I’ve highlighted the strong positive correlation between EUR/USD (Euro/US Dollar) since the stock market peaked around the start of 2022 many times since then & that correlation is still very much in play. As with the stock market, EUR/USD is overbought on the daily time frames with negative divergences on the 60-minute charts (shown here), increasing the likelihood of an impending correction.

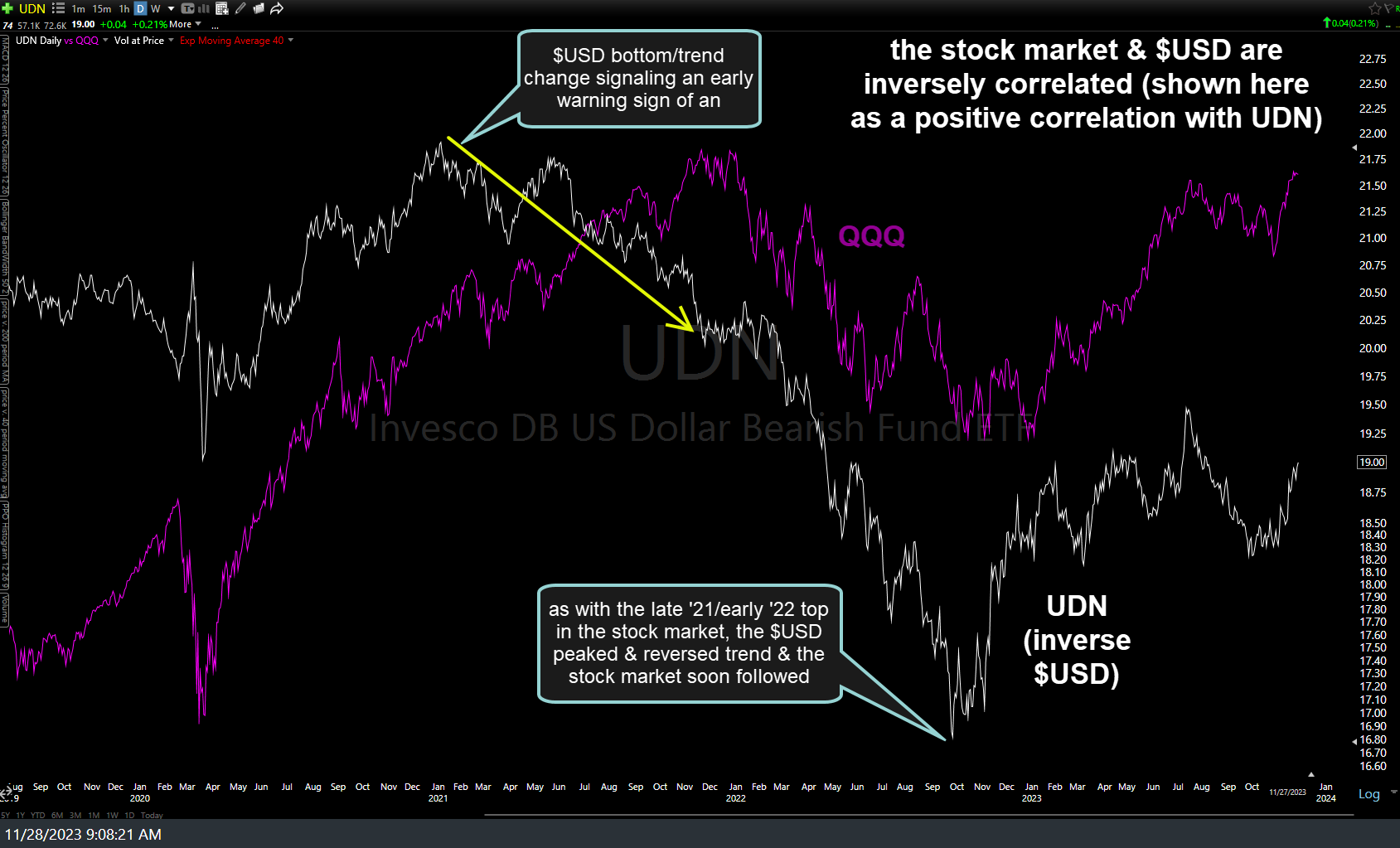

The chart below illustrates the unmistakable inverse correlation between the stock market (shown here via QQQ) and the US Dollar (shown here using the inverse US Dollar ETN; UDN, in order to more easily see the relationship as a positive correlation).

I’ve also highlighted the unmistakable & even the recent “hyper-sensitive” correlation between interest rates (via US Treasury bond yeilds) and the stock market. This breakdown & backtest of the bearish rising wedge pattern on the 60-minute chart of TLT (20-30 yr Treasury bond ETF) increases the odds of a correction soon as the negative divergences continue to build.

