QQQ has rallied about 2% off the lows after trading on the 185.46 initial downside target/support level all morning while trading at the 188.21 minor resistance level/minimum bounce target now. This could be it for the bounce although I’d give nearly equal odds of a continued advance up towards the 189.64 resistance level. Not a bad time to either tighten up stops or take the quick profits (for those that reversed from short to long off the 1st target/support earlier). Previous & updated 30-minute charts below.

- QQQ 30m 2 March 27th.png

- QQQ 30m 3 March 27th

SPY has rallied 2.5% off the 250.50ish support/downside target into the 256.43ish resistance level/minimum bounce target from earlier today which offers an objective level to book quick profits or raise stops if holding out for additional gains. Previous & updated daily charts below.

- SPY 30m 2 March 27th.png

- SPY 30m 3 March 27th

So far, a successful test & reversal off the uptrend line in /NQ followed by a break above the minor downtrend line. If /NQ can now clearly take out the 7710ish R level, a continued move up towards the 7785 R level followed by a reaction there is likely. 60-minute chart below.

So far, a successful test & reversal off the uptrend line in /ES followed by a break above the minor downtrend line. If /NQ can now clearly take out the 7710ish R level (/ES has already taken out 2550), a continued move up towards the 2589 R level followed by a reaction there is likely.

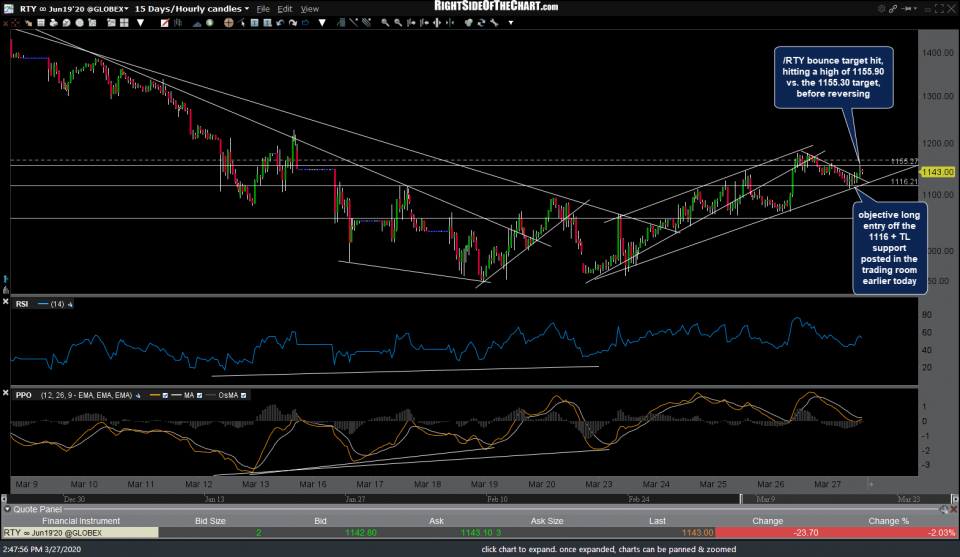

/RTY (Russell 2000 Small-Cap Index futures) was posted as an objective long entry off the 1116 price + uptrend line support in the trading room earlier today off. The sole bounce target has been hit with /RTY printing a high of 1155.90 vs. the 1155.30 target, before reversing.