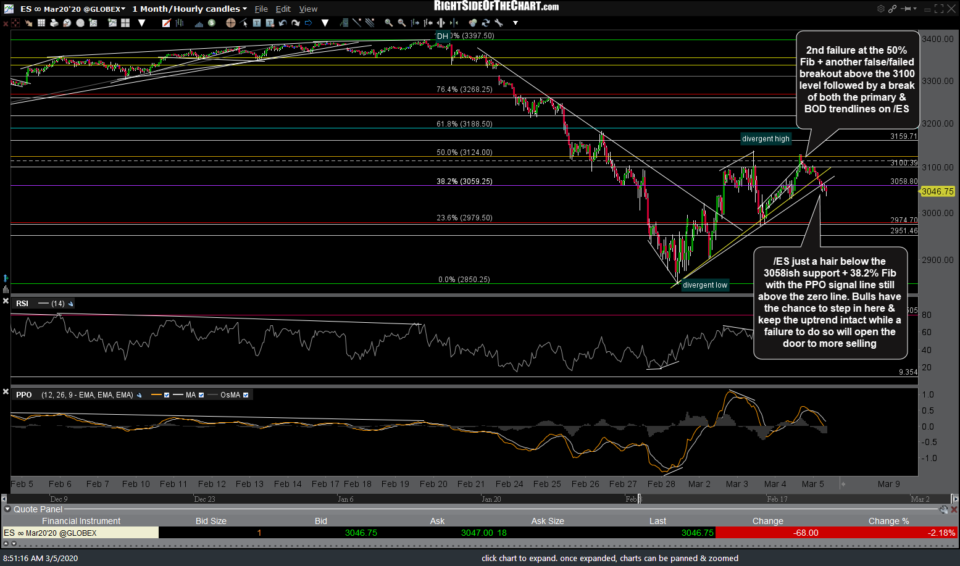

As per my comments yesterday, the false breakout (aka- whipsaw, bull trap, failed breakout, etc.) above the 3100 resistance in /ES and comparable 310.65 level in SPY has played out with the usually impulsive reversal so far. Fewer things are more bearish than a failed breakout as that results in a sudden shift in positioning as those that took the breakout suddenly sell and the shorts that smell blood in the water (including those that were shaken/stopped out of their positions) pile back in, thereby creating even more selling pressure.

