This market continues to show extreme complacency in the face of deteriorating fundamentals, a fiscal cliff which, by consensus, the market has already priced in the most optimistic scenario, and now deteriorating market action. I will rarely mention options on this site as options should only be used very judiciously by all but the most experienced traders (and completely avoided by inexperienced traders IMO) but I did want to point out that with the risk of a possible sharp sell-off in the market elevated right now, one could consider going long some $VIX calls as a possible hedge to any longs (or as a speculative short play for very aggressive and experienced traders).

I don’t have the time today (or really ever in a single post) to explain all of the variables and nuances of trading the $VIX but I will mention a few common misconceptions and briefly share my thoughts on the $VIX. First off, realize that you can’t directly buy or sell the $VIX. The “VIX” that most traders are familiar with is referred to as the spot VIX. There are several ways to attempt to benefit from swings in the volatility index with the favorite for the retail crowd being the VIX tracking etf’s. Again, too long to explain all the ins & outs of these etf’s/etn’s that attempt to track the VIX but most do a lousy job at it and suffer from price decay and/or tracking error. It is also necessary to be aware of which futures each particular etf/etn is rolling but the bottom line is that I avoid these vehicles.

The two most viable options, again in my opinion (and I am far from an options expert so take it with a grain of salt), is to either trade the $VIX futures or $VIX options. My preference is usually the options so I’ll quickly speak to that. First off, options on the VIX are not based off the spot VIX. VIX options are puts or calls based on the futures for the same month as the futures that they expire on. e.g.- The Feb 20 calls are priced against the Feb VIX futures contract, which will almost always differ in price from the spot VIX. Just like equity index futures, there is usually a time premium built into the VIX futures.

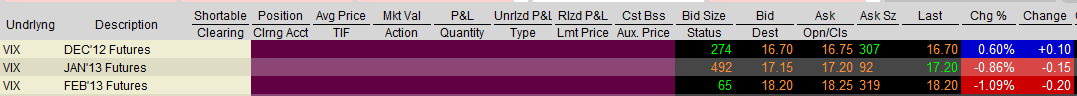

As I type, the spot VIX is at 16.91 (and moved up a bit since I took these screenshots). It takes a little time to put this posts & screenshots together but you can see the price for the VIX futures above. Basically, the Jan VIX futures were asking (selling for) 17.20 here… a very modest premium over the spot VIX, considering the potential for a large move in the near future. The Feb VIX futures were only asking 18.25, again a bargin IMO, considering the current potential risks in the broad market. The image below is a snap-shot of the option chain for the Jan & Feb VIX calls. Once again, if considering buying or paper trading any of these calls, remember that the Jan Calls are based off the Jan futures, not the the spot VIX. Also be aware that VIX options have different expiration dates than equity options. More info on the VIX can be found here.

As I type, the spot VIX is at 16.91 (and moved up a bit since I took these screenshots). It takes a little time to put this posts & screenshots together but you can see the price for the VIX futures above. Basically, the Jan VIX futures were asking (selling for) 17.20 here… a very modest premium over the spot VIX, considering the potential for a large move in the near future. The Feb VIX futures were only asking 18.25, again a bargin IMO, considering the current potential risks in the broad market. The image below is a snap-shot of the option chain for the Jan & Feb VIX calls. Once again, if considering buying or paper trading any of these calls, remember that the Jan Calls are based off the Jan futures, not the the spot VIX. Also be aware that VIX options have different expiration dates than equity options. More info on the VIX can be found here.