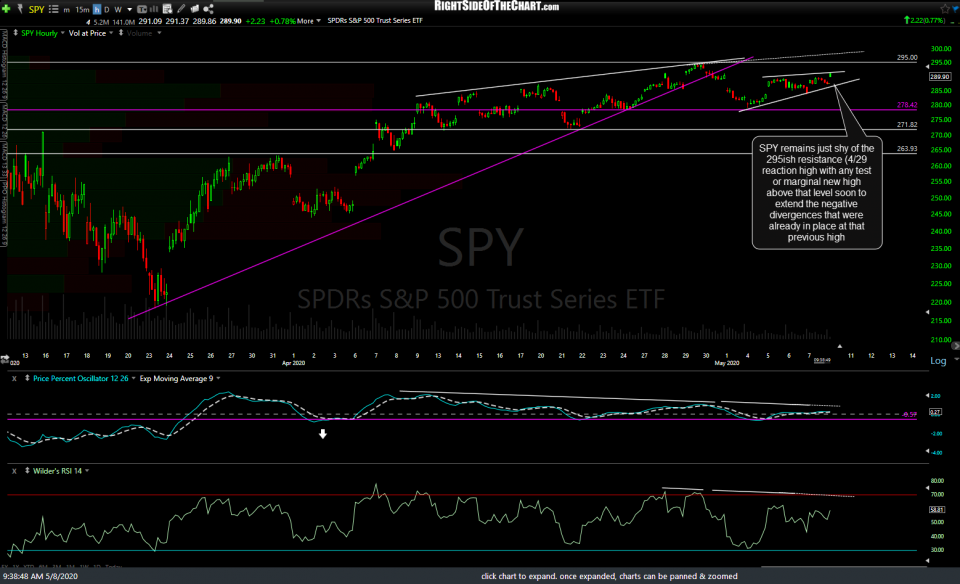

Here’s a quick look at some levels & developments to watch for on the major stock indexes, gold & US Treasury bonds. SPY remains just shy of the 295ish resistance (April 29th reaction high) with any test or marginal new high above that level soon to extend the negative divergences that were already in place at that previous high.

QQQ is inching on up to the key 224.18 resistance level, which is defined by several very significant gaps & reactions from January & February while riding up this minor trendline as the negative divergences continue to build.

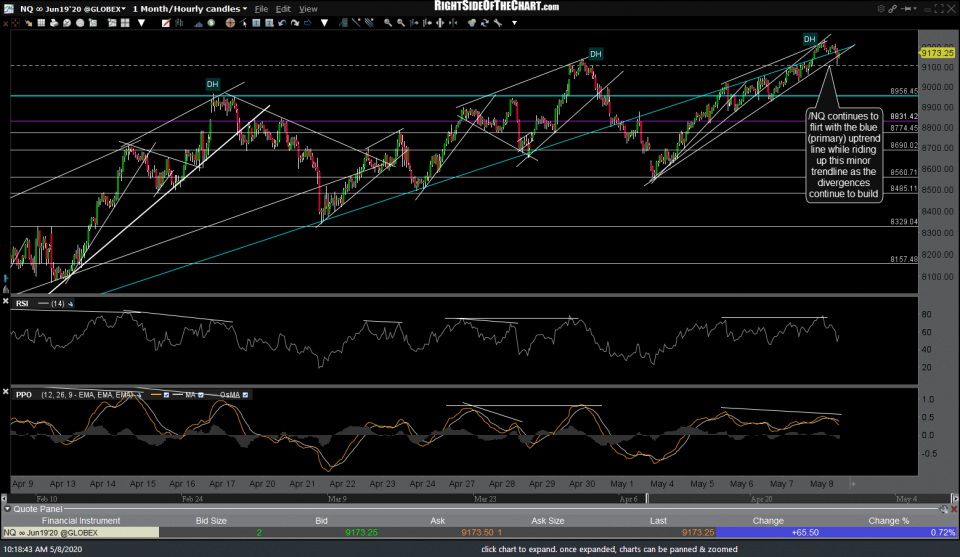

/NQ (Nasdaq 100 futures) continues to flirt with the blue (primary) uptrend line while riding up this minor trendline as the divergences continue to build.

/ES (S&P 500 futures) continues to wedge higher with negative divergences in place, still shy of the late April high & with a similar technical posture (slope of the uptrend lines, divergences, etc..).

I’m also monitoring the risk-off assets, particular gold & US Treasury bonds for any potential follow through to yesterday’s bullish developments. /GC gold futures & GLD went on to breakout above the 60-minute triangle patterns that were highlighted in yesterday’s video.

While I didn’t have time to cover Treasury bonds in yesterday’s video, in the comment section below that post I had highlighted the 30-yr Treasury bond futures contract, /UB, recently reversing off the support while at an extreme oversold reading of 22 on the RSI 14. On watch for a potential breakout above the minor downtrend line above which would likely trigger more upside in Treasuries, indicating institutional buying of safe-haven assets which typically occurs with profit-taking in equities.