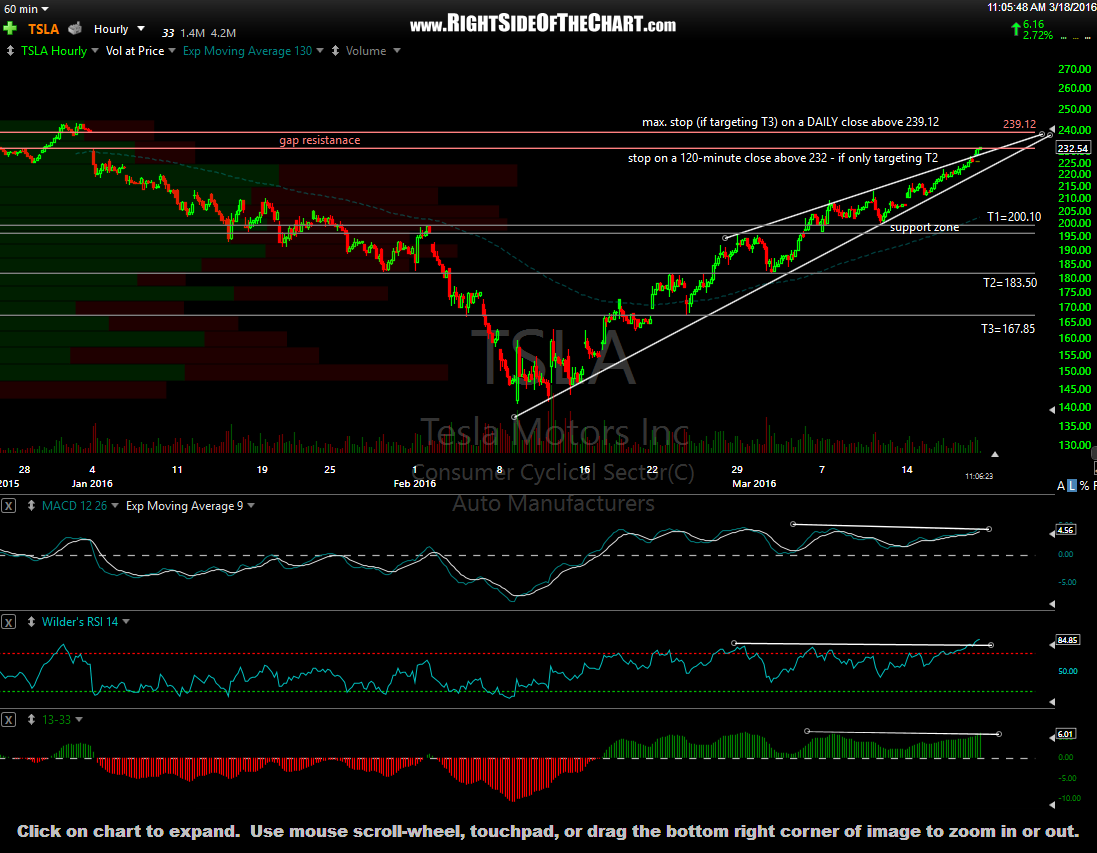

The suggested price targets & max. suggested stop have been added to this updated 60-minute chart for the TSLA Active Short Trade idea that was posted yesterday. The price targets are T1 at 200.10, T2 at 183.50 and the final target, T3, at 167.85.

The maximum suggested stop for those targeting T3 will be based on a daily close* above 239.12, which is the top of the resistance zone defined by the Dec 31st/Jan 4th gap while those only targeting T2 might consider a stop based on a 120-minute candlestick close above 232 although my preference if targeting T2, even though I’m holding out for T3, would be to wait until Monday before stopping out over the 232 level as today is a triple-witching options expiration day (which is marked by increased volatility/intraday price swing). Those only targeting T1 might consider a stop based on a 3:1 or better R/R based on your entry price.

* When using stops based on a daily close, you can either close the position just before the closing bell or close the trade in the after-hours session, assuming that particular position trades actively in the AH session, thereby providing ample liquidity.