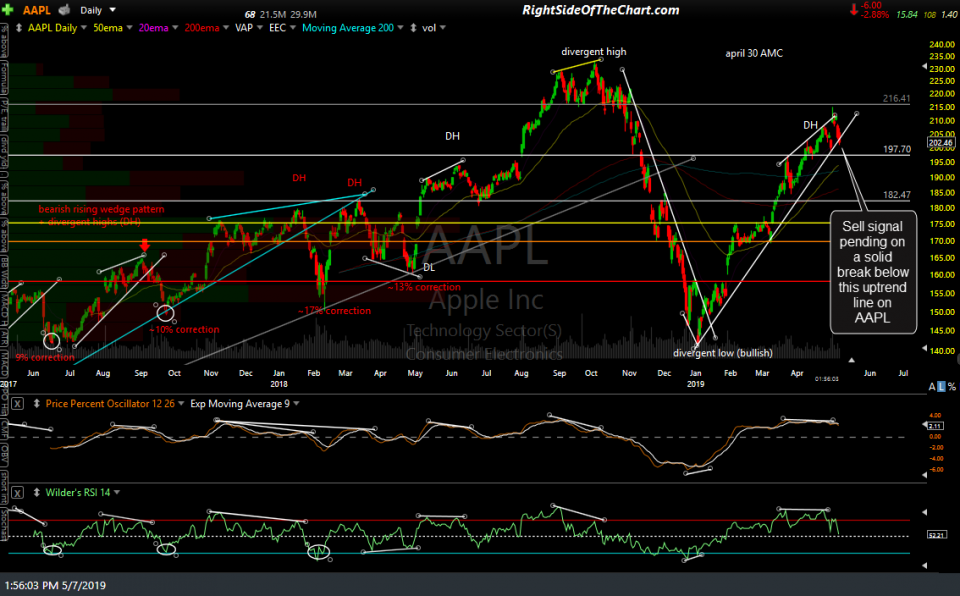

In recent videos, I have highlighted the uptrend lines off the Dec 24th lows on QQQ, XLK as well as the 5 market-leading FAAMG stocks, stating that a break below those trendlines on the majority of the FAAMGs (the more, the better) would help to confirm a sell signal on the US stock market. While QQQ & XLK have already triggered sell signals by clearly taking out those trendlines, 3 of the 5 FAAMG stocks have yet to do so as of now.

- AAPL daily May 7th

- MSFT daily May 7th

- AMZN daily May 7th

No need to post the charts of FB & GOOGL as the trendlines on both of those were very clearly & impulsive taken out on their large earnings-induced gaps. That leaves the BIG 3: AAPL, MSFT & AMZN which are not just the largest of the FAAMGs but the 3 largest publicly traded companies in the world (and also the top 3 components of the S&P 500). As I type, all three are testing those key uptrend lines off the Dec 24th lows & while the technicals continue to indicate that breakdowns in all 3 are likely to occur soon, but as I like to say: Support is support until & unless broken.

As such, a solid (1%+) break & close below today’s lows “should” do the trick, i.e.- trigger sell signals/breakdowns in any or all 3 of those stocks, thereby opening the door for a much deeper correction and at least a move down to the first target on the QQQ short trade before any significant counter-trend rally. Likewise, it would be prudent for those current long (looking for a reason to exit or reduce their index or FAAMG stock positions) or those that aren’t already short but looking for the next objective entry to wait for these trendlines to be taken out with conviction.

While there is just too much contrary (bearish) evidence in the charts to convince me to do so, those bullish on the market looking for objective entries on pullbacks to support could certainly step in here with stops somewhat below these trendlines, ideally on a solid closing basis.