While /NQ (Nasdaq 100 futures) currently has potential divergences building that could result in a correction anytime now while another ~½% or so pop to the 7925 resistance level followed by a reversal would put some “clean” divergences in place with nice separation between the peaks in the indicators. The 192.88ish level on QQQ is comparable to the 7925 resistance level on /NQ.

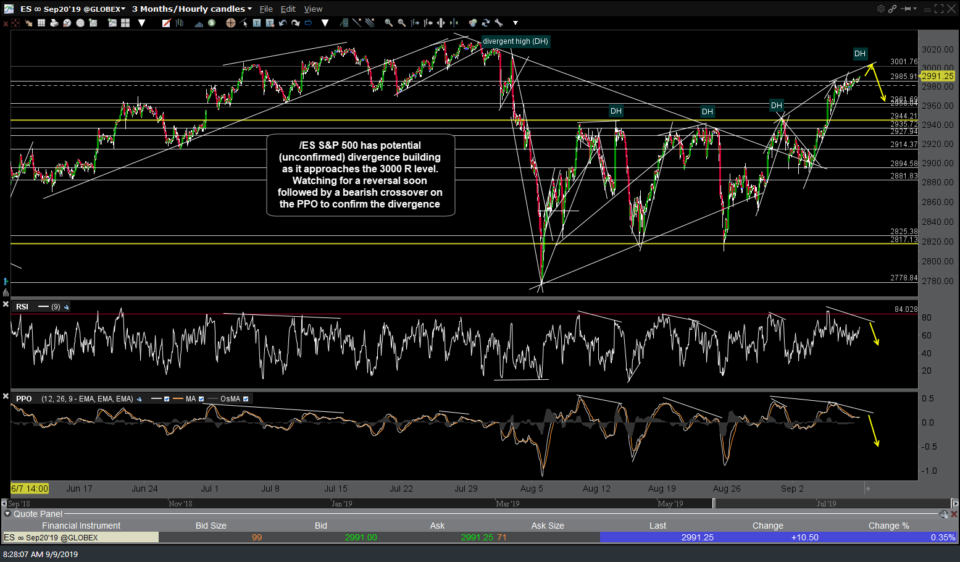

Likewise, /ES (S&P 500) has potential (unconfirmed) divergence building as it approaches the 3000 resistance level, also roughly ½% above. Watching for a reversal soon followed by a bearish crossover on the PPO to confirm the divergence.

/RTY (R2K Small Caps) recently put in a divergent high & would continue to do so on another marginal new high soon.