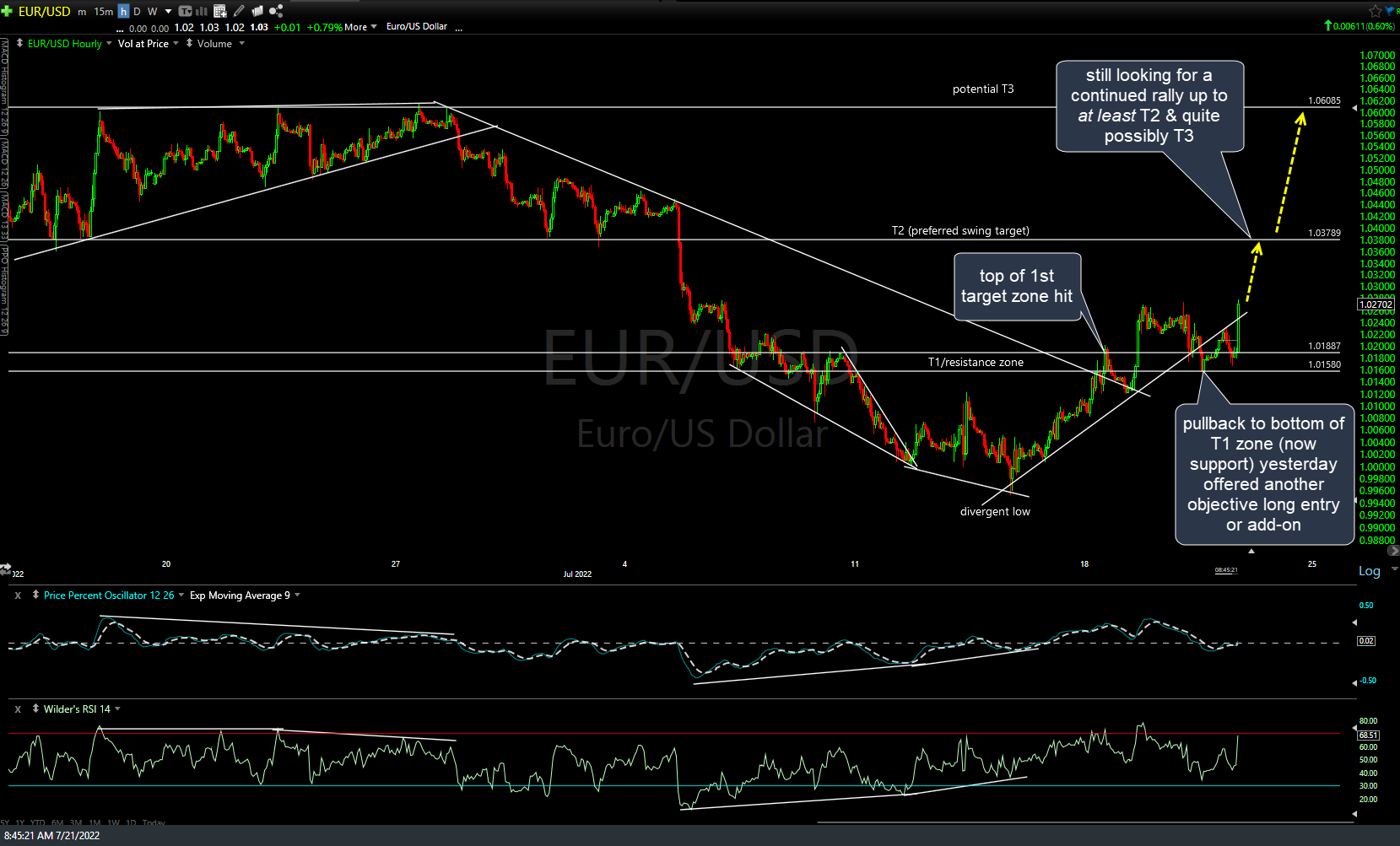

Member @crlists13 asked for an update on gold in the comment section below yesterday’s trade ideas video. Although I usually mention the direct correlation between gold & Euro as the primary reason that I provide frequent analysis on the Euro and US Dollar (which is inversely correlated to gold, simply because it takes more dollars to buy an ounce of gold when the $USD is falling in value & fewer $$ to buy an ounce of gold when the dollar is rising), I neglected to specifically state that when I reiterated my current bullish & long positioning in the Euro in yesterday’s video, which had pulled back to the bottom of the first target zone during the recording of the video (T1 zone was former resistance & resistance, once broken, then become support when backtest from above). Updated 60-minute chart below with a nice rally off the bottom of the T1 zone so far, boosted by (the expected, as I mentioned earlier this week) rally following today’s ECB meeting & rate hike.

The next chart below makes that positive correlation between gold & the Euro about as clear as it gets. However, I often state that the correlations between certain pairs of securities, such as stocks & bonds; gold & the Euro/USD, etc.., will experience periods of a “disconnect” from time to time. Depending on the particular pair of securities & the cause behind the disconnect, those disconnects can range from days to weeks or even months. In the case of gold & the US Dollar or Euro, it is usually a short-lived disconnect with a reversion to the mean that follows as the chart below illustrates.

Here’s the 60-minute chart of /GC (gold futures) with some near-term price targets which are likely to be hit assuming that EUR/USD continues to play out as expected. As mean reversions from disconnects in the correction between gold & the EUR/USD are often pretty swift, there’s a good chance we can see a strong rally in gold, silver, & the other PM’s and mining stocks in the coming days to weeks.