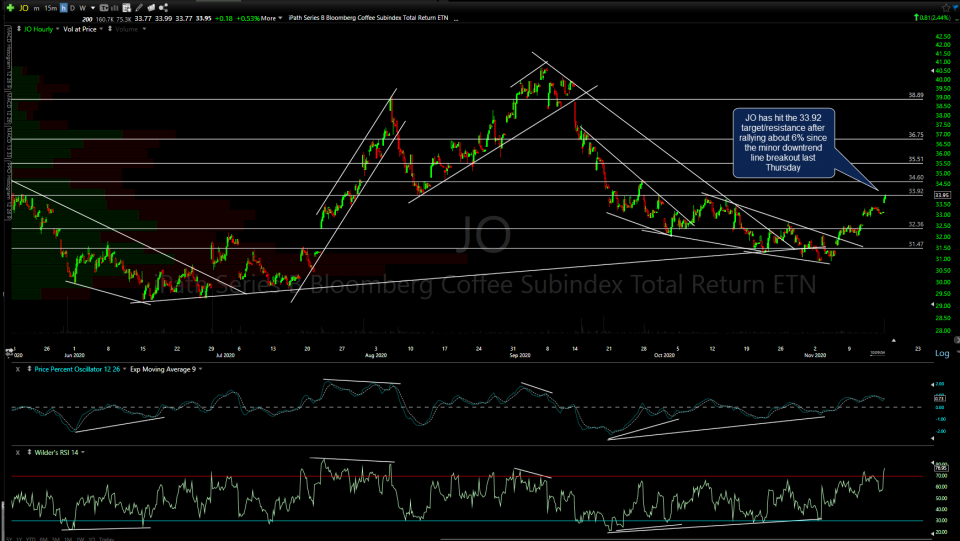

Likewise, JO (coffee ETN) has hit the 33.92 price target/resistance after rallying about 6% since the minor downtrend line breakout last Thursday. 60-minute chart below.

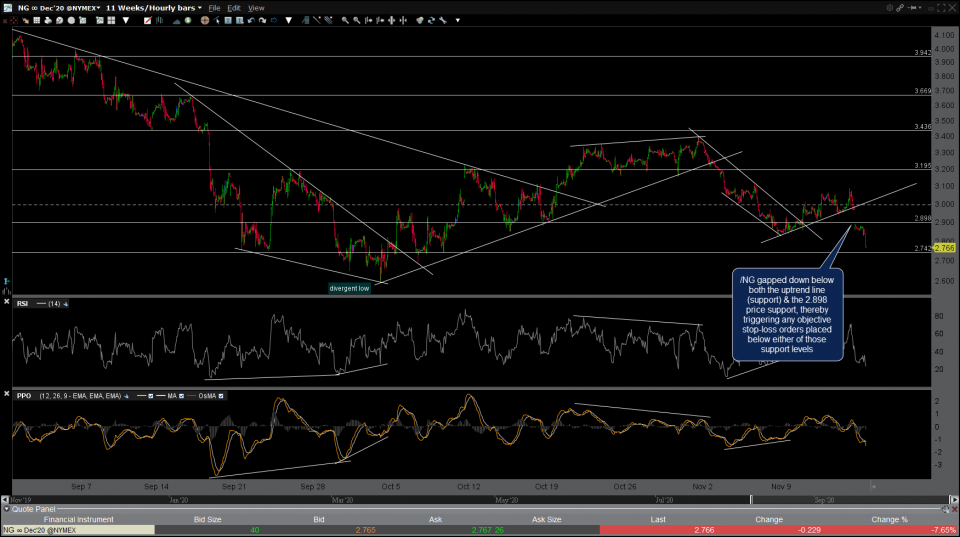

/NG (natural gas) gapped down below both the uptrend line (support) & the 2.898 price support, thereby triggering any objective stop-loss orders placed below either of those support levels. 60-minute chart below.

/GC gold continues to climb toward the downtrend line (min. target) and the potential 2nd target of 1914. 120-minute chart below.

INTC (Intel Inc.) has been lagging behind the rest of the semis but with one of the more constructive (bullish) charts at this time. Recently reversing off a major support zone with positive divergences, any or all of the marked levels are potential price targets. Daily chart below.