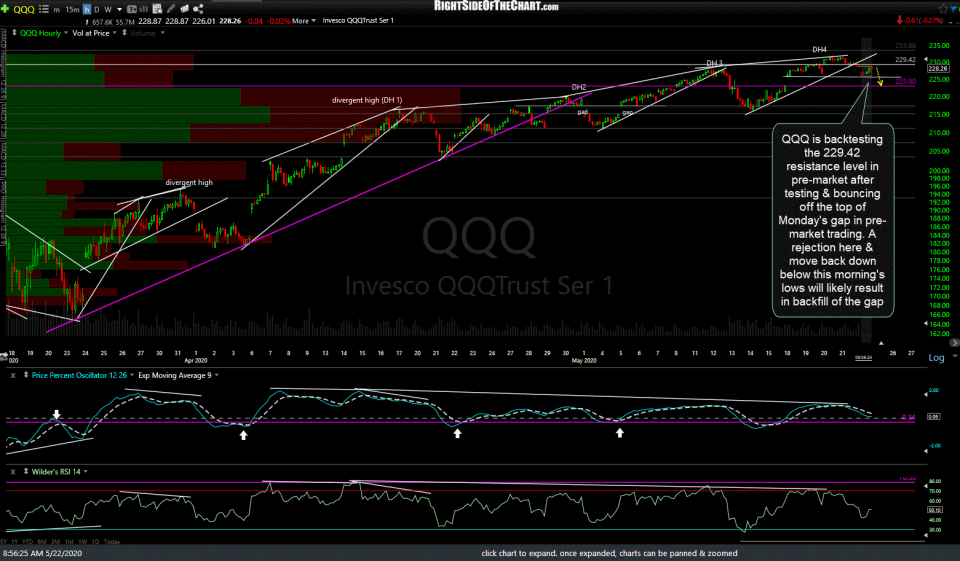

QQQ is backtesting the 229.42 resistance level in pre-market after testing & bouncing off the top of Monday’s gap in pre-market trading. A rejection here & move back down below this morning’s lows will likely result in backfill of the gap. 60-minute chart below.

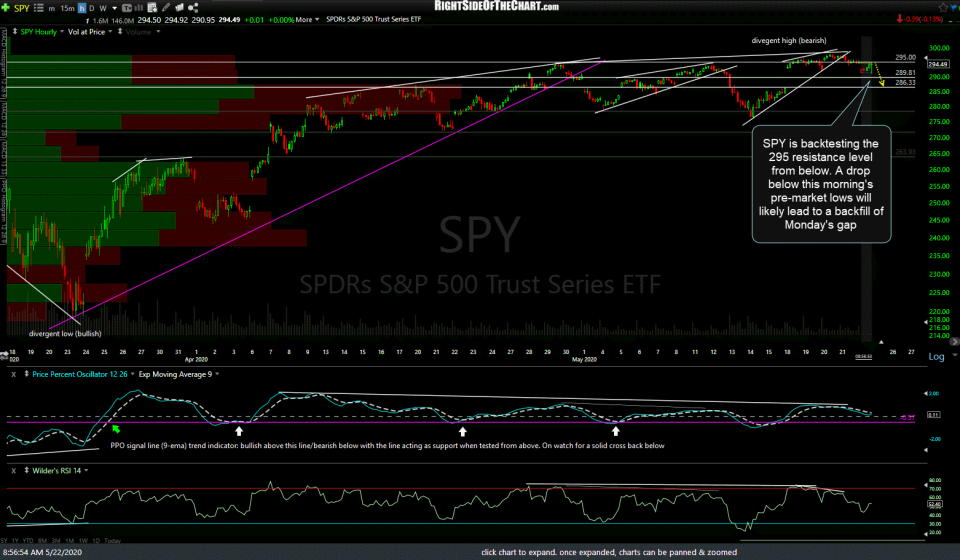

SPY is backtesting the 295 resistance level from below. A drop below this morning’s pre-market lows will likely lead to a backfill of Monday’s gap.

