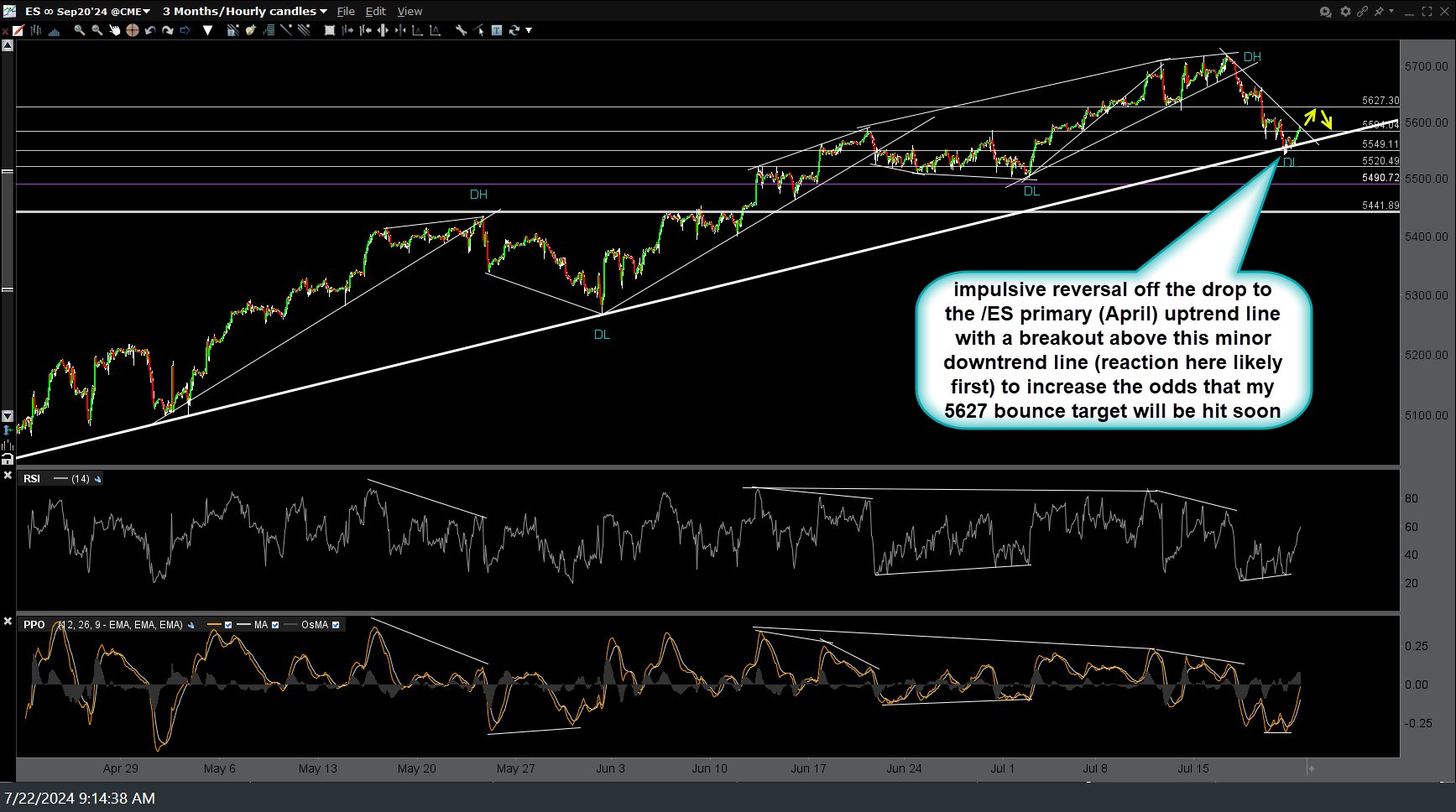

/ES (S&P 600 futures) made an impulsive reversal off the drop to the /ES primary (April) uptrend line which it parked on at Friday’s close with a breakout above this minor downtrend line (reaction here likely first) to increase the odds that my 5627 bounce target will be hit soon. Previous (Friday’s) & updated 60-minute charts below.

