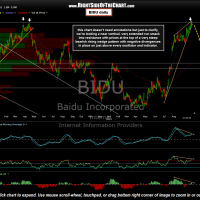

Several of the key stocks covered in this week’s video overview of the top 10 holdings in the Nasdaq 100 and the S&P 500 have officially broken down and closed below the bearish technical patterns and/or support levels that were discussed, with several others, such as TXN and BIDU shown below, poised to follow suit on the slightest downside. With so many leading stocks closing the week in or near breakdown mode, I believe that the odds for a broad-based sell off beginning next week is about as high as it’s been in quite a while. Maybe it happens, maybe not. All but the shortest-term trend indicators remain bullish for now but with so many leading stocks breaking down or quickly losing momentum, make sure to have a plan in place in case things start to get ugly. For those longer-term bullish, waiting to add exposure on a pullback, there’s nothing wrong with buying the dip if we get one. Just make sure to have a plan as to what, where and when to buy as well as predetermined criteria of when a “dip” starts to become more than just that. For those of the bearish persuasion, make sure to have your wishlist ready to go with predetermined entry or add-on criteria for each trade along with your preferred target(s) as stocks typically fall much faster than they rise. Again, maybe my read on the market is wrong and with my calls on broad market in recent months as bad as I can remember in a long while, this market could just continue this low-volatility slow-grind higher for a while longer. Personally, I remain net short equity partially hedged with relatively small long positions in the precious metal stocks and high-yielding CEF’s, with room to add should the market leaders continue to break down. Here are the updated charts of some of the $NDX & $SPX Top Ten holdings discussed in this week’s videos. Have a great weekend!

(click on first chart to expand the gallery, then click anywhere on the right of each expanded chart to advance to the next)

- XOM 2-day period

- CVX daily

- BRK.b daily

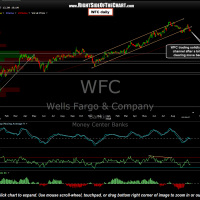

- WFC daily

- CSCO daily

- QCOM daily

- TXN daily

- BIDU daily