The bullish divergences & reversal off support earlier today/late last night have played out for a rally so far which has now taken the major stock index futures into & just above some significant resistance levels/bounce targets. I’m using the 60-minute charts of the stock index futures below as they show some of the recent support & resistance levels more clearly than the index ETFs (SPY, QQQ, & IWM) which only trade 6½ hours M-F vs. the futures which trade nearly 24 hours per day, Sunday evening through Friday.

Following the recent divergent low (bullish) and reversal off the 2941 support level, /ES (S&P 500) has made what is likely to prove to be a brief momentum-fueled overshoot of the 3060ish resistance level, thereby offering an objective level to short and/or book profits on a long bounce trade as well as to raise stops on any longs, if holding out for additional gains.

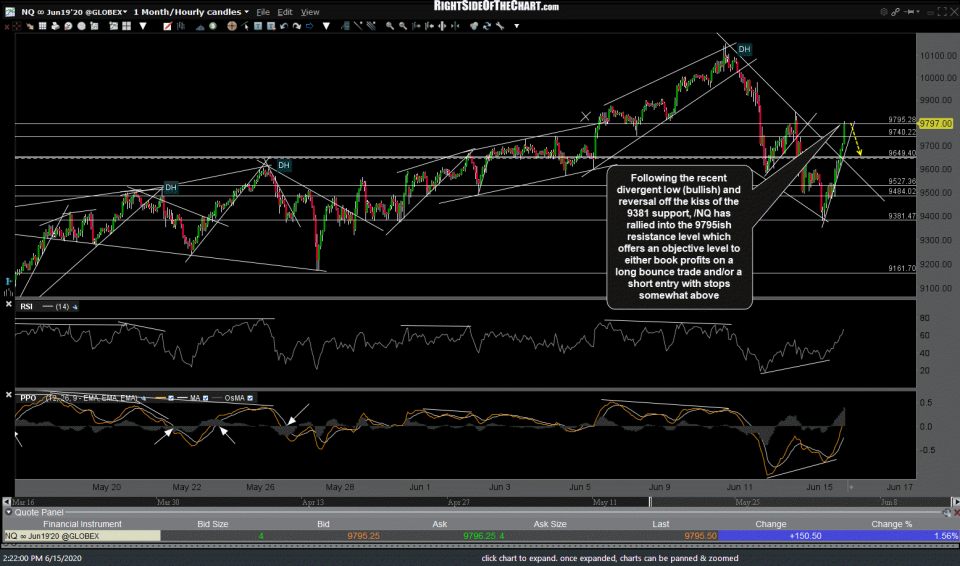

Also following the recent divergent low (bullish) as well as the reversal following the kiss of the 9381 support, /NQ (Nasdaq 100) has rallied into the 9795ish resistance level which offers an objective level to either book profits on a long bounce trade and/or a short entry with stops somewhat above.

Also following the recent divergent low, /RTY (Russell 2000 Small-cap futures) have rallied into the 1415.50 resistance level where a pullback & possible a more lasting reversal is likely, thereby offering an objective short entry. Despite the vigor or the bounce off this morning’s lows in the stock index futures & what appears to have all the makings of a trend day so far, I’d put decent odds on a fade of this rally starting around current levels that takes back a substantial chunk of today’s gains.