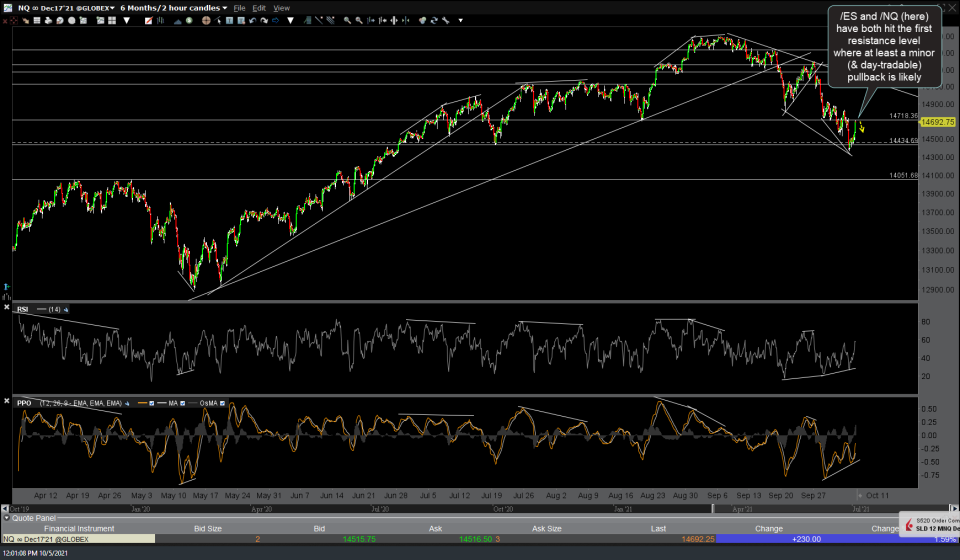

/ES and /NQ have both hit the first resistance level where at least a minor (& day-tradable) pullback is likely. As another leg up towards those 60 & 120-minute downtrend lines still has decent odds, those trading the bounce long can opt to ride out any pullbacks with the appropriate stops in place or reverse back to short in an attempt to game a pullback. Resistance levels are (roughly) 14,720 on /NQ & 4355 on /ES but you might want to allow for a relatively brief momentum-fueled overshoot of those levels.

For the latter, maybe consider a relatively tight trailing stop (~1%) & let it ride whereas those targeting a rally up towards the potential targets highlighted in today’s video (around the downtrend lines), it would be prudent to raise stops from below yesterday’s lows up to at or near entry for any short-to-long reversal (or long entry) today. Also, note that the next overhead resistance level on SPY comes in slightly higher around 436 with the next resistance on QQQ around 359.50-360, another reason to give a short-reversal trade here a little more room.