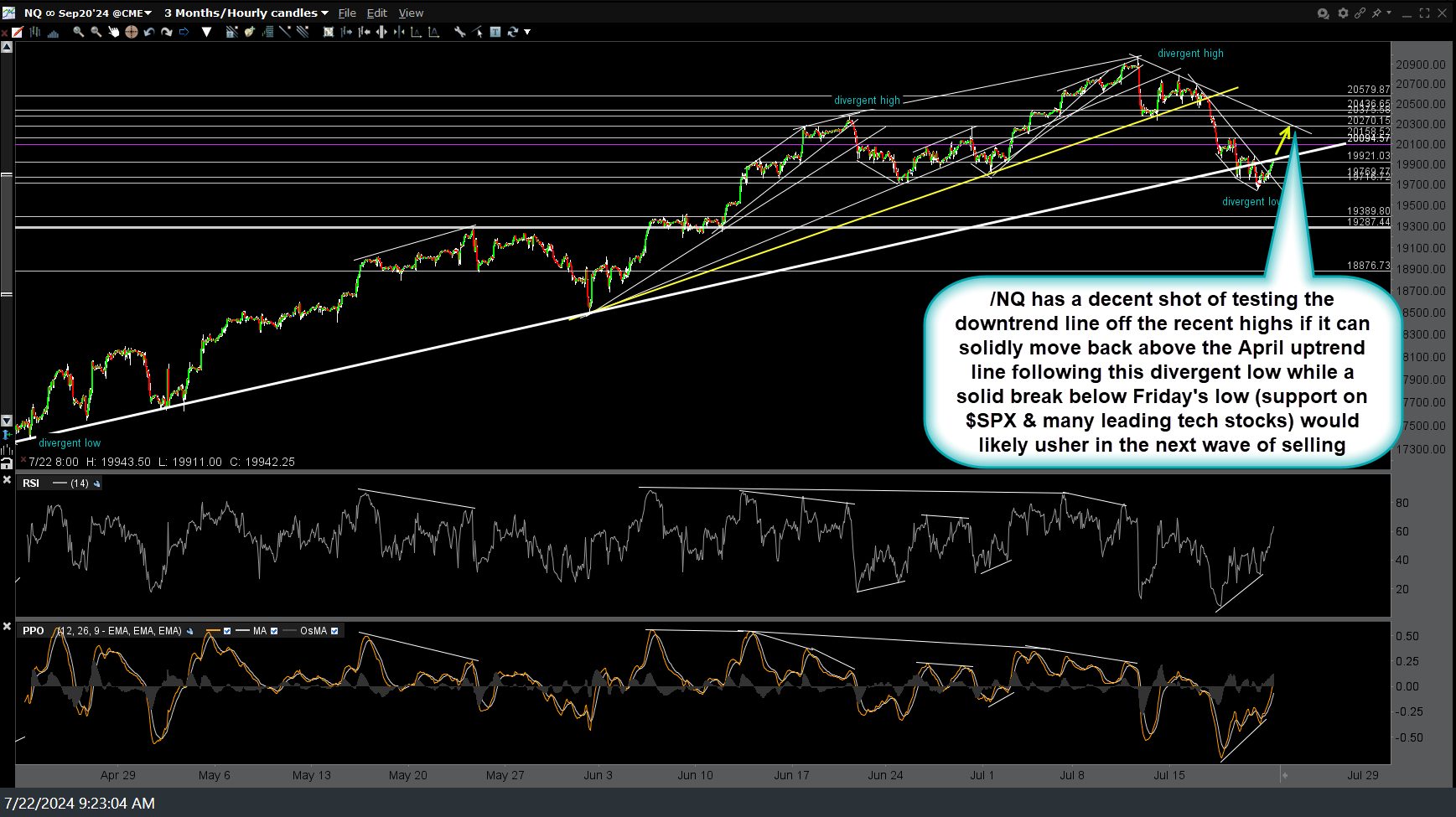

/NQ (Nasdaq 100 futures) remains in a precarious technical posture (backtesting the April uptrend line from below) but has a decent shot of testing the downtrend line off the recent highs if it can solidly move back above the April uptrend line following this divergent low while a solid break below Friday’s low (support on $SPX & many leading tech stocks) would likely usher in the next wave of selling. 60-minute chart below.

