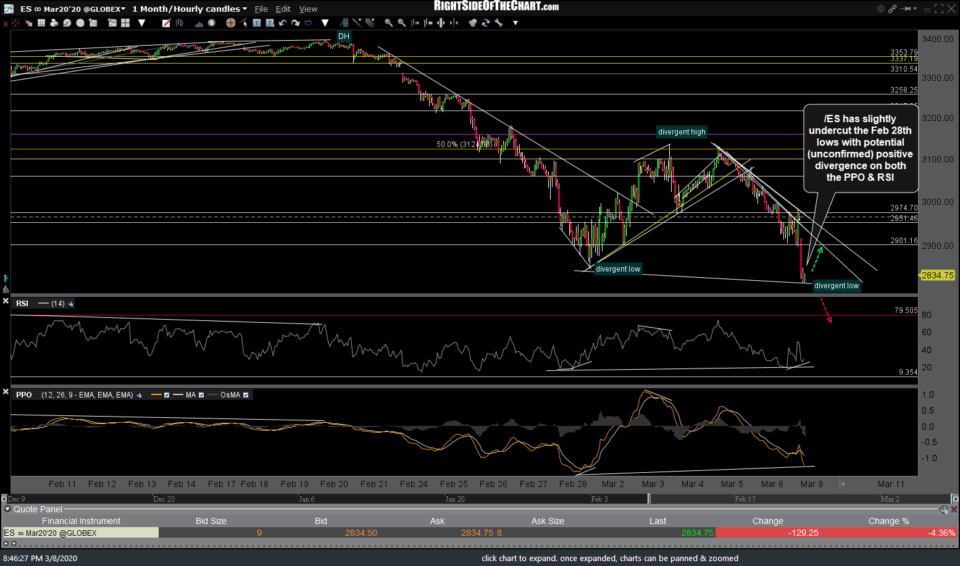

/ES (S&P 500 futures) hit lock-limit down at 2819 after taking out the Feb 28 low. There is potential divergence *if* /ES can manage to rally once the down limit before or after the down limit is removed after tonight’s session although both the intermediate & near-term trends remain solidly bearish for now. The lock down limit was triggered when the futures fell 5% from the price calculated in the last 30 seconds of trading Friday. The curb means the contract can’t trade at a lower price for the remainder of the overnight session, although transactions at or above the threshold are allowed.

/NQ also triggered the lock limit down rule at 8093.25. Obviously, a bearish event, although should /NQ rally from around or not too far below the 8093.25 level before or after the down limit is removed, a bullish crossover on the PPO would ‘confirm’ the potential divergence & could set the stage for a counter-trend rally. Until & unless that happens, the trend remains bearish.

On the daily chart below, /NQ was approaching the top of a support zone that runs from about 8078 to 7998 with trendline support as well. This support zone aligns with T1 on the QQQ short trade so we’ll have to see where QQQ is trading in the pre-market session tomorrow after the down limit lock on the futures is removed. As of now, T1 remains the final target on the QQQ official short trade although I’ll assess the charts tomorrow morning to decided whether to add an additional target(s), pull T1 and let the trade ride for the time being while lowering the suggested stop to protect profits, or even potentially revise T1, if we get any decent evidence of a reversal once the down limit is removed.