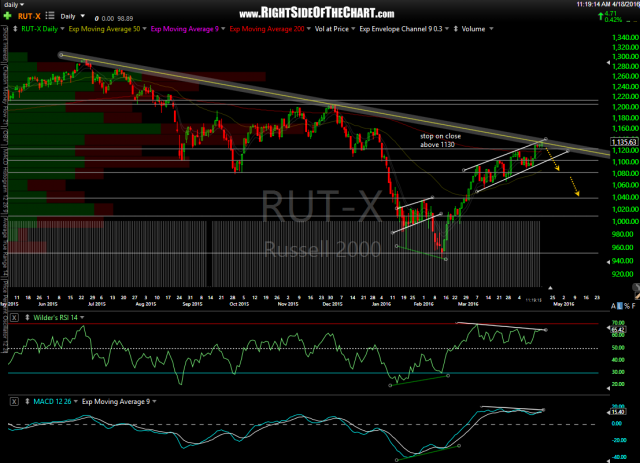

The TNA short/TWM long trade idea entered on March 4th exceeded the suggested stop of a close above 1130 on the $RUT on Friday, accounting for a 13.7% loss on TNA (or about a 9% loss on TWM). Although this trade will be removed from the Active Trades category & assigned to the Completed Trades, it still appears that the odds for a reversal & substantial correction in the Russell 2000 Small Cap index appears likely as the $RUT is now challenging the downtrend line off the mid 2015 highs with negative divergences in place on this daily chart.

- $RUT daily March 4th

- $RUT daily April 18th

For those still short or looking to add short exposure here, the $RUT looks to offer an objective short entry or add-on with a stop on a solid daily close above this downtrend line AS WELL as a solid daily close above 11.84 on QQQ, which is the top of the very technically significant New Year’s gap.