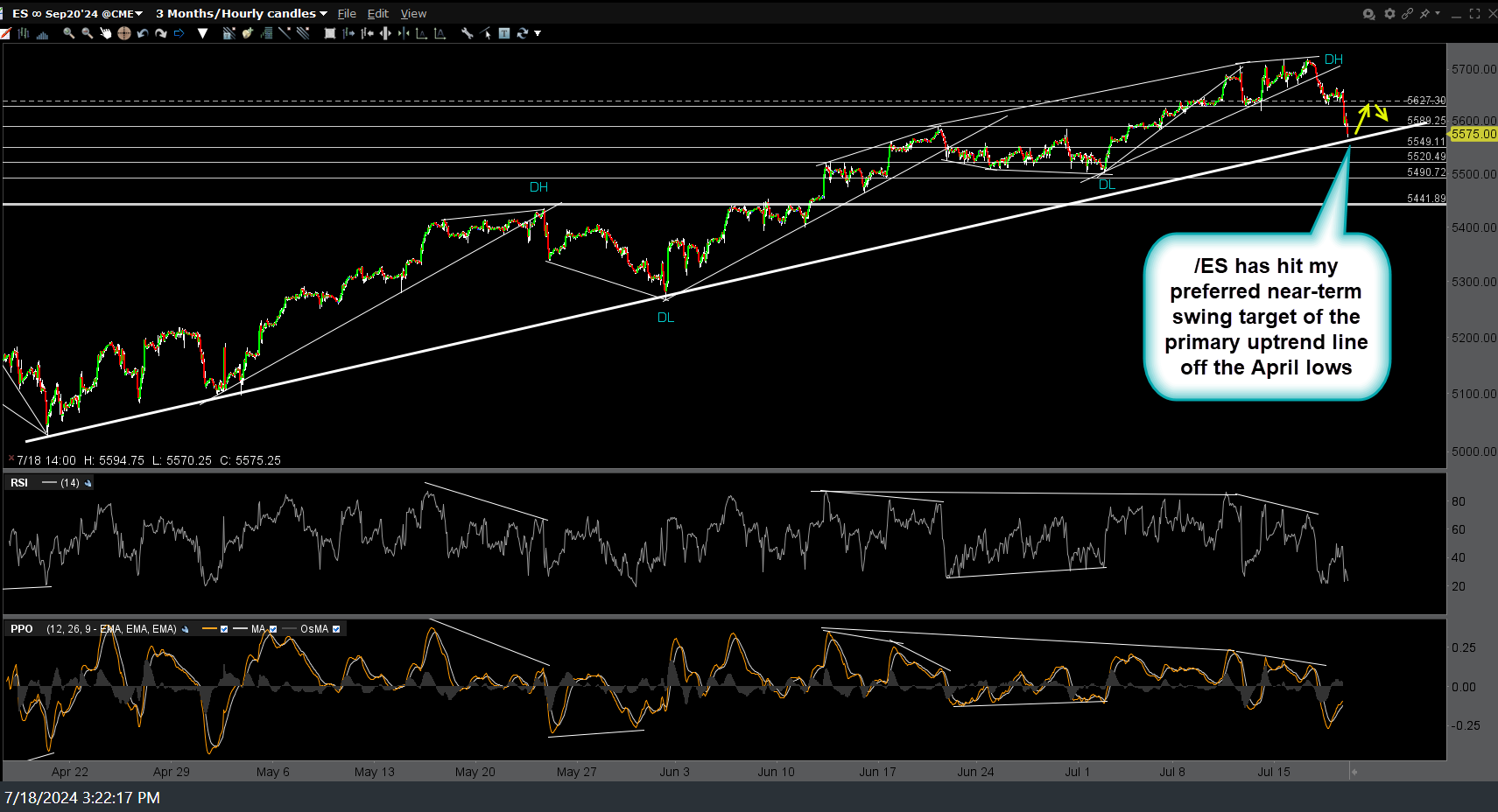

Most likely scenario for today: Initial post-opening selloff with /ES & /NQ currently testing downtrend line resistance levels, followed by the buyers stepping in with a breakout above those trendlines with another thrust up to my near-term bounce targets. However, a solid break of Friday’s lows in both the $SPX, $NDX, & the major of market-leading tech stocks that parked on or just above comparable support levels on Friday would likely open the door to my next downside swing targets.