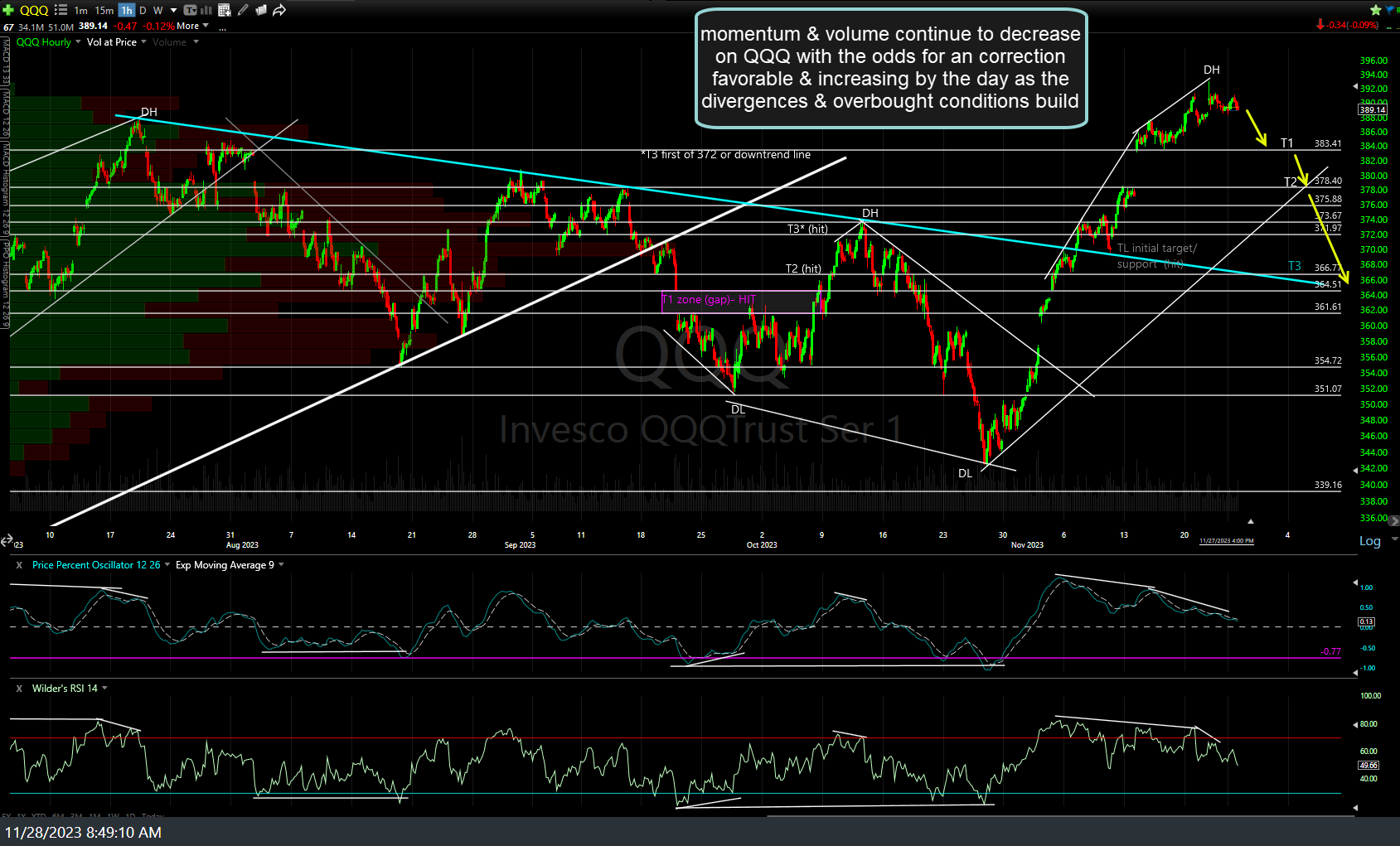

Last but not least, the momentum & trading volume continues to decrease on QQQ with the odds for a correction favorable & increasing by the day as the divergences & overbought conditions build. 60-minute chart below.

Bottom line: The “BIG 3” above are 3 completely different asset classes (stocks, bonds, & currencies) yet have an unmistakable correlation with trend reversals in either Treasuries or the EUR/USD (or just the US Dollar, as the Euro is basically an inverse of the US Dollar as the largest component of the US Dollar index) often providing an early heads up on a trend change in the stock market.

At this time, all three remain in a near-term uptrend with similar technical postures but lacking any very solid & clear sell signals (other than the recently triggered QQQ low-volume sell signal). Some of the potential catalysts that could trigger a sell off on the economic calendar this week are Consumer Confidence at 10 am EST today, GDP tomorrow at 8:30, Jobless Claims as well as Personal Income 8:30 Thursday, & ISM Manufacturing (10am) as well as J. Powell Speaking on Friday (11 am).