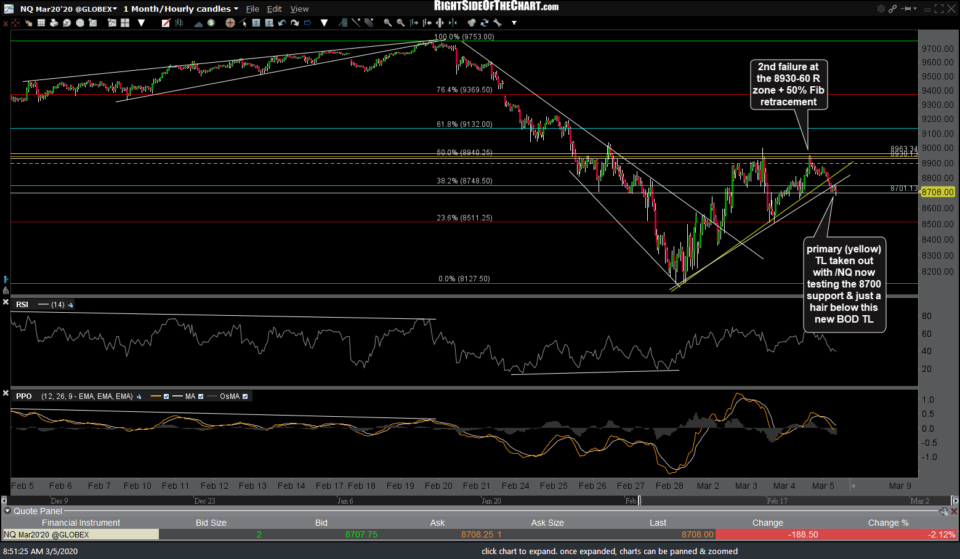

- NQ 60m March 5th

- ES 60m March 5th

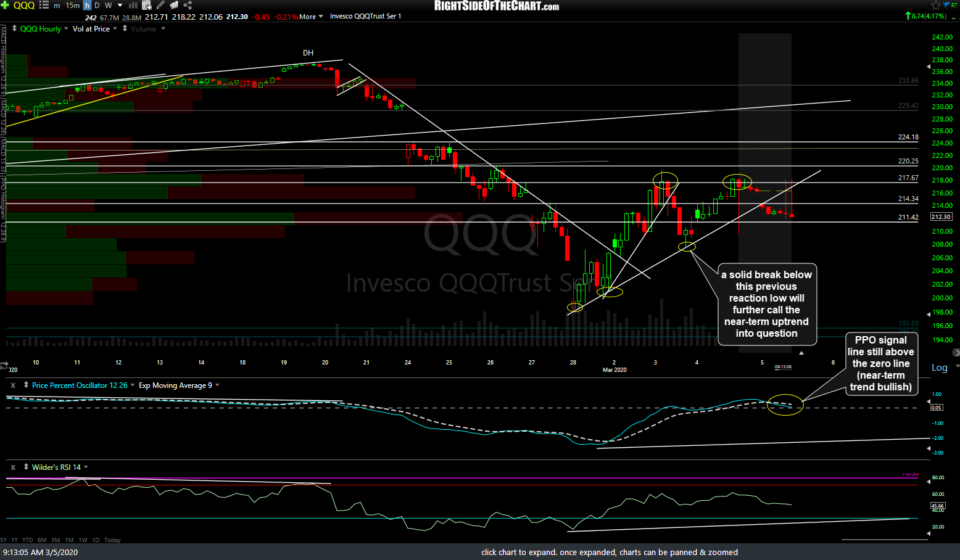

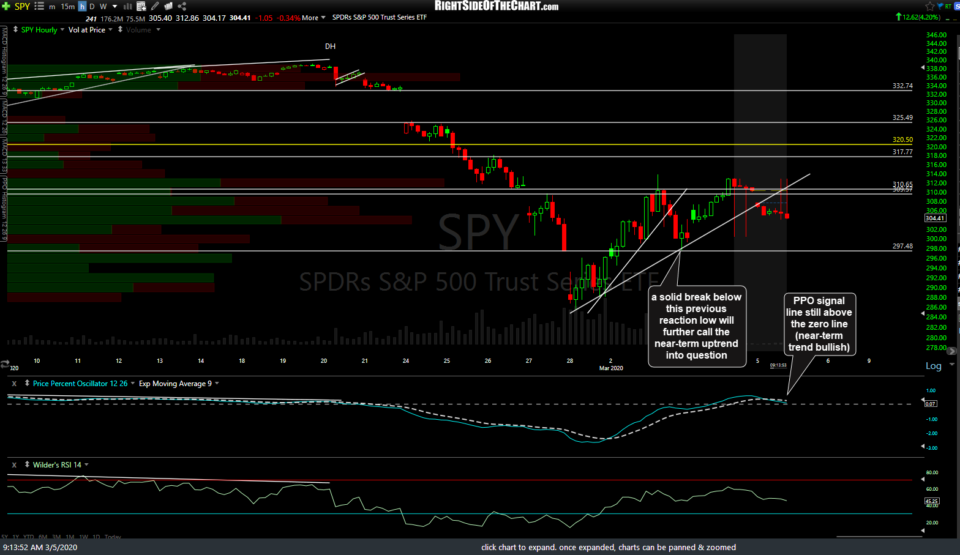

Unfortunately for those still short, it is too early to say if this pullback that has started immediately after yesterday’s close is the start of the next major leg down or simply another pullback within the near-term uptrend off February 28th lows. One of the early signs to look for to help firm up the former would be a solid break below Tuesday’s lows of 297.57 in SPY and 207.62 in QQQ as those are the previous reaction lows. Until then, the near-term uptrend (higher highs & higher lows) is still intact. Also, note that the PPO signal lines on both SPY & QQQ remain above their respective zero lines as of now, signaling the near-term trend is still bullish until & unless they both solidly cross back down below the zero line.

- QQQ 60m March 5th

- SPY 60m March 5th

Bottom line: The key levels to watch at this time are yesterday’s highs (bullish, if solidly taken out) and the 297.50ish level on SPY & 207.60ish on QQQ (Tuesday’s lows), bearish if taken out. I continue to favor the bearish scenario but fully recognize that is far from baked in the cake at this time so I will remain flexible & adjust/react as the charts develop.