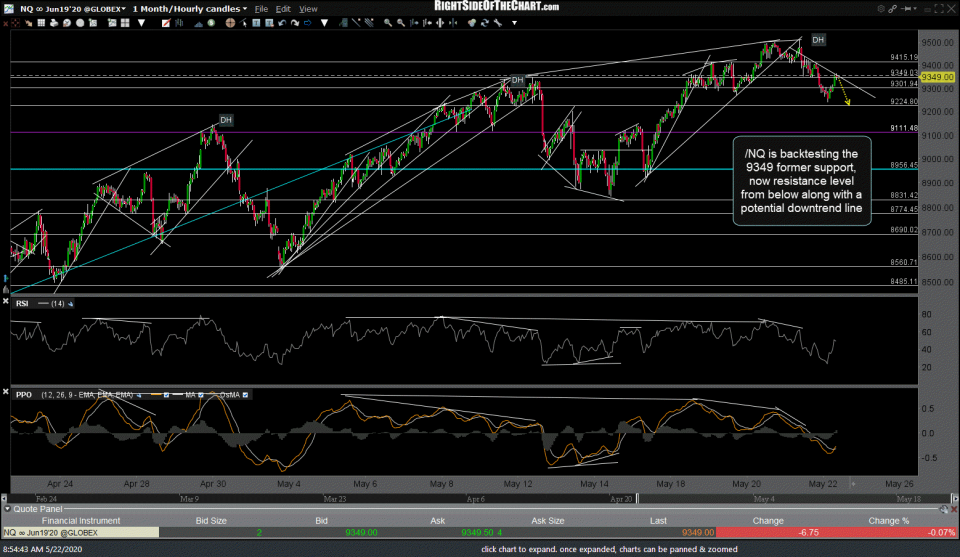

/NQ is backtesting the 9349 former support, now resistance level from below along with a potential downtrend line.

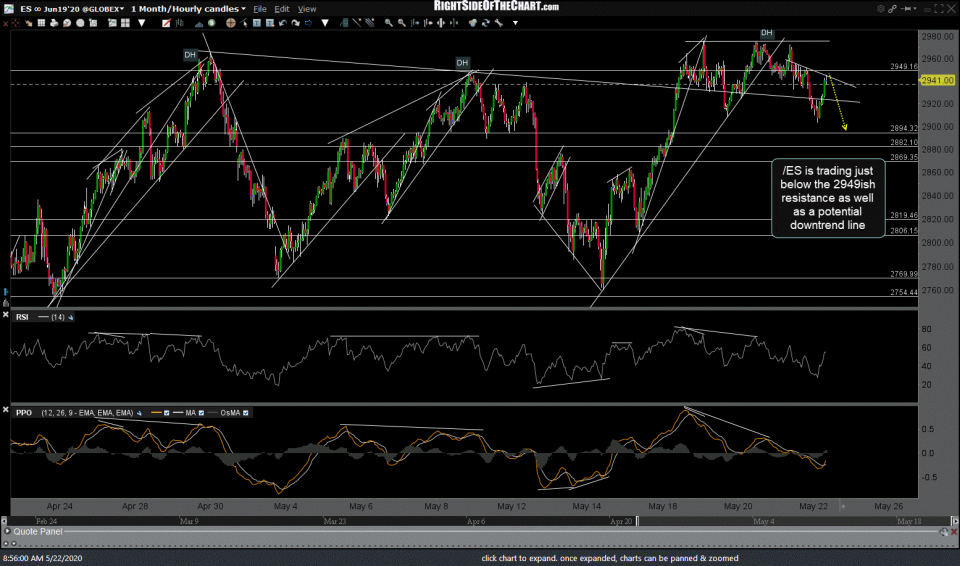

/ES is trading just below the 2949ish resistance as well as a potential downtrend line.

Arrows on all charts above show my preferred scenarios but should these resistance levels get clearly taken out today, any marginal new high soon will extend the divergences that were in place at the recent highs, keeping the odds for a substantial correction elevated, at least into early next week. Also worth noting is the fact that SPY fell & closed back below the 200-day EMA yesterday* (*edit: see the correction posted in the comment section below) so should it backfill Monday’s gap soon, especially via a solid red close today, that would mean the recent marginal pop above the 200-ema proved to be a false breakout (aka- whipsaw signal). The bottom line is that the broad market remains at a key technical juncture or a battleground between bulls & bears.