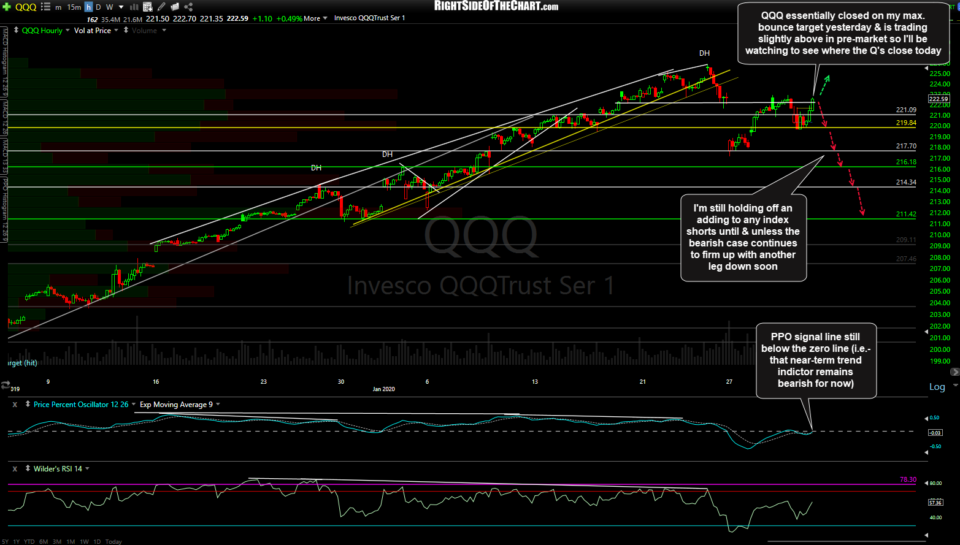

QQQ essentially closed on my max. bounce target yesterday & is trading slightly above in pre-market from the post-earnings boost from AMZN, so I’ll be watching to see whether the Q’s close above or below that level today. As such, I’m still holding off an adding to that starter short position on the $NDX until & unless the bearish case continues to firm up with another leg down soon.

The more diversified broad-market (S&P 500) has been lagging the tech-heavy Nasdaq 100 on the recent bounce off support with SPY still well off the previous highs. I’ll be watching to see this double-gap resistance (328.40) continues to cap any advances in SPY today & into next week. As with QQQ, the 60-minute PPO trend indicator remains bearish for now (signal line/9-ema below the zero line).

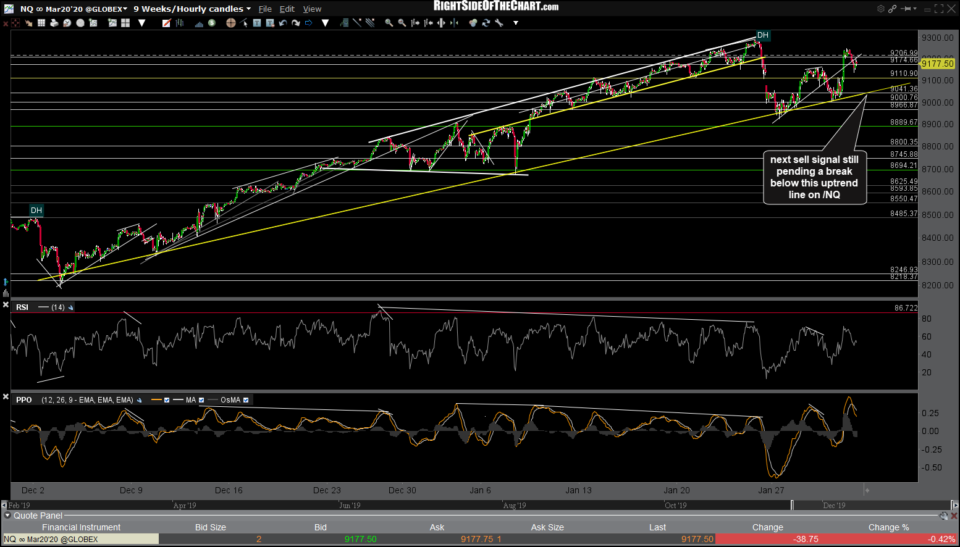

Stock futures had a spike up following AMZN’s earnings last night with most of the post-session (4 pm+) gains having been faded so far today and the next sell signal still pending a break below this uptrend line on /NQ.

/ES has lagged behind /NQ on the recent bounce off the 60-minute uptrend lines while reversing off the 3300ish resistance following the AMZN-induced pop. Near-term bullish if 3300 is taken out, bearish if the uptrend line and the 3232 support level are taken out. Hopefully, we’ll get clues as to which way the indexes are going to break today but if we don’t close substantially higher or lower today, the markets will keep us guessing over the weekend & one will have to decide how to go home positioned over the weekend as the chances of an opening gap up or down on Monday will be decent now that the $VIX (volatility) has recently woken up.

My plan is to hold off on initiating or adding to any trades with a high correlation to the stock indexes until we get better visibility as to which way the major indexes will go from here. I plan to follow up with analysis on some other asset classes such as precious metals, Bitcoin and various commodities such as oil, natural gas and some of the agricultural commodities that may be setting up for the next swing trading opp.